Today's Ethereum Price: $2,570

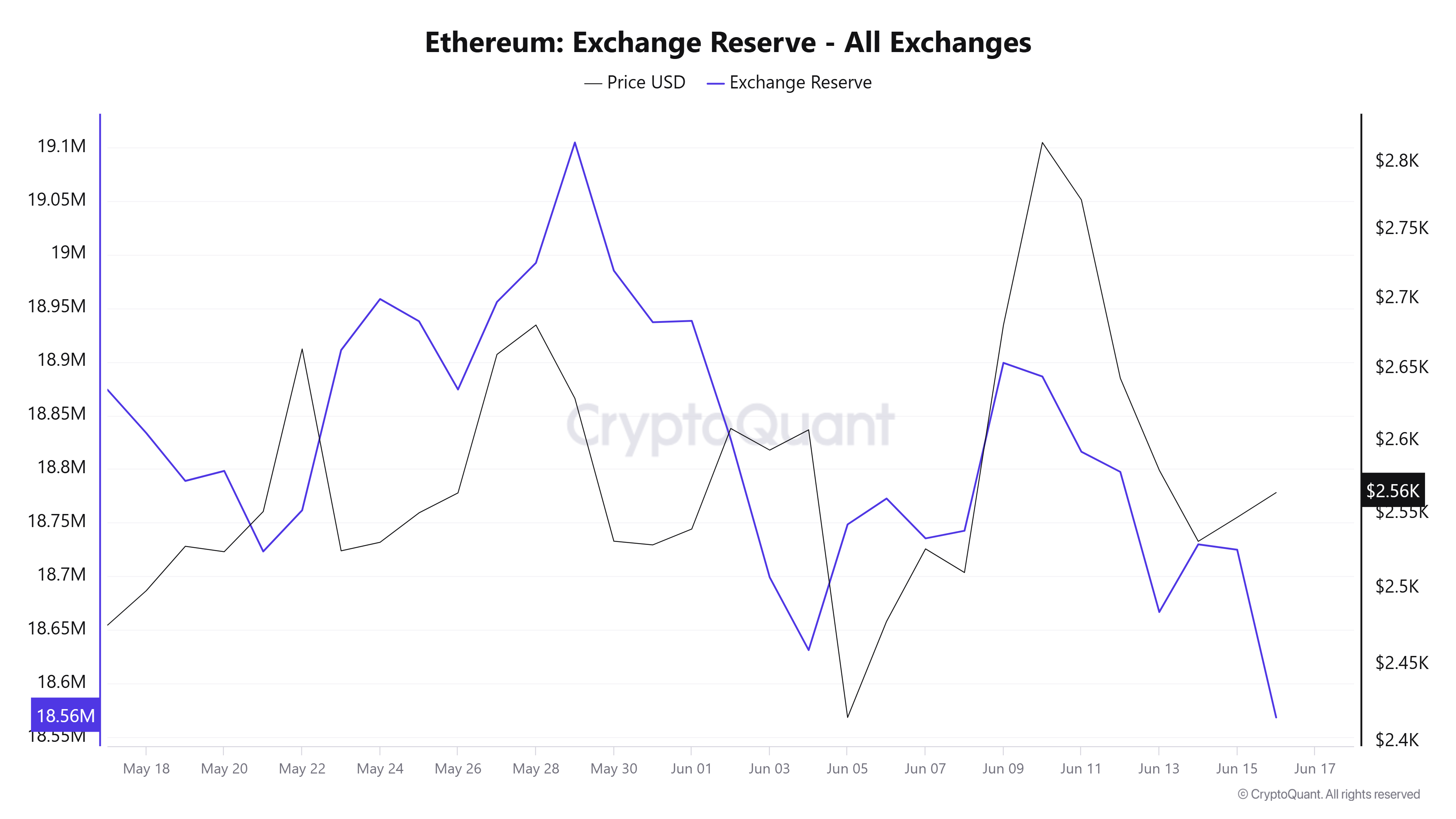

- Ethereum Exchange reserves have turned upside down towards accumulation, reaching an ETH of 18.57 million in history.

- Ethereum ETFS recorded a net inflow of $583 million each week, the strongest performance since December.

- MEXC's Tracy Jin offers careful ETH price growth forecasts despite positive developments surrounding the Ethereum ecosystem.

- ETH is facing a denial in 200 days of SMA after receiving $2,500 in support over the weekend.

Ethereum (ETH) temporarily surpassed $2,600 on Monday after switching to Top Altcoin's accumulation to Exchange Reserve last week.

Ethereum Exchangeh amid $583 million inflow of ETFs

Ethereum resumed bullish behavior on Monday after replacement reserves returned to downtrends, dropping from 1872 million ETH on Saturday to an all-time low of 18.57 million ETH in the last 24 hours. A drop in total exchange prices indicates a rise in purchasing pressure.

