Decentralized physical infrastructure (DePIN) protocol Peak has signed a memorandum of understanding with Dubai’s Virtual Assets Regulatory Authority (VARA) to develop a regulatory framework for on-chain robotics and tokenized machines.

According to Thursday's press release, the memorandum focuses on peaq's Machine Economy Free Zone and also includes additional areas of cooperation such as guidance for projects seeking VARA licenses, joint training efforts in technology and compliance, and data sharing to support research and regulation.

The Machine Economy Free Zone, which opened in July, is a controlled environment to test how robotics and AI work within a decentralized network.

Peaq co-founder Max Teke said the agreement “represents a significant commitment from both sides to enable the machine economy in a compliant manner, enabling people to participate in, build, and profit from entirely new economic sectors.”

Man and machine on the peak. sauce: peak.xyz

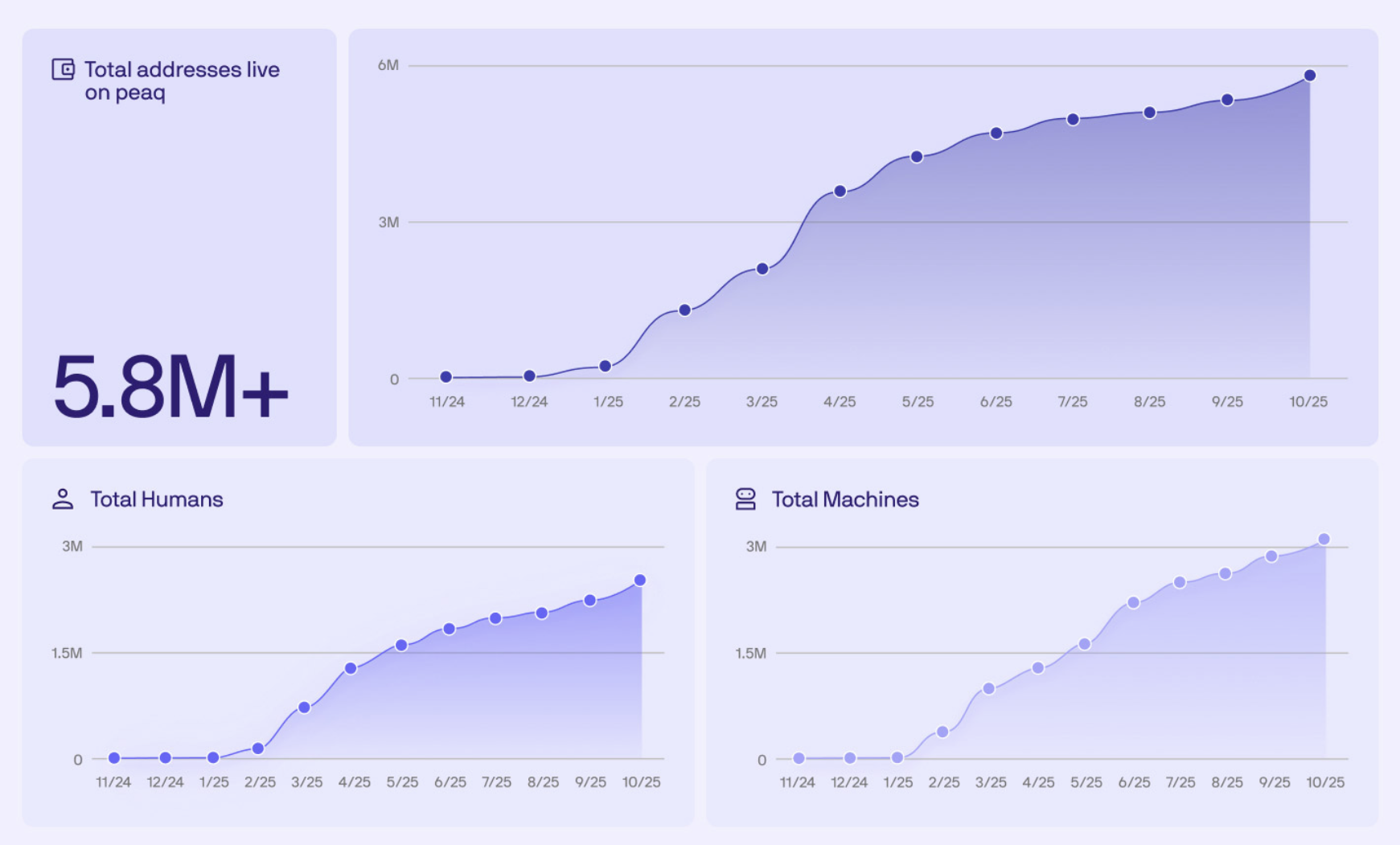

Peaq is a layer 1 blockchain for the machine economy, a network where connected devices and robots can own assets, share data, and earn income. Powering DePIN and tokenized real-world assets.

VARA is Dubai's cryptocurrency and digital assets regulatory authority. Established in 2022, it oversees licensing, compliance and policy for virtual asset businesses across the emirate.

The announcement comes about a week after VARA entered into a strategic partnership with DMCC, Dubai's government-backed commodity and business free zone, to develop a regulatory framework for tokenized products.

Matthew White, CEO of VARA, said the agency aims to “position Dubai as a global benchmark for safe and sustainable growth in this next generation asset class”.

Related: Singapore and UAE are the “most crypto-obsessed” countries: report

Cryptocurrency promotion in Dubai and UAE

Since VARA was established in March 2022 to oversee the regulation of cryptocurrencies and Web3, it has helped transform Dubai and the entire UAE into one of the world's leading digital asset and blockchain innovation hubs.

On May 19, VARA updated its rulebook for domestic virtual asset service providers (VASPs) to clarify the issuance and distribution of RWAs. According to UAE-based law firm NeosLegal, the new rules will allow people to issue RWAs and list them on the secondary market.

In August, VARA and the UAE Securities and Commodities Authority (SCA) entered into a strategic partnership to synchronize regulatory approaches for digital assets. Under the agreement, the Dubai-based license will apply across the UAE.

On September 22, the UAE signed the Multilateral Competent Authority Agreement under the Crypto Asset Reporting Framework (CARF) to establish automatic tax information sharing on crypto assets among member states. The Ministry of Finance said the framework will come into force in 2027, with the first data exchange scheduled for 2028.

Dubai and the UAE's approach to digital assets is understandably attracting high-net-worth crypto investors to relocate. The UAE has become a major destination for millionaires, with around 9,800 people expected to move there in 2025.

Chase Ergen, director of crypto investment firm DeFi Technologies, predicts that the crypto sector will grow to become the UAE's second-largest industry within five years.

magazine: Crypto City: Dubai Guide