There has been recent activity in U.S. crypto exchange traded funds (ETFs) this week, with at least five new product applications filed with the U.S. Securities and Exchange Commission despite the ongoing government shutdown.

The latest development comes from VanEck, which on Thursday filed an S-1 Form with the SEC for the VanEck Lido Staked Ethereum ETF, which will track the performance of stETH, Lido's liquid staking token.

As a result of stETH's underlying protocol-based liquid staking activity, “the trust expects to earn certain staking rewards through its ownership of stETH,” the trust said.

VanEck took early steps toward product launch by registering a statutory trust in Delaware on October 2nd.

stETH is a liquid staking token that represents staking rewards that accrue on top of deposited Ether (ETH), allowing holders to earn income while maintaining liquidity.

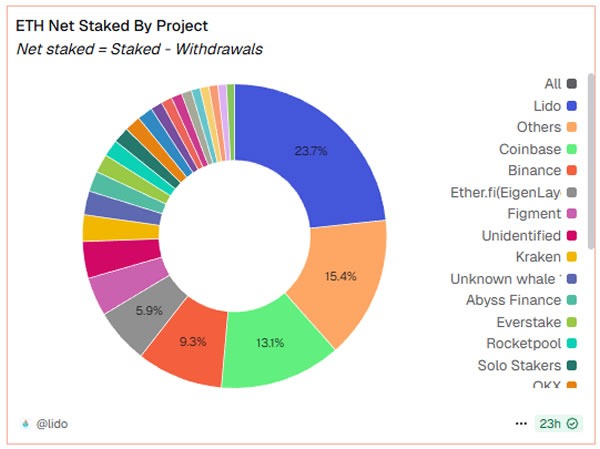

Lido is the largest liquidity staking platform with approximately 8.5 million ETH staked, valued at approximately $33 billion. We currently offer a staking yield of 3.3% on deposited ETH.

Lido has most of the ether staked. sauce: dune analysis

Leveraged Hyperliquid ETF

Meanwhile, ETF issuers are creating more unusual products under new guidance from the SEC. But the U.S. government shutdown, which has now lasted 17 days, appears to have frozen all decision-making.

Related: October is “ETF Month”, 16 crypto funds await final decision

21Shares on Thursday filed for a leveraged crypto ETF with 2x exposure to Hyperliquid's native token, HYPE. Leverage only applies to the daily performance of the token, not over the long term.

Eric Balciunas, an ETF expert at Bloomberg, said the filing is “very niche… but in three or four years it will be in the billions.”

“It's really a land rush right now,” he said of the current large number of crypto ETF applications.

ARK Invest's new BTC service

Cathie Wood’s ARK Invest filed for three new Bitcoin ETFs on Tuesday.

The ARK Bitcoin Yield ETF is designed to generate income through yield-based Bitcoin strategies such as selling options and collecting premiums.

The ARK DIET Bitcoin 1 ETF offers 50% downside protection while allowing investors to participate in the rally after Bitcoin prices rise by 5% quarterly. The ARK DIET Bitcoin 2 ETF offers 10% downside protection and allows further upside if Bitcoin trades above the quarter's opening price.

Other crypto ETF news

Earlier this week, Volatility Shares filed for a new range of 3x and 5x leveraged ETFs tracking cryptocurrencies and major U.S. stocks, Balchunas reported.

On Wednesday, VanEck filed an updated Solana staking ETF application with a 0.3% fee, according to Bloomberg ETF analyst James Seifert.

“Once the government shutdown ends, the floodgates for spot crypto ETFs will open… It’s ironic that fiscal debt is rising and the usual political theater is preventing this from happening, which is exactly what cryptocurrencies are targeting,” Nova Deus President Nate Geraci said earlier this week.

magazine: Binance shakes up Morgan Stanley’s security tokens in South Korea, Japan: Asia Express