Welcome to our newsletter “Crypto Long & Short”. this week:

- Insights on the next big step for stablecoins (hint: it’s not another USD token) by Martin Brucko of Schuman Financial

- A mood check on the post-holiday crypto selloff, upcoming fusaka upgrades, and why ETH's role will be important in leading the broader market recovery (Andy Baehr)

- Top headlines educational institutions should read by Francisco Memoria

- This week's chart “Hyper Liquid Weekly Volume vs HYPE/BTC”

-Alexandra Levis

Expert insights

Don’t write off your euro stablecoins yet

– by martin blancoCEO and Co-Founder, Schuman Financial

The ranking of stablecoins is overwhelmingly dollar-based. USDT, USDC, and other USD tokens account for the majority of supply and usage, with the dollar accounting for approximately 99% of the over $300 billion market. At around $600 million, Euro stablecoins seem trivial, especially now that public debate in Europe focuses more on CBDCs than privately issued Euro stablecoins.

However, today's numbers can be misleading. Stablecoins are already solving large-scale real economic activity. In 2024, it will process approximately $28 trillion, more than Visa and Mastercard combined. This marks the emergence of parallel payment rails that are already functioning at system scale.

The problem for Europe is that almost all of this activity is settled in dollars rather than euros. Euro stablecoins are not small because they do not require a euro leg. Although Europe is small because its currency is not tied to infrastructure that is already operational, the transition to tokenized finance is irreversible.

Traditional payment rails still rely on cut-off times and adjustment cycles measured in days. A new stack is forming around this aging stack, where assets and payments are settled directly on-chain. Stablecoins are becoming an important core infrastructure for financial services. Standard Chartered predicts that there will be $30 trillion in tokenized real-world assets by 2034. Citigroup predicts that by 2030, tokenized digital securities could reach up to $5 trillion, and tokenized assets could reach 10% of global GDP. These cannot function without on-chain fiat currency. The world's second largest currency is too important not to play a role. The Eurozone has a $16 trillion economy and is the world's second largest currency area.

Suppose we accept two simple facts. 1. The euro will not disappear, 2. Europe will not dollarize, so it is only natural that a globally significant euro stablecoin will emerge. The underlying euro economy is huge. In 2023, the Eurosystem's T2 platform processed approximately 2.2 trillion euros per day. According to the Bank for International Settlements (BIS), average daily foreign exchange transaction volume worldwide in April 2025 reached $9.6 trillion, with US dollars accounting for approximately 89% of all transactions. The euro ranks as the second most active currency in the world. Even if 0.1% of euro flows moved on-chain, that would mean 2.2 billion euros in payments each day, or more than 800 billion euros per year. This is more than enough to support the Euro stablecoin ecosystem worth hundreds of billions of dollars.

The real question for policymakers and investors is not whether euro stablecoins will win outright, but which combination of on-chain euro options best balances innovation and financial stability.

Dollar stablecoins have had a head start over 10 years. Europe is now catching up. The next big expansion of stablecoins will not be another USD token, but a reliable and scalable euro stablecoin built to the size of the European economy and privately issued.

this week's headlines

– Written by Francisco Rodriguez

This week's headlines suggest that despite short-term volatility, institutional investors are more confident and have prudent money positions for the long term. Japan and the Fed are showing signs that volatility is not going away anytime soon.

- Bank of America gives wealth advisors the green light to recommend up to 4% Bitcoin allocation. The news comes just hours after a long-term crypto holdout, with asset management giant Vanguard announcing it would allow customers access to digital asset ETFs.

- JPMorgan's IBIT-linked structured notes align with halving: JPMorgan has introduced a new investment product that pays in line with Bitcoin's four-year halving.

- Michael Saylor’s Sunday changeup hints at new announcements to come: Michael Saylor teased a switch from orange dots to green dots in a general social media post announcing additional BTC purchases.

- Japan to cut virtual currency tax burden to 20% across the board to support local Bitcoin traders: A government-backed tax reform bill would classify virtual currency profits under a separate tax framework.

