After collecting $2,600 earlier this week, Ethereum prices today return to the $2,550-$2,560 zone, violating major intra-support. The refusal from the $2,610 supply zone caused an updated downside as the bear forced a breakdown below the rise in the short-term trendline.

ETH Price Dynamics (Source: TradingView)

At the time of writing, Ethereum is trading nearly $2,560 with mild daytime losses as short-term indicators keep its momentum down and volatility up.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

The four-hour chart shows that Ethereum price action occurred beyond the multi-week consolidation range of nearly $2,520, and is rejected near the resistance band between $2,610 and $2,620. The zone has been increasing and lowering ETH three times since mid-June, strengthening its main supply area. Support for the rising trendline from the late June low is currently being breached, turning the short-term structure bearish.

ETH Price Dynamics (Source: TradingView)

Meanwhile, in the daily time frame, ETH remains trapped in a large, symmetrical triangle pattern, with vertices drawn. This low support for the triangle is currently coinciding with the $2,420-$2,440 zone, and if the current weakness continues, it becomes the next potential bounce area.

Why are Ethereum prices falling today?

ETH Price Dynamics (Source: TradingView)

The reason for the price of Ethereum today is likely due to multiple bearish technical and emotional clues. On the 30-minute chart, a clear breakdown under the blue support channel around $2,570 opened up space for further losses. MACD is in the negative territory and shows a decline in bullish momentum, but the RSI on the same chart is 35.6, with multiple bear divergence signals confirmed on July 3rd.

ETH Price Dynamics (Source: TradingView)

VWAP analysis reveals that ETH averaged below the session's average of $2,576, indicating a short-term price decline. In DMI, the -DI line is dominant, but ADX is rising.

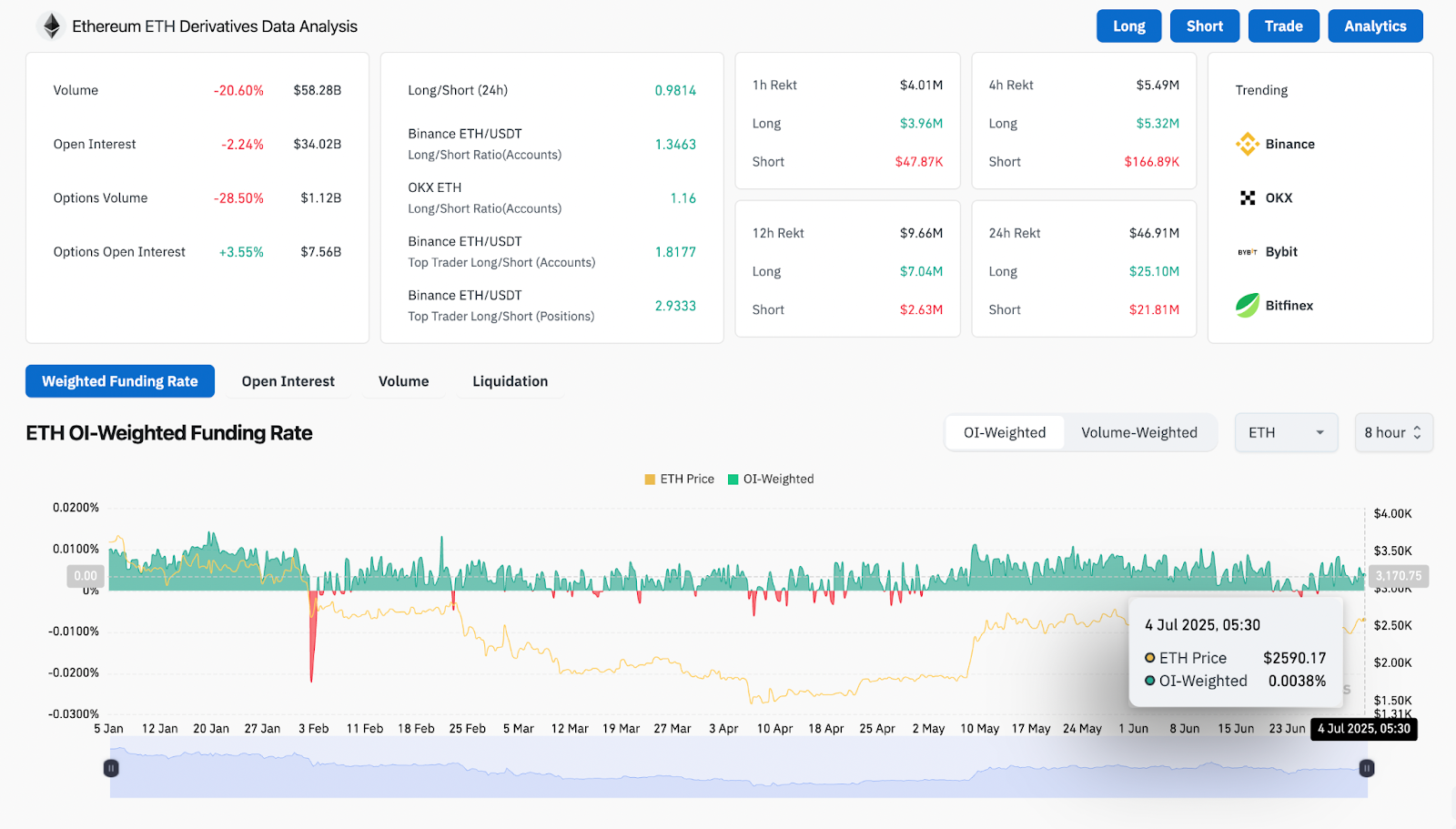

The Derivatives dashboard shows a 20.60% decline in volume and a 2.24% decrease in open profit, reflecting a decline in market convictions. Most notably, short liquidation over the past four hours is minimal compared to long liquidation, meaning that the seller is still in control. Fundraising rates remain barely positive and suggest that leverage skew remains slightly longer, which could lead to more downsides if sentiment gets worse.

Price indicators, signals, graphs, charts (24 hours)

ETH Price Dynamics (Source: TradingView)

Bollinger bands on the 4-hour chart are beginning to expand after compression. This is a signal of increased volatility in Ethereum prices. ETH is currently closing the four-hour candle ($2,560) below the midband, suggesting that downward pressure could continue towards the lower band, nearly $2,515.

The EMA cluster provides mixed signals. The ETH is still held just above the 20 and 50 EMAs, which are close to $2,534 and nearly $2,491 respectively, but below the 100 EMAs ($2,482). If prices continue to close below 100 EMA, momentum could shift crucially in the bear's favor.

On-chain data remains neutral. Despite a positive financing rate of 0.0038% and a long/short ratio supporting long (1.34 Binance account), a bullish lack of follow-through of $2,610 suggests traders are cautious.

ETH Price Forecast: Short-term Outlook (24 hours)

If Ethereum Price cannot immediately recover $2,570, the next support will be at $2,515 (bottom and horizontal support for the Bollinger Band). Under that, the demand zone between $2,440 and $2,460 is consistent with the trendline and Fibonacci confluence, offering a bounce area.

The advantage is that a $2,580 landfill could negate the breakdown, with resistance again at $2,610 and then $2,645. For the bull to regain control, ETH will need to regain its VWAP mid-zone and outweigh its descending resistance from its June high.

With RSI and MACD becoming bearish and less volume, traders need to monitor sales pressure or sudden liquidation-driven core spikes.

Ethereum price forecast table: July 5, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.