Tom Lee, managing partner at FundStrat Global Advisors, predicts Ethereum could reach $5,500 in the coming weeks and rise to $10,000-$12,000 by the end of the year.

At the same time, Bitmine accumulated hundreds of thousands of ETH, and the growing “supply squeeze” in the market sparked concerns. This has led investors to question whether ETH's big breakouts are right around the corner.

New Ethereum forecasts for 2025

In a recent interview, Bitmine Chairman Tom Lee also caused ripples to the community with his discussion. He predicted that Ethereum would reach $5,500 in just a few weeks and could move from $10,000 to $12,000 by the end of the year.

This is not just an optimistic prediction, but a statement from an influential figure closely tied to Bitmine's large-scale ETH financial strategy.

Lee summarises his predictions into two important arguments. First, facilities have become increasingly purchasing power (via ETF, staking, and the Ministry of Corporate Treasury). Second, Ethereum's supply structure is tightened.

In terms of facilities, Bitmine has emerged as one of the most aggressive ETH accumulations. The data reveals that BITGO has transferred 95,800 ETH from its custody wallet to six new wallets suspected to be linked to Bitmine.

This size quickly pushed Bitmine to billions of dollars in Ethereum, becoming the world's largest ETH Treasury Ministry.

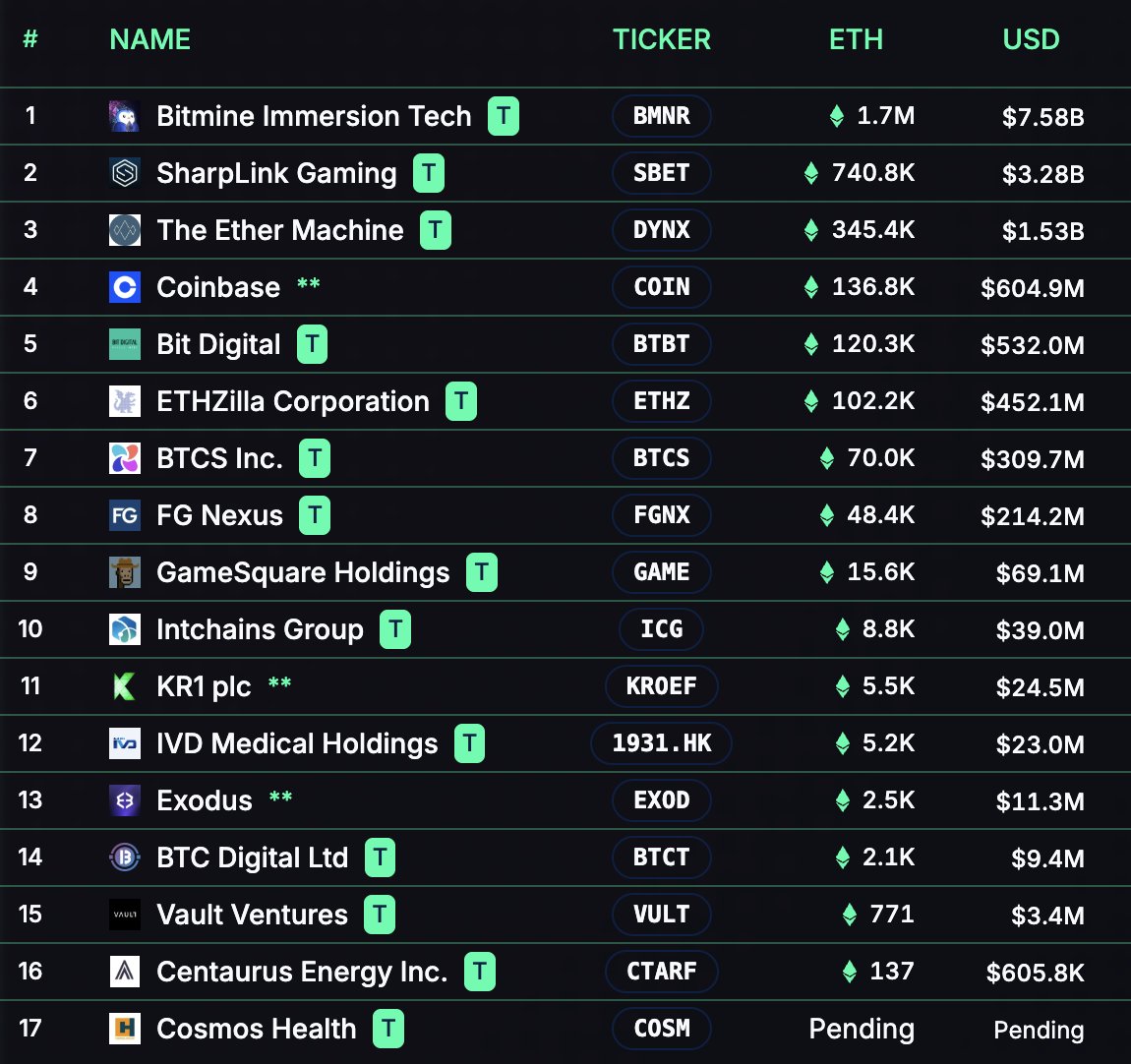

A list of companies that own ETH. Source: Lark Davis from X

If such large institutions continue to accumulate, the impact on the balance of supply and demand is clear. In fact, observers in many chains warn that Ethereum is in the “supply squeeze.” ETH continues to grow as ETH is trapped and burned through EIP-1559.

“Six months ago, ETH's finances were not even a thing. Today, they have 3.3 million ETH, more than $14.5 billion, which is 2.75% of all ETHs trapped in. Lark commented.

Beyond supply dynamics, analysts closely track Ethereum through the ETH/BTC ratio. Many analysts hope that the pair will soon break the trend established in 2017.

ETH/BTC ratio. Source: x cryptoelltes

Such a breakout could mark the beginning of a strong rally with price targets between $10,000 and $15,000. This forecast further strengthens Tomley's confidence that Ethereum may be on an unprecedented crisis of acceleration.

However, these Ethereum predictions should be viewed as scenarios rather than certainty. Several conditions must be aligned for ETH to reach these price milestones. A sustained institutional influx, a supportive macroeconomic background without major liquidation pressures, and most importantly, a sudden liquidity shock from a large wallet will not benefit.

As Beincrypto recently reported, 98% of the ETH supply is profitable, so it could indicate a sale.

ETH prices have been moving over the past 24 hours. Source: Beincrypto

Now, ETH shows signs of a retracement after breaking a recent all-time high. At the time of writing, data shows ETH transactions at $4,572.14, an increase of 3.92% over the past 24 hours.

Post Ethereum eyes were broken out when Tomley predicted that between $5,500 and $12,000 would appear in Beincrypto in 2025.