- Bitcoin ETF is now BlackRock's biggest revenue generator, executives say: The company's Spot Bitcoin ETF has unexpectedly become BlackRock's biggest revenue generator.

Vibe check

Sunday is fear, Wednesday is upgrade.

– by Andy Baer, CFA; Head of Products and Research, CoinDesk Indices

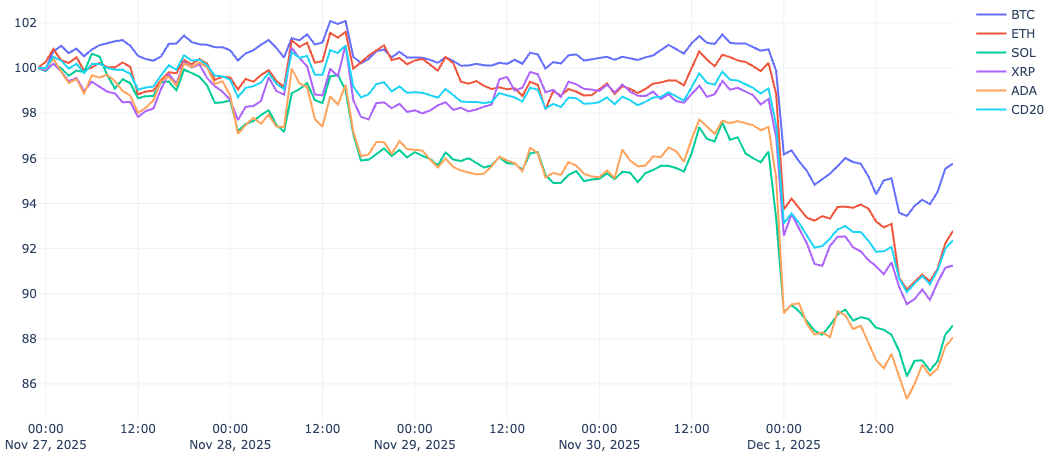

After a thankfully calm long Thanksgiving weekend, crypto markets delivered a fireball of fear on Sunday. Bitcoin fell 5% in a matter of hours, and Ethereum fell 7%, wiping out its recently regained $200 billion market cap. All the confident optimism of my Cryptocurrency Weekly Review Podcast playlist evaporated with it.

“…At least we got to enjoy the long weekend.”

Monday's decline continued with further declines, pushing Bitcoin to $84,000 and Ether to $2,700. By the close of trading at 4 p.m., the CoinDesk 20 Index had fallen 8.15% in 24 hours to 2,695.59. Just when I thought I was out of the woods, I was wrong.

ETH is important

Back in April, when the tariff tantrum was winding down, we wrote “Which one is ETH?” We are calling for an ETH-led rally to counter Bitcoin's narrative dominance and create breathing room for the broader asset class. By the time we released “Ether Real” on July 20th, our wish had been granted. ETH's rally has been so strong that it briefly had a higher weight on CoinDesk20 than Bitcoin, driven by stablecoin and tokenization optimism symbolized by the passage of the Genius Act.

We continue to believe that the rise of the broader digital asset class is not possible without ETH's participation, if not leadership.

Which brings us to Wednesday's Fusaka upgrade, a distinctive Ethereum portmanteau combining Hulu (star) and Osaka (Earth's host city), Ethereum's second major hard fork of 2025. As traders panicked over Sunday's flash, Ethereum developers were finalizing what Fidelity Digital Assets called “arguably the most exciting upgrade in years.”

Why is fusaka important?

Fusaka represents a strategic turning point. This is the first Ethereum upgrade that was shaped by clearly defined economic priorities rather than disparate technical desires. As Consensys said in a recent post, this upgrade delivers “some of the biggest gains in network scaling since the merger” through backend improvements rather than flashy user experience features.

At its core is PeerDAS (Peer Data Availability Sampling), which allows nodes to validate blocks without downloading all the data. This democratizes validation efforts, enables the planned 10x increase in blob capacity, and dramatically increases Layer 2 throughput. The mainnet gas limit will also increase to 60 million units, increasing the capacity for direct layer 1 transactions.

