After regaining its $3,325 supply zone earlier this week, Ethereum prices were launched in the Vertical Rally, rising more than 20% in just three sessions. Today's Ethereum prices have traded at around $3,655, the highest level since early 2024. This movement is driven by a confirmed breakout from long-term triangular structures. The bullish continuation depends on ETH that holds above the main previous resistance levels.

What will be the price of Ethereum?

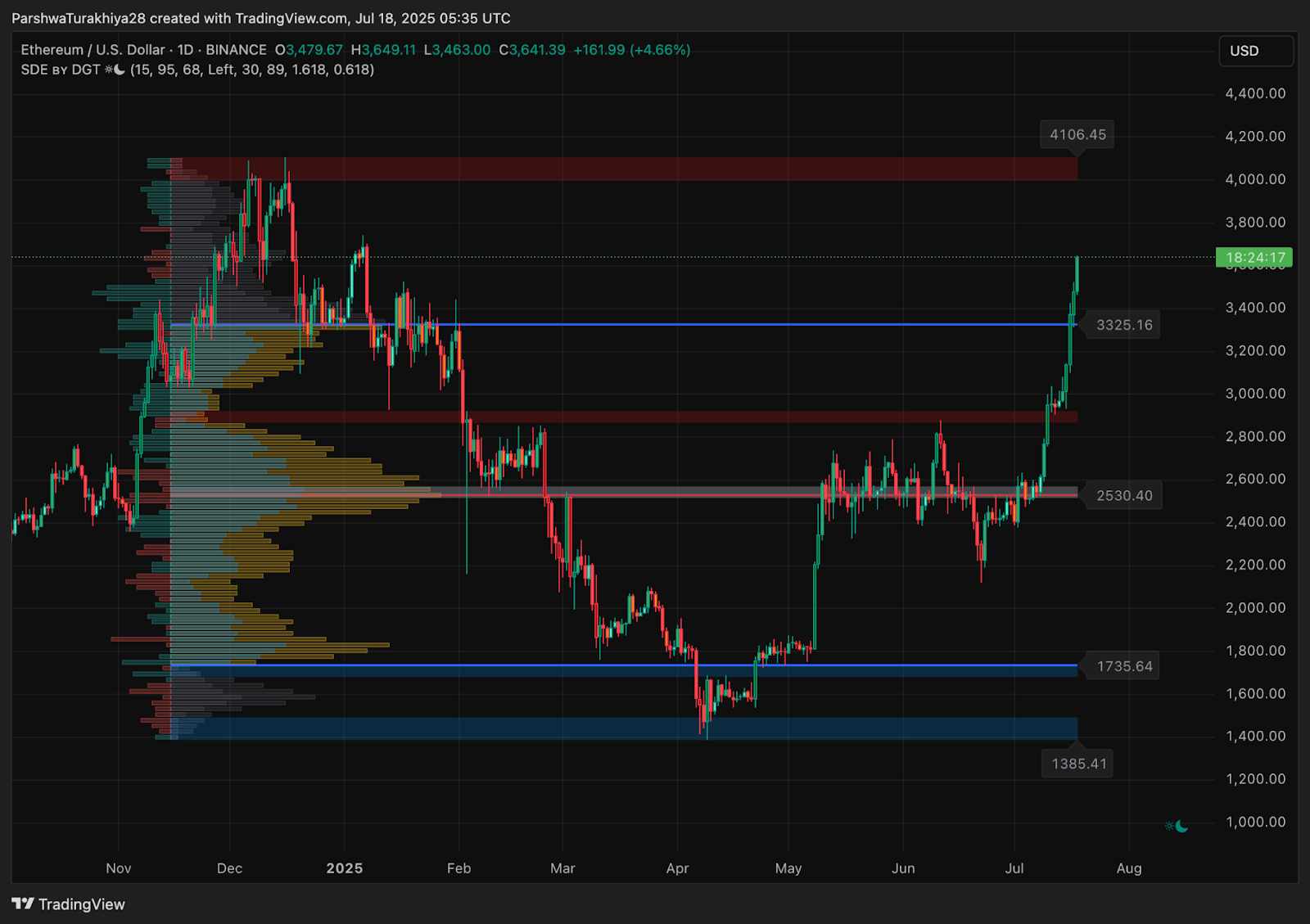

ETH Price Dynamics (Source: TradingView)

The weekly chart shows that Ethereum prices exceed the 0.618 Fibonacci retracement level at $3,067, and are now approaching the 0.786 level, close to $3,524. The rally unfolds shortly after ETH saw a breakout from the multi-year symmetrical triangles that appear on the monthly chart. Its structure has kept ETH down since 2022, and breakout candles now reflect the much-anticipated changes in macro trends.

ETH Price Dynamics (Source: TradingView)

In the daily time frame, ETH has been gaining momentum, cutting major levels, including $2,530 and $3,325. The volume profile highlights a low-liquid pocket between $3,500 and $3,700, increasing the chances of prices rising towards the $4,100 zone. Volume expansion supports this movement, and we have not yet encountered any critical supply zones.

Why are Ethereum prices rising today?