Eth Exchange Reserve. Source: Cryptoquant

During the period, the total amount of ETH has grown by 80k ETH, indicating stronger bullish sentiment among investors. beaconchain.

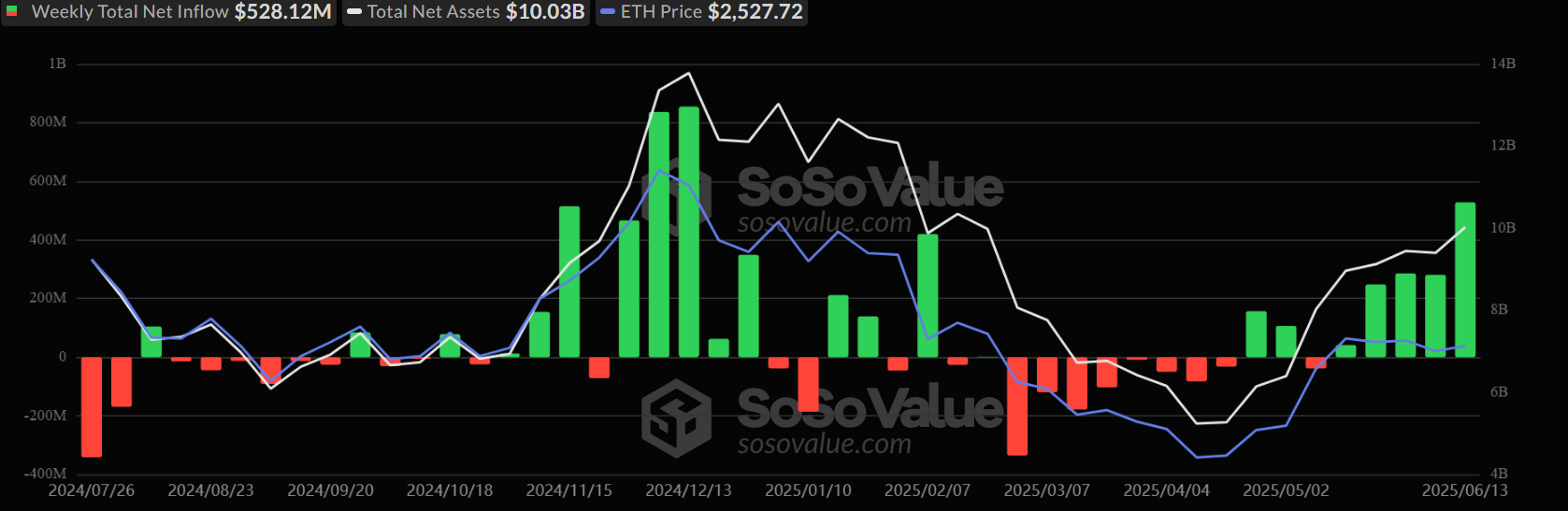

According to data from Coinshares, the shift to ETH accumulation followed a week of strong institutional purchasing pressure, pushing the net inflow of global Ethereum products to $583 million last week.

Purchase pressure spearheaded $52,812 million to the US Spot ETH Exchange Trade Fund (ETF), the highest weekly performance since December 2024. The product recorded a 19-day net inflow before breaking its winning streak on Friday.

US Spot ETH ETF flow. Source: SosoValue

“Ethereum recovery isDigital oil“We're looking forward to seeing you in the future,” said Tracy Jin, COO of Crypto Exchange MEXC.

“It's also good to make sure that rules regarding staking and new stubcoin-related ETFs are in place, which has helped to boost investors' trust.”

Despite the recent positive developments surrounding ETH, Jin has carefully maintained ETH's year-end price forecast.

“ETH will be between $2,800 and $3,600 by the end of the year, and could be even higher if ETF staking and network development speed up,” Jin said.

Ethereum price forecast: ETH sees rejection at 200-day SMA

Ethereum has experienced a $134.04 million futures liquidation, with long and short liquidation of $755 million and $63.49 million for each Coinglass data over the past 24 hours, respectively.

ETH held nearly $2,500 in support through the weekend and tested the 200-day simple moving average (SMA) as dynamic resistance before experiencing rejection. Top Altcoin can test a $2,850 key resistance by flipping 200-day SMA support. Rejection at $2,850 means double-top formation.

ETH/USDT Daily Chart

On the downside, if a $2,500 support fails, ETH must retain the low boundary of key channels enhanced by a 50-day SMA, preventing a reduction to a support range of between $2,260 and $2,110.

The relative strength index (RSI) is above neutral levels, allowing you to test moving average lines, while the stoch oscillator (Stoch) is below neutral levels. A successful crossover above with both metrics will strengthen bullish momentum.

Related News

- Ethereum price forecast: ETH's new valuation framework tagged “digital oil” and highlights a $8,000 bull case

- Ethereum Price Prediction: ETH maintains downtrend despite Sharplink's $463 million purchase

- Crypto Today: Bitcoin, Ethereum, XRP rebound and surge in open interest, trading volume