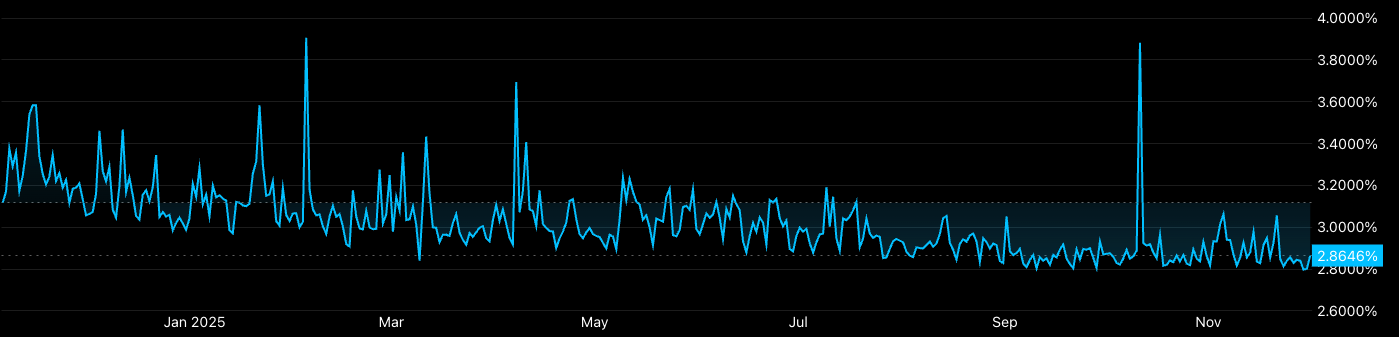

A strategic shift toward layer 1 value capture is paramount. Increased mainnet activity drives revenue directly into Ethereum's base layer through two mechanisms: increased rewards to validators through increased transaction fees and MEV, and deflationary pressure through EIP-1559 fee burn. More activity means more ETH is spent, creating a “buyback-like” enhancement to the value of the token, while also increasing staking yield.

CESR (Composite Ether Staking Rate) may be improved by Fusaka

fast money, slow money

As Bitcoin lethargy, DAT doubts, liquidity issues, and retail inertia plague Fast Money, Fusaka's determined direction could help ETH lead the way again. The quiet march of Ethereum development continues regardless of price trends. ConsenSys emphasizes that the developer is currently aiming to “accelerate the pace of hard forks twice a year” while maintaining the momentum of the surge phase of Ethereum’s roadmap.

Sunday's decline dominated the headlines, but Wednesday's upgrade may be more important.

