Ripplex has announced the next phase of the XRPL agency's Defi roadmap. This update focuses on compliance, lending and privacy. It shows a clear push to make regulated players on-chain.

Ripplex is the developer and innovation arm of Ripple. It supports the XRPL (XRP Ledger) ecosystem, funds projects, and develops features such as tokenization and Defi tools.

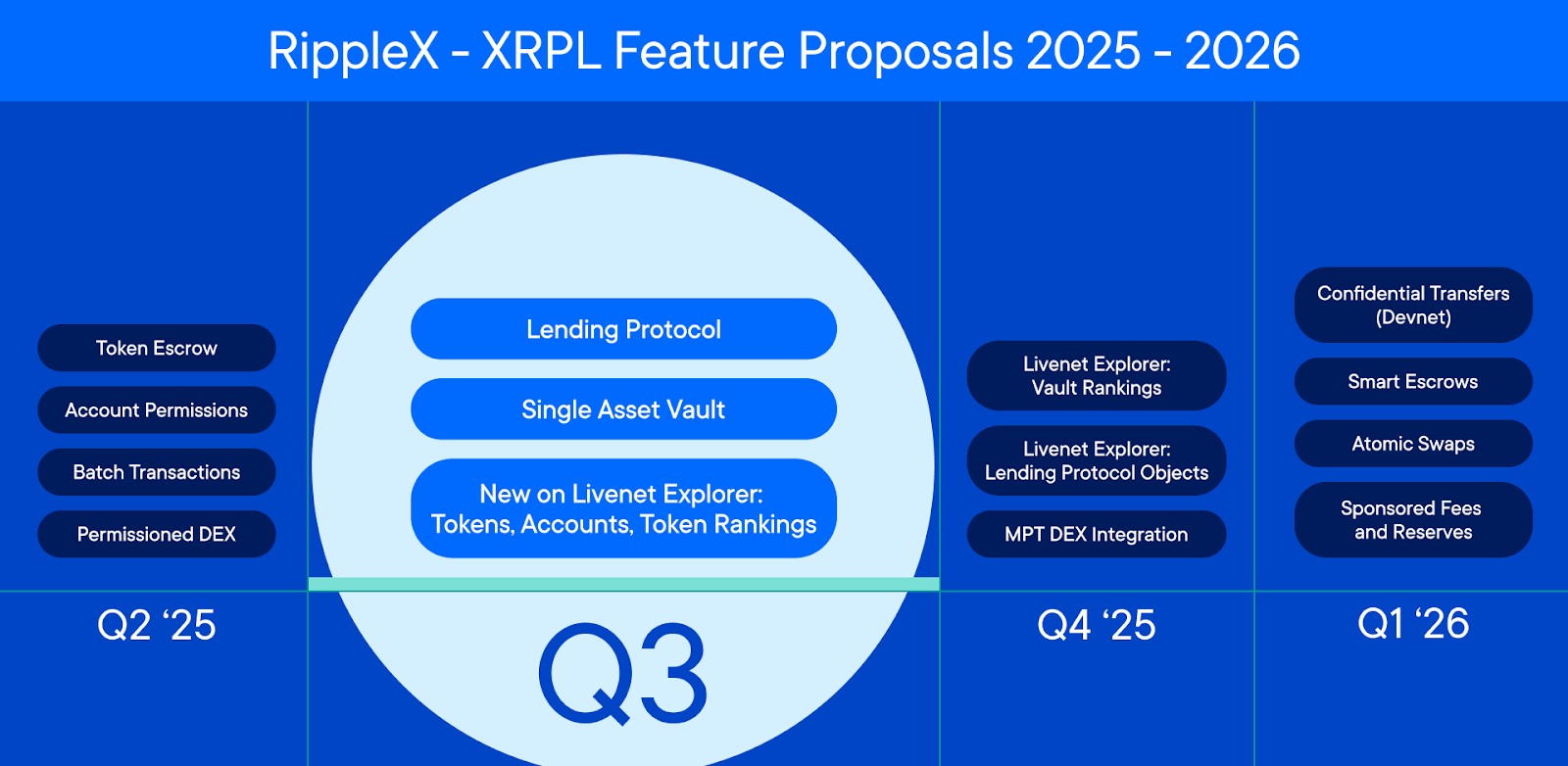

Roadmap highlights

The roadmap outlines three pillars for growth. First of all, compliance features such as credentials and deep freeze are already live. Second, the native lending protocol will be released later this year with XRPL version 3.0.0.

Third, Zero Knowledge Proof (ZKP) integration is under development. These allow confidential transactions while satisfying regulators. Ripplex is hoping for a confidential multipurpose token (MPT) in early 2026.

Ripplex XRPL Roadmap. Source: Ripplex

XRPL records Stablecoin volumes of over $1 billion each month. It is currently ranked among the top 10 chains of real-world asset activities. Ripplex sees these milestones as evidence of the rapid expansion of institutional regulations.

“This momentum underscores the evolution of XRPL's real-world funding into a major blockchain. Ledgers are now strengthening two of the most important use cases in today's global market. Stubcoin payments, collateral management and tokenization provide an essential foundation.

This shift reflects what we saw in the tokenization market. Beincrypto recently reported on its plans to place macroeconomic data such as the US Department of Commerce's GDP and PCE index into the blockchain, highlighting the rise in mainstream adoption of digital assets. XRPL's Multipurpose Token (MPT) standard is part of the same wave and aims to provide publisher tools for regulated on-chain finance.

It also covered the rise of the Compliance First Defis Platform earlier this year. Ripple's allowed Dex launch was an example of how the chain adapts to regulated pressure. The new roadmap continues its theme with a deep freeze that strengthens credentials and XRPL compliance focus.

Future challenges

Ethereum and its L2 still dominate Defi. Solana and Avalanche also target tokenization and institutional adoption. Ripplex needs to prove that a high-compliance approach can attract liquidity.

The lending protocol is the following major tests: If successful, it could create a low-cost, compliant credit market on a large scale. However, the institution only commits if liquidity continues.

Ripplex has placed institutional defi at the heart of the future of XRPL. The roadmap reflects a clear strategy built on compliance, credit, and confidentiality. The following year shows whether the institution will accept it.

Post Ripplex announces the XRPL Defi Roadmap: Does it attract institutional capital? It first appeared in Beincrypto.