Ethereum is entering a critical phase as its on-chain signals, technical structure, and institutional position converge once again. Market watchers are reporting renewed interest in the stock after months of decline.

As a result, analysts are now revisiting longer-term upside scenarios, including a possible return towards the $5,000 level. This change comes as Ethereum has shown increased network engagement and price trends have stabilized around key demand zones.

In addition to price fluctuations, validator activity is also gaining attention across the market. Ethereum is currently recording significant traffic in both its ingress and egress queues. Over 772,000 ETH is currently waiting to participate in staking, with activation delays exceeding 13 days.

Meanwhile, over 288,000 ETH is being held in the exit queue, indicating balanced participation rather than panic withdrawals. Therefore, the data suggests long-term conviction rather than short-term speculation.

Additionally, Ethereum’s validator base continues to grow. Currently, nearly 1 million validators have secured approximately 35.5 million ETH. This figure represents more than 29% of the total supply.

Staking yields are hovering around 2.85%, reinforcing Ethereum’s role as a yield-producing network asset. As a result, increased staking demand reduces liquid supply during times of market uncertainty.

Network strength is built behind the scenes

sauce: coin codex

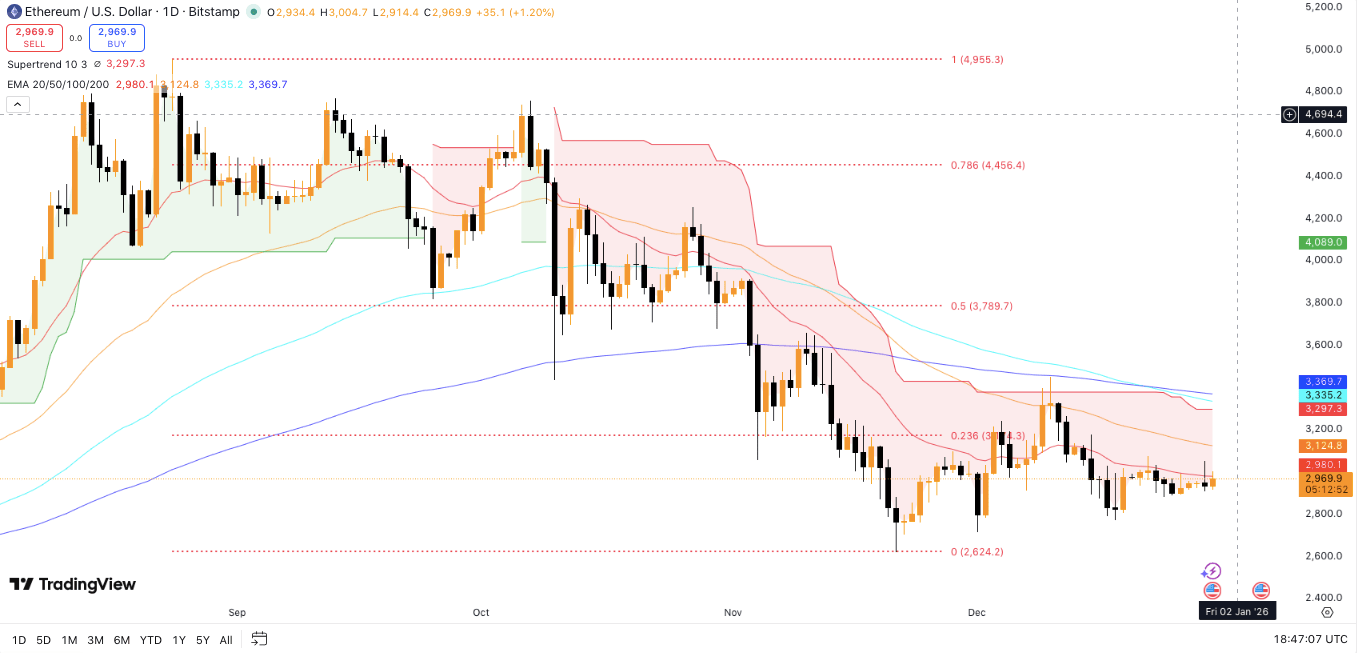

ethereum According to CoinCodex data, the price is trading around $2,970 after a slight daily and weekly increase. However, the overall trend remains corrective.

ETH price is currently below all major moving averages. The 200-day EMA near $3,369 continues to act as a major resistance level. Additionally, the supertrend indicator remains bearish, reinforcing cautious short-term sentiment.

ETH price dynamics (Source: Trading View)

However, the rate of decline appears to be slowing. Ethereum remains above the $2,950 to $3,000 range. Importantly, the price also remains well above the previous cycle low near $2,624. This behavior suggests base formation rather than distribution. Therefore, traders are increasingly monitoring breakout levels rather than new lows.

The technical forecast outlines several upside scenarios. A daily close above $3,125 could indicate an early trend improvement. This move will create room for the price to move towards $3,350 and $3,400. Such an increase would represent an increase of approximately 13% from current levels. Additionally, a retracement of the 200-day EMA could create further momentum towards $3,790.

Above that level, analysts track the $4,450 to $4,800 zone. If the breakout there persists, broader bullish continuity could be reinstated. As a result, the long-term forecast once again ranges from $4,955 to $5,000.

Analyst structure and ETH institution accumulation

Titan of Crypt pointed out that ethereum A deep retracement from the previous impulsive move. The analyst highlighted $2,750 as a key level to monitor during consolidation. Historically, there have been similar retracement zones before strong recoveries in previous cycles.

Additionally, the Bitcoin Census identified a Wyckoff accumulation structure forming in higher timeframes for Ethereum. This pattern suggests late-stage consolidation with potential intensity expansion. Phase D characteristics, when confirmed by volume, often precede a definitive trend reversal.

Institutional behavior further supports this narrative. Tom Lee's Bitmine has significantly expanded its Ethereum holdings. company added Recent purchases totaled over 44,000 ETH, valued at nearly $130 million. As a result, Bitmine currently manages approximately 4.11 million ETH.

Furthermore, Bitmine has already staked over 408,000 ETH. The company plans further expansion of validators through the MAVAN network starting in 2026. The company's strategy focuses on long-term accumulation and yield optimization. Therefore, trust in institutions is matched by improvements in on-chain metrics.