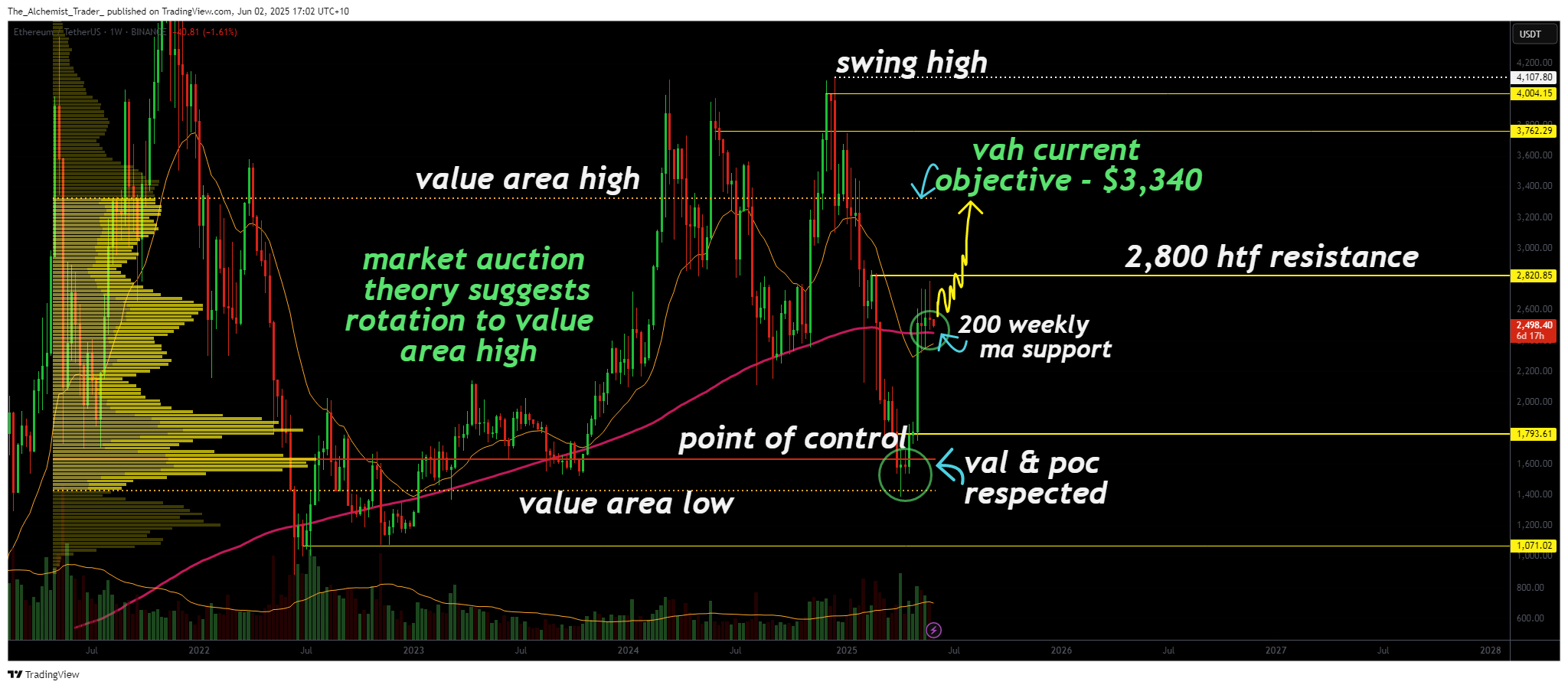

Ethereum has surpassed its crucial 200-week moving average after it has come out of its main support zone. With volume rising and the structure still intact, a full market rotation to $3,340 is increasingly likely.

The current setup is closely in line with market auction theory, a framework that explains how it tends to rotate between low-price and value areas. For Ethereum's (ETH), Value Area Low was established between $1,400 and $1,600, and prices were considered undervalued by market participants.

After testing that zone, ETH gathered in strength, regaining control points and pushing above the 200-week moving average.

Important technical points

- 200-week moving average serving as support: Prices currently outweigh this high frame support, indicating the consistency of strength and long-term trends.

- High time frame resistance of $2,800: This is the last local ceiling before completing the full rotation into the high value area at $3,340.

- Rotation of Market Auction Theory in Play: Prices have already moved from the value area to the POC, and the value area is now higher.

Ethusdt (1W) Chart, Source: TradingView

The 200-week moving average is not merely a technical indicator, but rather a significant level of institutional interest that often corresponds. Ethereum's ability to hold it above after a strong impulse suggests that this trend may not only be intact, but also accelerate. When prices are combined above this level, they build a base that will increase the next move.

Once $2,800 is convicted and breached, the next logical target is the $3,340 value area. This completes the complete auction rotation as outlined in Market Auction Theory. This explains how prices vibrate between realms of perceived value. A clean tap in high value area indicates that prices reached the “overvalued” edge of the spectrum, at least temporarily, before the market seeks a new balance.

You might like it too: Ripple, Dogcoin, Solan Whale moves to Winner's Mining Cloud Mining

Supporting this setup is a continuous volume inflow, especially after breakouts starting at $1,600. This suggests that fresh buying interest is still strong, and as long as this momentum continues, Ethereum will remain positioned for a higher target. Volume has confirmed demand, and now demand is in the face of resistance.

What to expect from future price action

As long as Ethereum continues to hold above the 200-week moving average and ultimately breaks $2,800 resistance with a strong volume, the road to $3,340 is technically effective. It appears that full market auction rotations are highly likely in the short to medium term.

read more: Will Bitcoin and altcoin rise in June or will a new crypto winter come?