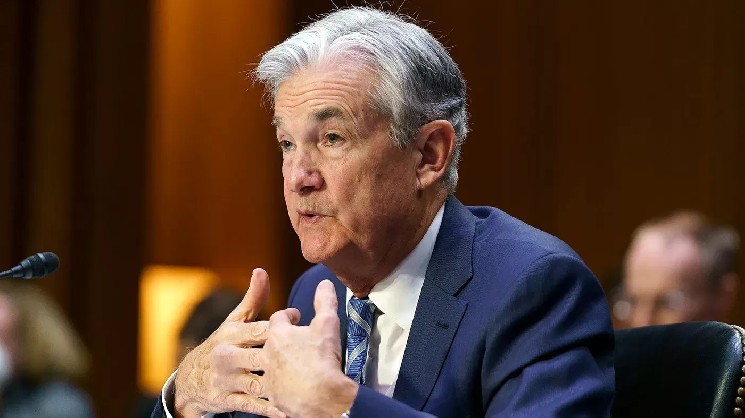

Jeremy Siegel, a finance professor at the Wharton School of Management at the University of Pennsylvania, said he expects the Fed to cut interest rates at its meeting this week, but in a “hawkish” tone.

Mr. Siegel was a guest on CNBC's “Squawk Box,” where he gave a critical assessment of the Fed's much-anticipated decisions, the nomination of the next Fed chairman, and the future of interest rates.

Siegel said he expects the Fed to cut interest rates by 25 basis points this week, but the decision won't be unanimous. “I'm calling this a 'hawkish cut,' because I think there will be opposition from both sides,” Siegel said.

Mr. Mester, the Fed's director, could push for a deep 50 basis point cut, but two or three Fed members could vote to keep rates on hold, he said. Siegel added: “If so, this could be the most dissenting opinion of Jerome Powell in his nearly eight years as chairman.”

Mr. Siegel also talked about the candidate for new Federal Reserve head, who will be announced by new President Donald Trump early next year, noting that Kevin Hassett's name has been floated.

“The odds that Kevin Hassett will become the next Fed chairman are currently about 70%,” Siegel said. “Even if his name is never formally announced, Mr. Hassett's rhetoric will start to move the market much more than it has in the past.” Mr. Siegel also noted that he and Mr. Hassett worked together on John McCain's campaigns in the past, calling him a “great economist.”

Governor Siegel was cautious about the impact of rate cuts on the bond market, saying he did not expect long-term interest rates to fall significantly.

Mr. Siegel elaborated on his analysis: “If you look at the past 75 years, we see that the federal funds rate has been about 100 basis points below the 10-year Treasury yield. Currently, the 10-year Treasury yield is 4.15%, which means the federal rate could fall below 3%. However, this may not significantly lower long-term rates and, by extension, mortgage rates.”

Nevertheless, Siegel said the rate cut would help the economy: “More than $15 trillion in loans are tied directly to the federal funds rate. Short-term borrowings such as auto loans, inventory loans, and credit card rates are directly affected. This will definitely stimulate the economy.”

Siegel added that despite concerns about tariffs, the economy is currently holding up well and has not seen a significant slowdown in sales.

*This is not investment advice.