The major Altcoin Ethereum has been heading downwards since an unsuccessful attempt to retrieve an all-time high on August 13th.

ETH prices are expected to continue to decline with 10% falling over the past five days as sales pressures strengthen as profits increase.

Ethereum Bears gain control

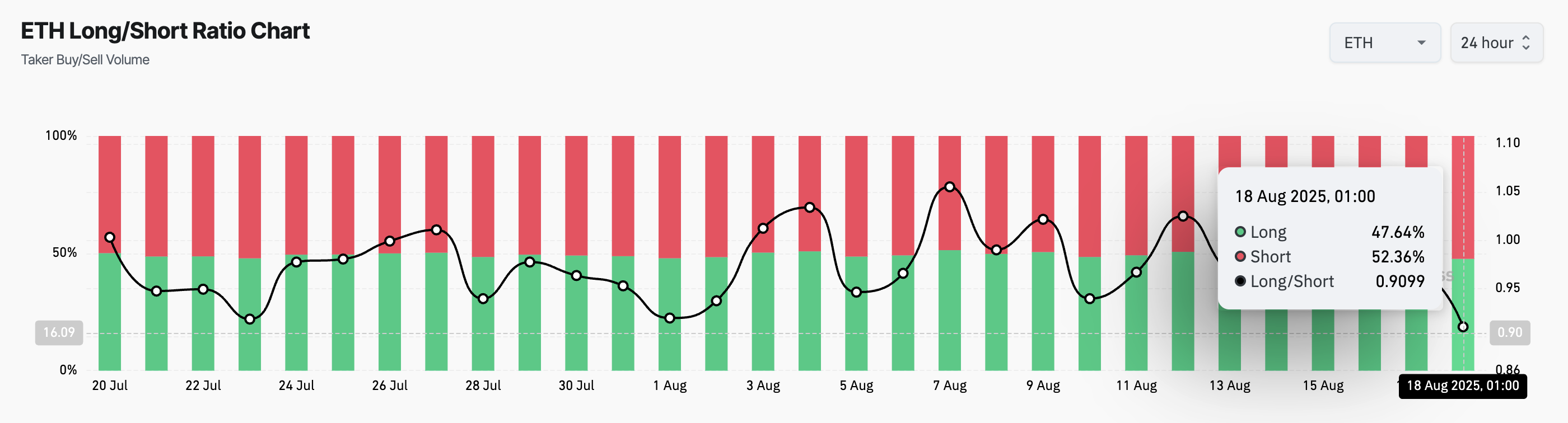

The long/short ratio of ETH fell to 30-day lows, reflecting increased trader attention and reduced bullish sentiment. At the time of writing, this ratio is 0.90.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

ETH long/short ratio. Source: Coinglass

This ratio compares the number of long and short positions in the market. If the long/short ratio of assets exceeds 1, it can be longer than the short position, indicating that the trader is primarily betting on price increases.

Conversely, as seen in ETH, one lower ratio suggests that most traders are positioning due to price drops. This highlights an increase in bearish sentiment among ETH futures holders as expectations for sustained negative movements grow.

