Ethereum (ETH) prices may be in the early stages of a new bullish phase. Both market analysts and on-chain data indicators reveal technical behavioral trends that support new stages of ETH price intensity.

The monthly RSI created a new level of support by touching the historic zone. Furthermore, long-term holders have substantial withdrawal of ETH from the centralized exchange.

RSI Retest Signals Historic Meeting Setup for Ethereum (ETH) Price

When writing, the relative strength index (RSI) was now placed in the zone that preceded the major Ethereum assembly previously. According to market analyst Cas_abbe, ETH's monthly RSI has returned to the 40-42 range.

This level has only been tested three times before. Each time, profits continued to be over 340%.

Source: x

In 2019, Ethereum (ETH) won around 349% after reaching this zone. The 2020 retest preceded more than 5,400% meetings, and in 2022, ETH rose more than 359% after a similar setup.

Analysts point out that ETH prices are integrated in technical “bottom areas” like in the past three cycles. If the pattern is repeated, ETH could reach $8,000 by the fourth quarter of 2025.

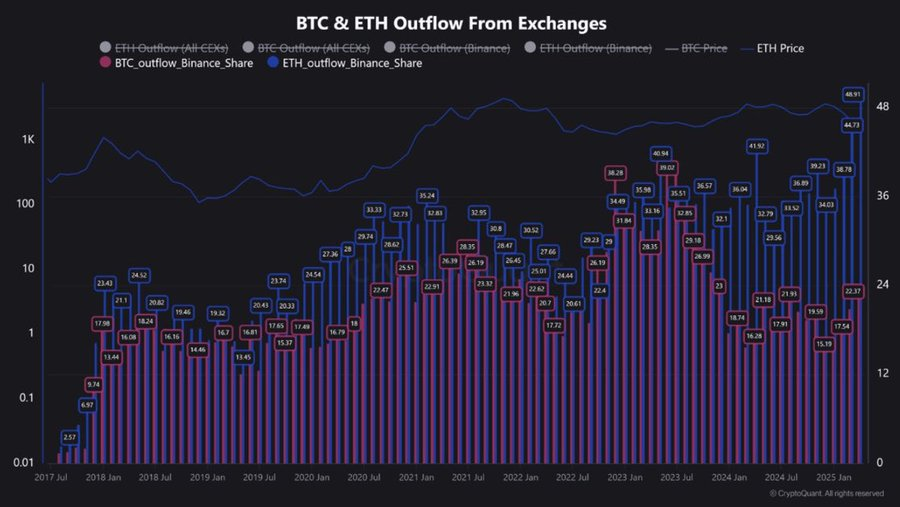

Exchange spill reflects long-term accumulation

ETH outflows from centralized exchanges represent an additional important indicator of positive market conditions.

In early 2025, the largest recorded Ethereum (ETH) withdrawals reached 49.91 million, according to cryptographic statistics.

Source | x

Institutional investors, along with long-term holders, have been withdrawing ETH coins from central exchanges since mid-2023.

The 44.73 million exit from ETH confirmed that investors would transfer assets to personal control and protect them through long-term storage.

Historically, large outflows have been considered bullish as they reduce the immediate supply available for sale.

A decline in exchange balances often indicates future price recovery. It happens when significant investor benefits appear during a stable market period.

Price stability for Ethereum during this market movement indicates that sales pressure may be subsided.

The exchange market holds supply. This indicates that increasing demand increases the risk of a decline in supply.

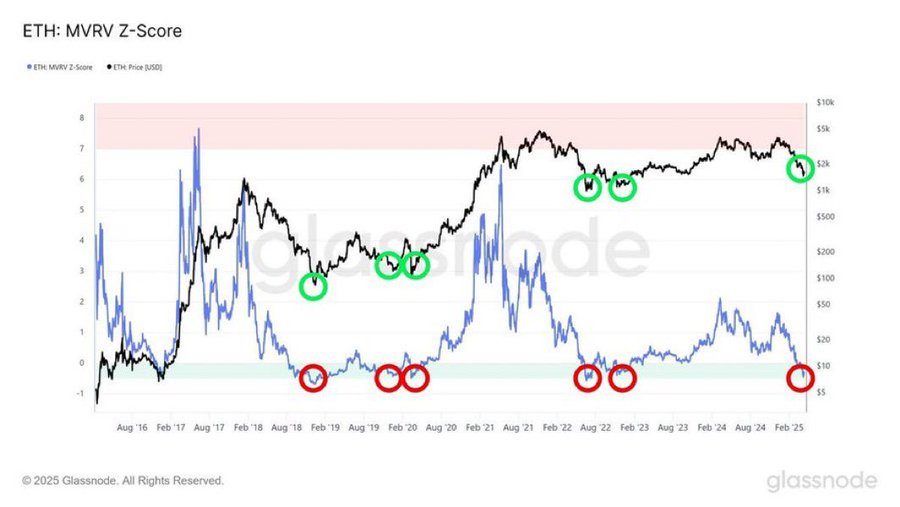

MVRV Z-scores indicate that Ethereum can be underestimated

The MVRV Z-score chart showed Ethereum (ETH) bullish behavior during pressing. Track market value against realised value ratio.

The MVRV Z scores showed underestimated conditions while entering the green zone according to long-term market performance data.

Source | x

In early 2025, the MVRV Z score moved near the green area. Previous entries into this range in late 2018, mid-2020, and early 2022 preceded a major price recovery. This pattern suggests that ETH may currently be trading below its fair value.

Ethereum (eth) Price breaks from falling wedges, eye target of $2,800

On the one-day chart of Ethereum (Eth/USDT), prices produced bullish breakouts from falling wedge patterns. It usually means a market reversal.

The long-term downward trend within the price action reduction has led to ETH breaking through the pattern-determined wedge resistance level.

Breakout means a shift in potential market trends as the wedge pattern shifts prices to $2,800.

1 Day Ethereum Trading Chart | Source: Trading View

Technical analysis signals indicate possible uptrends at press time. MFI, along with the RSI, suggested an ongoing bullish trend as both indicators showed readings of 70.28 and 58.30, respectively. Cumulative volume delta (CVD) also showed positive buy-side activity.

Ethereum (ETH) maintained its position near $1,796.60 as it continued to move upwards while combining with a higher high. It shows an upward momentum in ETH prices trend.

If ETH prices remain in positions above $1,800, bullish momentum remains unharmed with an upward trend of $2,500 to $2,800.

Ethereum sees a rise in institutional benefits amid bullish long-term signal

The positive trend in the market direction of Ethereum is more important due to the growing institutional interest.

The recent market integration phase demonstrated institutional support for Ethereum when Grayscale investment purchased $11.98 million in ETH as part of its long-term investment strategy.

Financial institution Fidelity invested $6.43 million in Ethereum through its Coinbase account. It shows how major institutions can maintain strong confidence in the upcoming rise in Ethereum (ETH) prices.

After the network utility sector gains momentum, market participants will continue to monitor technical resistance signals as Ethereum approaches its $8,000 potential target in the final quarter of 2025.