Today's Ethereum prices have been consolidated at $4,270, down 4.5% from the peak, nearing the $4,480 peak. The move comes after a strong July-August rally that pushed ETH from $3,000 to a new annual high. Sellers are currently testing whether the Bulls can hold more than $4,200. This is a level tailored to both the short-term liquidity zone and the EMA support cluster.

Ethereum price forecast table: August 19, 2025

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

On the daily charts, ETH has recently tapped a weaker high of nearly $4,480, then went back to $4,270. The price structure remains bullish on the higher time frame, but the short-term chart shows a pause. The Smart Money Concept highlights character changes of less than $4,500, suggesting that sellers are trying to force changes in market structure.

ETH Price Dynamics (Source: TradingView)

In the 4-hour time frame, ETH from the rising triangle is broken, with support zones identified between $4,150 and $4,200. The wider uptrend remains intact, but destruction indicates momentum is declining to the top.

The RSI is at around 51st place on the 4-hour chart, reflecting neutrality after last week's excessive stretching. This suggests that ETH is consolidating rather than entering a confirmed reversal, but buyers need to intervene immediately to avoid deeper losses.

Why are Ethereum prices falling today?

ETH Price Dynamics (Source: TradingView)

The decline in Ethereum prices today is due to both technical rejection and wider spills. On the 30-minute chart, ETH slid in at VWAP level for $4,349, confirming his bearish inner control. The RSI has fallen low at 22, showing heavy sales conditions, and MACD continues to expand negatively.

ETH Price Dynamics (Source: TradingView)

The 4-hour chart super trend indicator has turned the wimp under $4,590, suggesting a pause in the trend. The DMI data confirms this, the -DI line overtakes +DI, and the ADX rises above 30, indicating downside momentum.

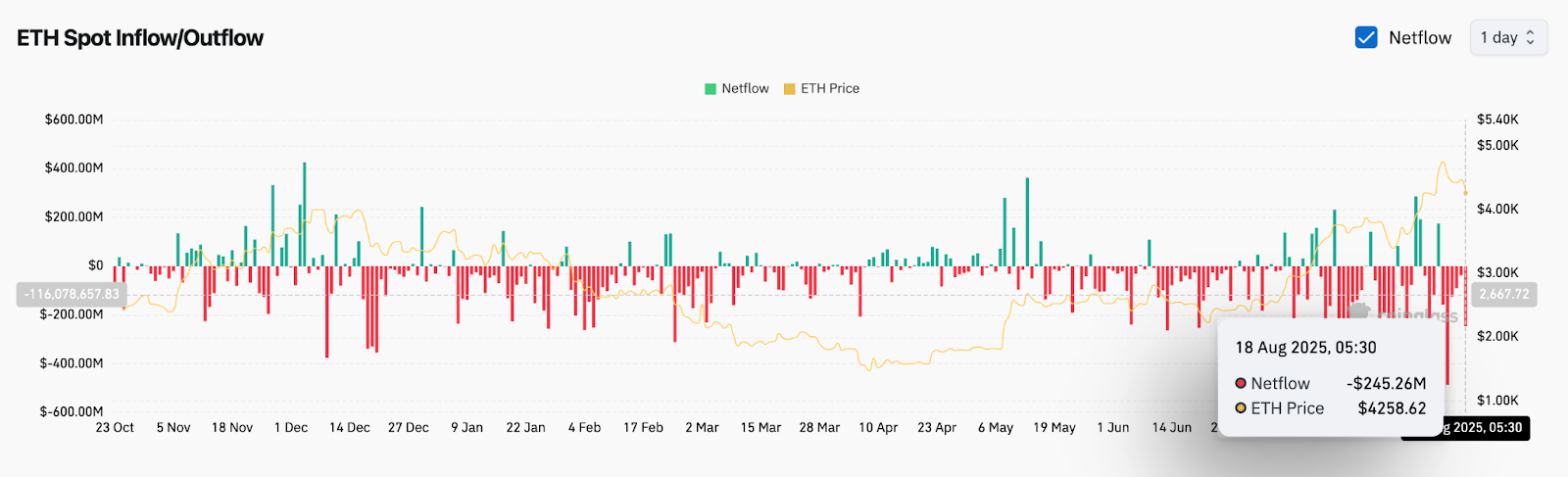

ETH on-chain analysis (source: Coinglass)

On-chain flow also highlights weaknesses. Spot exchange data coincides with a $245 million net spill on August 18, usually a bullish signal long term, but in this case, price denial of nearly $4,480. The imbalance between short-term inflow and macro sales pressure exposes ETH to pressure.

The indicator signals a retest of the key for $4,200

ETH Price Dynamics (Source: TradingView)

Ethereum finds itself at a pivotal technical point. The 20 EMA on the 4h chart was close to $4,387, while the 50 EMA slipped to $4,190. The Bollinger band shows ETH hugging the lower band, nearly $4,260, with volatility still rising following the rejection spike.

Momentum indicators confirm mixed emotions. The 30-minute RSI is oversold, referring to a potential bouncing, but the MACD slope remains bearish. The liquidity sweep also displays approximately $4,200. This means that this level can act as both a springboard or a breakdown trigger, depending on the volume of the next session.

Ethereum price forecast: Short-term outlook (24 hours)

For the next 24 hours, Ethereum prices are expected to remain volatile within the $4,200-4,350 range. When Bulls defends $4,200 and regains $4,350, they rebound to $4,480, and ultimately make it $4,600. On the other hand, if $4,200 fails, ETH could slide to $3,950, even in the $3,800 demand zone highlighted in the daily chart.

Given the oversold intraday signals and heavy spills, Ethereum's short-term bias is cautiously bearish. However, the long-term trend remains bullish at over $3,800, suggesting that this is more likely to be a consolidation than a complete reversal.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.