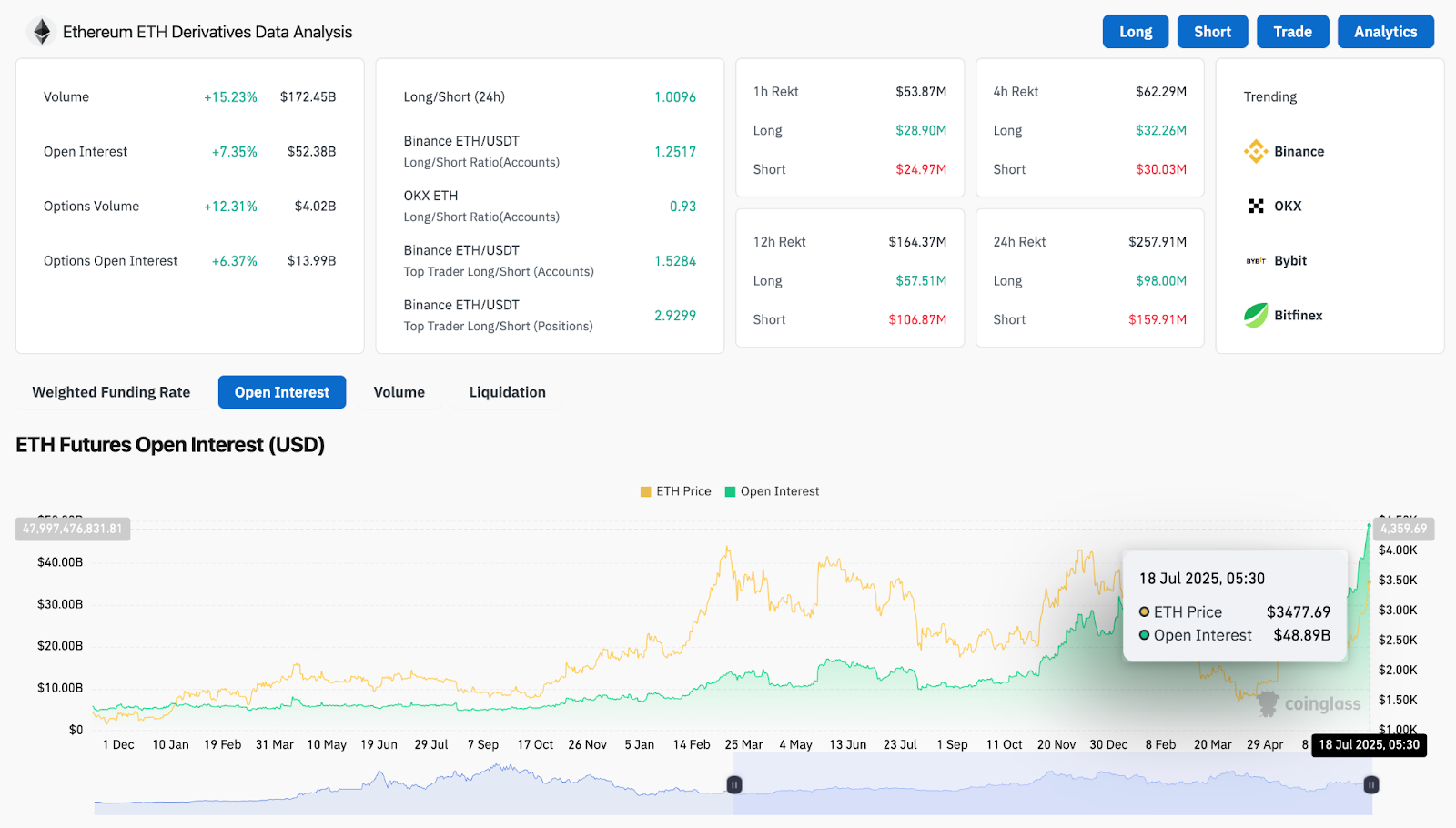

ETH derivative analysis (source: Coinglass)

Today's strong Ethereum price gatherings are supported by strong derivatives flows and market participation. ETH Open Intering rose 7.35% to $523.8 billion, bringing volume to $172.45 billion to 15.23%, according to Coinglas. Binance's long short ratio is 2.92 for top traders, indicating their preference for advantages.

ETH Price Dynamics (Source: TradingView)

Technically, Ethereum price action on the 4-hour chart is supported by bullish EMA alignment. The $3,323 20 EMA and $3,103 50 EMA are well below current prices. MACD remains positive, and RSI is overbought, but continues to show a bearish divergence. Parabolic SAR dots are below prices in the daily time frame, confirming bullish trend control.

ETH had previously been consolidated to nearly $2,900, forming a solid base before it broke out. This integrated zone acts as the first structural support in the event of a pullback.

ETH prices will expand volatility in excess of $3,600

The Bollinger band in the 4-hour time frame has been significantly expanded, suggesting that the rally is entering a high-volatile expansion phase. Ethereum prices embrace upper bands, a typical feature of trending movements. Despite reading too much RSI, the lack of inverted signals means that the bull remains completely controlled for the time being.

ETH Price Dynamics (Source: TradingView)

The daily price structure shows that ETH holds tightly at $3,600. The $3,325 level now serves as the closest support, while the $4,100 stands as the next major resistance. This area also coincides with a complete Fibonacci retracement from the 2024 highs, making it a critical level to watch.

VWAP measurements show that prices are trading comfortably above average session levels, with no immediate weakness in lower time frames.

Ethereum price forecast: Short-term outlook (24 hours)

ETH Price Dynamics (Source: TradingView)

As long as today's Ethereum prices exceed $3,325, the short-term bull control remains intact. A successful retest of the $3,525-$3,600 zone could push ETH to $3,850 and ultimately to $4,106. The territory marks a complete Fibonacci retracement and is also consistent with historic resistance.

If the Bulls fail to defend $3,325, the price could slide towards the $3,103 EMA region or the wider $2,900 integrated base. However, as open interest has risen, trend structures have turned bullishness over, and derivative data shows strong long interest, bias is supporting a continuation to $4,000 in upcoming sessions.

Ethereum price forecast table: July 19, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.