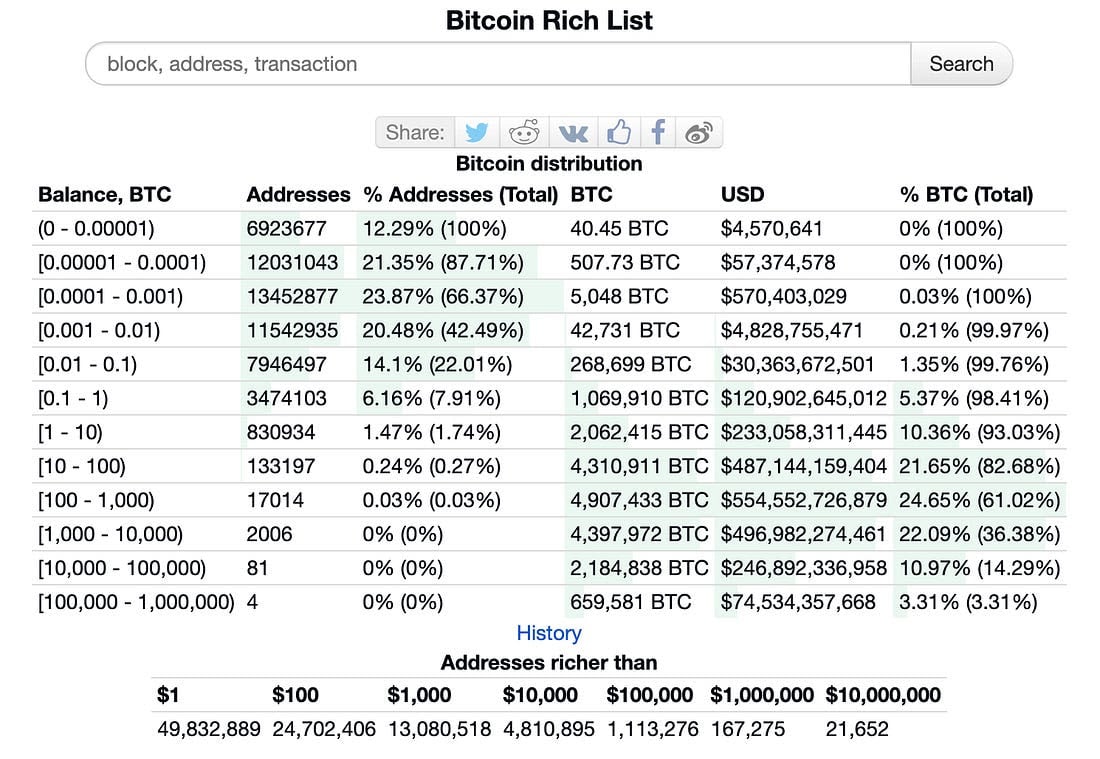

Scott Melker, host of the “The Wolf of All Streets” podcast, revived the “Bitcoin Rich List” in his August 29th newsletter. This is a table showing how BTC spreads across different size wallets.

Mercer says he last edited the list in 2023, and his latest version provides a snapshot of how Bitcoin ownership has changed over the past two years.

summary

- According to Melker, the top 98% of owners are addresses that hold at least one BTC account.

- The most important two-year change is that the number of addresses holding up to 0.0001 BTC has doubled.

- The price of becoming a Wholecoiner is growing year by year. Hardcore Bitcoiner says it's never too late to invest in BTC.

You don't have to be a “wholecoiner”

Mercer claims that by owning 0.1 BTC, one of the top 8% owners.

Also, you don't have to be a “Wholecoiner” who holds at least one BTC to become the largest Bitcoin owner. why? If BTC is trading at around $110,000 (currently priced at $108,500), then owning 0.1 BTC will make Bitcoin more abundant than 92% of all other Bitcoin holders.

And having one or more bitcoin would be more than 98% of all holders.

This data does not exclude any holdings stored in crypto exchange wallets. Of the 20 addresses that hold the maximum amount of BTC (36,000-250,000 bitcoins), only eight belong to unidentified entities.

In general, the data shift between 2023 and 2025 is not dramatic. Mercer says the total number of Bitcoin addresses has increased by 10 million in two years to over 56 million.

The most notable change is the influx of addresses held between 0.00001 and 0.0001 BTC. It increased from 3.5 million to 6.9 million. “That makes sense, as more people start to get smaller,” says Mercer:

“Its stability is actually healthy. It shows that the distribution of ownership in Bitcoin is mature.”

You might like it too: Analysis: Bitcoin's dormant supply growth surpasses new issuance for the first time in history

Additional data attached to the Melker article shows that in 2025, the amount of Bitcoin dust reached an all-time high at 1.58,000 BTC. Bitcoin dust refers to leftovers. This is too small to send on a small scale, as transaction fees are insufficient.

Meanwhile, the dormant wallet chart shows:

- 12.5 million Bitcoin (more than half of total supply) is only a year old.

- Over 10 million Bitcoins have remained inactive for more than two years.

- About 8 million Bitcoin has not moved for three years.

Following the 2024 presidential election, the curve showing the amount of BTC at dormant addresses has become sharper after President Donald Trump vowed that America would not sell Bitcoin.

Become a wholecoiner in 2025

If you keep 0.1 BTC, then someone becomes “Bitcoin Rich” and owns full Bitcoin (the coveted “wholecoiner” status), you certainly do. However, the price of becoming a Wholecoiner has risen dramatically over time. Buying one BTC in 2013 was a very different proposal than buying in 2025.

At almost every stage of Bitcoin's history, skeptics have argued that it's “too late” to buy, claiming that prices are already rising too much for even more. Countless stories online reflect this suspicion, with many early adopters regretting selling them quickly. Even when Bitcoin was traded for under $100, people were hesitant to buy it back because they already felt it was “expensive.”

One of the most famous examples is from early adopter Greg Shane. In 2011 he tweeted that he had bought 1,700 BTC for $0.06 each, but sold for $0.30. He lamented that he missed the opportunity to sell for $8. The tweet became so iconic that Shane auctioned off as an NFT in 2022. What he didn't know was that by 2025, 1,700 BTC would be worth more than $180 million.

bitcoin pic.twitter.com/kgs2jvhwwu It's never too late

– Bitcoin Archive (@BTC_ARCHIVE) August 14, 2025

Today, just over 2,000 Bitcoin addresses hold over 1,000 BTC. It remains unclear whether Shane is still in it, but his story presents a timeless theme of Bitcoin. Almost every era feels “too late.”

I wish I had kept it at 1,700 btc @$0.06 instead of selling it for $0.30. #bitcoin

– Gregschoen.eth (@gregschoen) May 16, 2011

Top Bitcoin Bar

The number of addresses above one bitcoin (less than 2%) is just under 1 million. According to the UBS Global Wealth Report, 18.1% of adults around the world hold assets of over $100,000.

That means that people with a wealth of bitcoin are not the biggest Fiat rich people. The top layer bar for the bitcoiner is set lower than the Fiat Money Holder. It reflects how quickly it is to consider Bitcoin as a widely adopted asset used to hold vast assets.

Despite all the hype, government adoption and influx of institutional funds, Bitcoin still has a special interest in a group of people who are still growing, but are not yet ubiquitous.

read more: Bitcoin Millionaire Wallet Triple in 2023