After weeks of accumulation, today's Ethereum prices are being pushed into a critical zone of resistance, close to $2,640. This concludes a consistently upward attempt from early June. The wider structure shows bullish intentions, but a clear breakout above this supply zone is needed to confirm the continuation of the trend.

What will be the price of Ethereum?

Ethusd Price Dynamics (Source: TradingView)

Ethereum price action approaches the vertices of a large symmetrical triangle that appears on your daily chart. The ETH price is currently at $2,623.83, with an intraday high of $2,646.02. This structure has been caught up in April, with prices consistently listing higher and lower values for horizontal resistance, forming what appears to be the ascending triangle within the wider integration phase.

Volume is slowly rising, with prices surpassing Bull Market Support Bands (20-week SMA and EMA), currently between $2,194.90 and $2,407.89. This structure reinforces medium-term bullish papers.

Ethusd Price Dynamics (Source: TradingView)

Smart Money's conceptual analysis shows that multiple chocks and BOS confirmations are close to $2,580-$2,600, adding weight to current breakout attempts. ETH also pushes through mild fluidity pockets, suggesting supply absorption is ongoing.

Why are Ethereum prices rising today?

The answer to why Ethereum prices are rising today lies at the bullish confluence across both price structures and centimetrics.

Ethusd Price Dynamics (Source: TradingView)

On the 4-hour chart, ETH remains the most important EMA (20/50/100/200), with the EMA20 at $2,574, serving as short-term dynamic support. The Bollinger band is expanding, with price tests testing the top band, close to $2,633. This is a sign of increased momentum and volatility.

Ethusd Price Dynamics (Source: TradingView)

The weekly Fibonacci retracement is seen at $2,745 just below the 0.5 level and at $2,424 near the 0.382 retracement. ETH has now printed two consecutive Green Weekly candles, over $2,500. Another bullish signal.

Ethusd Price Dynamics (Source: TradingView)

The momentum indicator also supports breakout cases. The 4-hour chart Money Flow Index (MFI) rose at 66.69, indicating a sustained capital inflow. The Chande Momentum Oscillator is over 50, enhancing upward momentum.

Ethusd Price Dynamics (Source: TradingView)

On the 15-minute chart, ETH appears to form an increasing wedge pattern, with immediate resistance of nearly $2,640. If the Bulls break above this ceiling, the next test will be between $2,685 and $2,715.