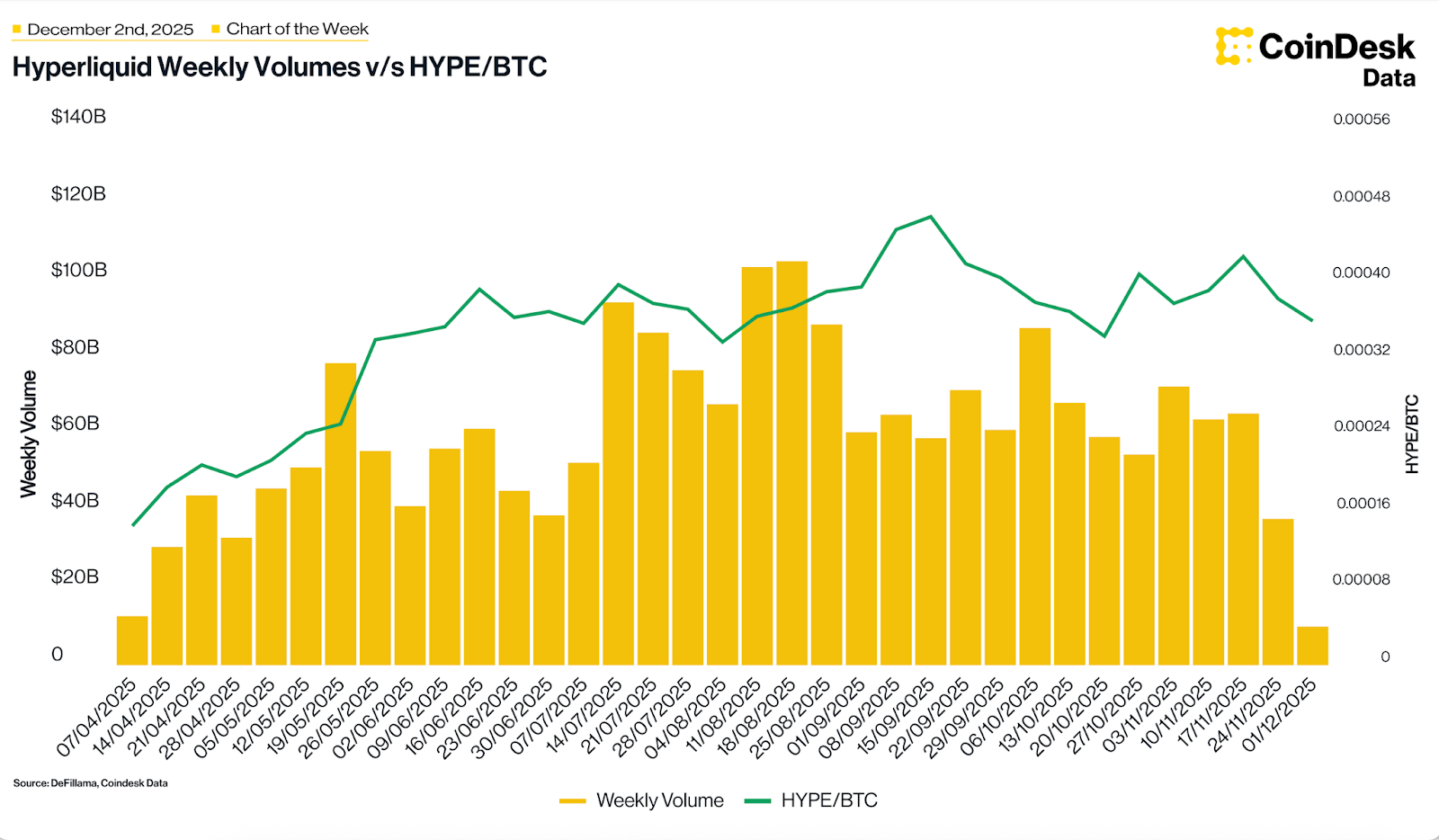

This week's chart

Comparison of Hyper Liquid weekly volume and HYPE/BTC

Although Hyperliquid's weekly trading volume has been in an obvious decreasing trend since October 2025, due to the general market slowdown as well as increased competition from platforms such as Lighter and Paradex, the HYPE/BTC ratio has shown some deviation and maintained a positive or flat trend. This suggests that HYPE maintains favorable price action against Bitcoin compared to most altcoins and even absorbed the recent token unlocking event. Assuming the HYPE/BTC ratio continues to maintain its current strength, an increase in platform fundamentals (weekly volume) in the future will create a favorable technical environment for HYPE token price movements.

listen. read. clock. engage.

- listen: How CoinDesk aims to professionalize cryptocurrency investing. David LaValle, President of CoinDesk Indices and Data, speaks with The Wealth Advisor.

- read: Stablecoin and CBDC report. The stablecoin market fell by $4.54 billion to $303 billion, the largest monthly decline since November 2022.

- clock: Andrew Baer and Galaxy's head of credit trading, Beimnet Abebe, discuss the main causes of the recent crypto market downturn.

- engage: For research, reports, and market insights delivered straight to your inbox, subscribe to the new CoinDesk Research Monthly Newsletter.

Looking for more? Get the latest cryptocurrency news at coindesk.com and market updates at coindesk.com/indices.