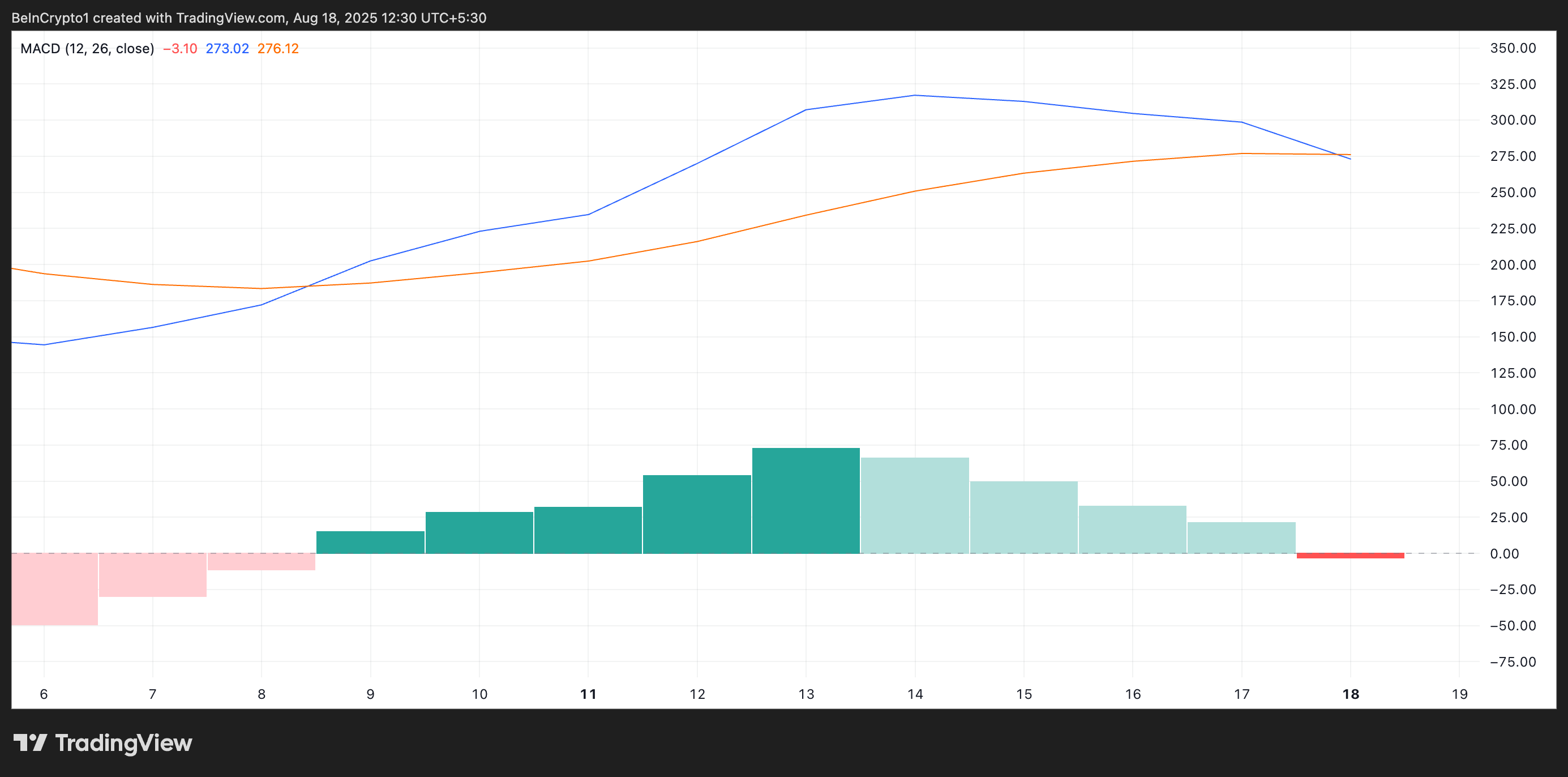

Furthermore, negative crossover of ETH moving average convergence divergence (MACD) during today's session refers to updating the seller's control. During pressing, the MACD line (blue) of the coin is located below the signal line (orange).

ETH MACD. Source: TradingView

MACD indicators identify trends and momentum in price movement. This helps traders find potential purchase or sale signals through a crossover between the MACD line and the signal line.

When a MACD line crosses beneath the signal line, it is considered a bear signal. This indicates that the downward momentum is increasing and the seller may be in control.

ETH's recent negative MACD crossover suggests that its prices could continue to face sales pressure. This exacerbates the risk of a drop of nearly $4,000 lower support levels.

ETH Prices face important tests

At press time, ETH trades for $4,224. If sales continue, there is a risk that major Altcoin will plummet to $4,063. If this price floor is not retained, the price of the ETH could drop to $3,491.

ETH price analysis. Source: TradingView

Meanwhile, as new demand enters the market, it could raise Altcoin's price to up to $4,793. A successful break beyond this level could bring the rally back to ETH's all-time high of $4,869.

Post Ethereum Bulls Retreat as your $5,000 dream fades. I saw the first $4,063 featured on Beincrypto.