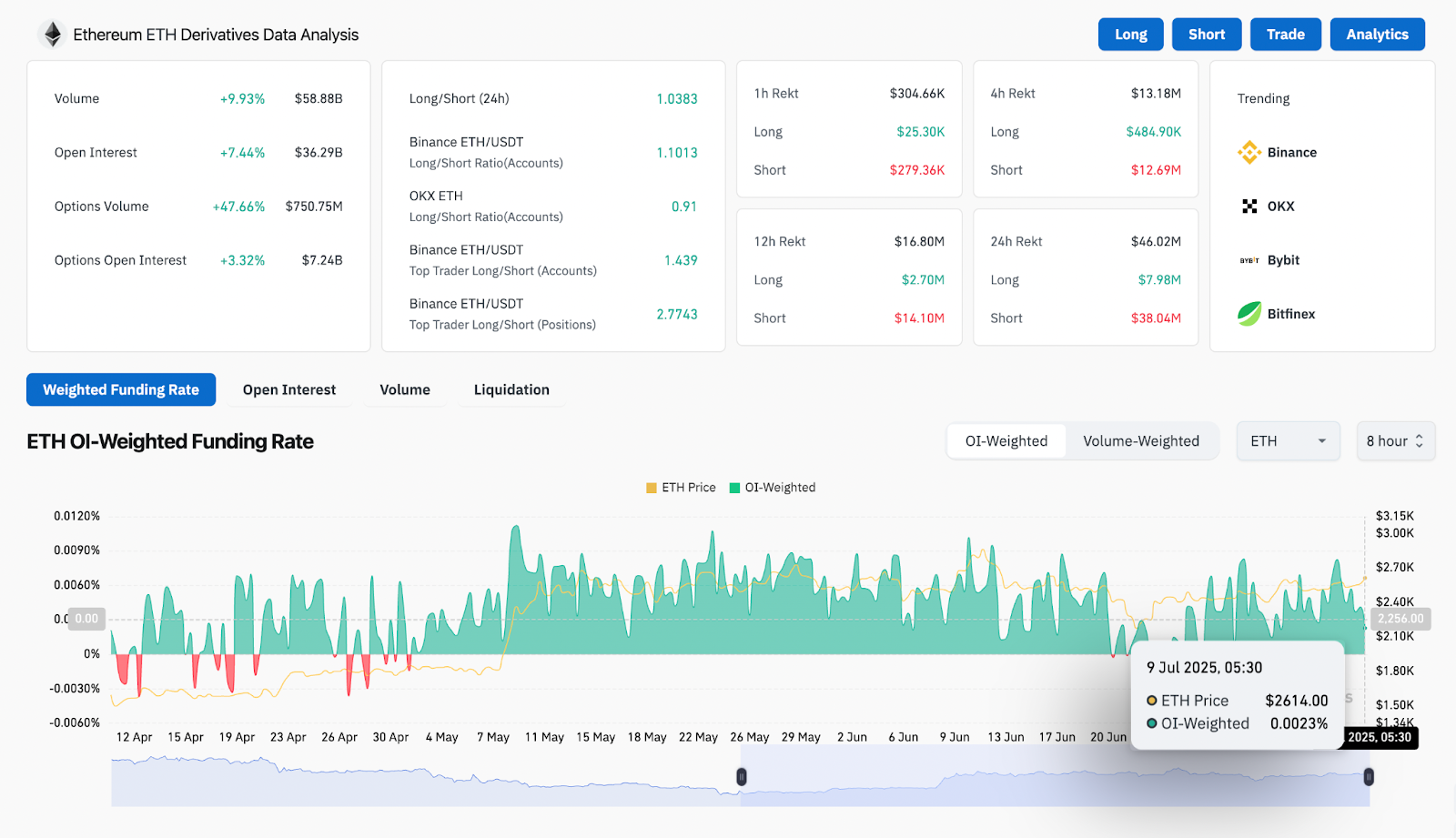

Derivatives and Volumes confirm the intent of uptrends

ETH derivative analysis (source: Coinglass)

Derivative data further highlights the growing optimism. Ethereum Open Inters, up 7.44%, to $3.629 billion, with options volumes ranging from 47.66% to $750.75 million. Daily volume has increased by nearly 10% to $5.888 billion. The Binance Top Trader Long/Short ratio is above 2.77, indicating long domination.

As of July 9th, the funding rate for ETH OI weights remains positive (0.0023%), confirming that length is paying premium to maintain position. This is a typical signal of bullish emotions.

Ethusd Price Dynamics (Source: TradingView)

Additionally, ETH is trading near the median of the pitchfork channel rising on the 4-hour chart. A clean break above the R3 pivot ($2,643.41) coincides with the channel's top trendline, paving the way for the next resistance band, near $2,715-$2,745.

Ethereum price forecast: Short-term outlook (24 hours)

Over the next 24 hours, Ethereum prices will be heavily influenced by whether the Bulls can decisively close to above $2,640. If confirmed on the volume, the next resistance follows $2,715 (R4) followed by $2,745 (FIB 0.5). The above breakouts that could aim for $2,852-$2,900.

On the downside, if your ETH fails to exceed $2,600, you could potentially retest $2,574 (EMA20) and $2,510 (EMA100). Beneath this zone, additional support is close to $2,424 (FIB 0.382) and $2,384 (previously breakout based).

With momentum, funding and market structures aligned, the outlook remains bullish, but a $2,640 rejection delays breakouts and causes short-term consolidation.

Ethereum price forecast table: July 10, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.