- With the intraday rally, Ethereum price is showing persistence above the neckline support of the upcoming head and shoulders pattern.

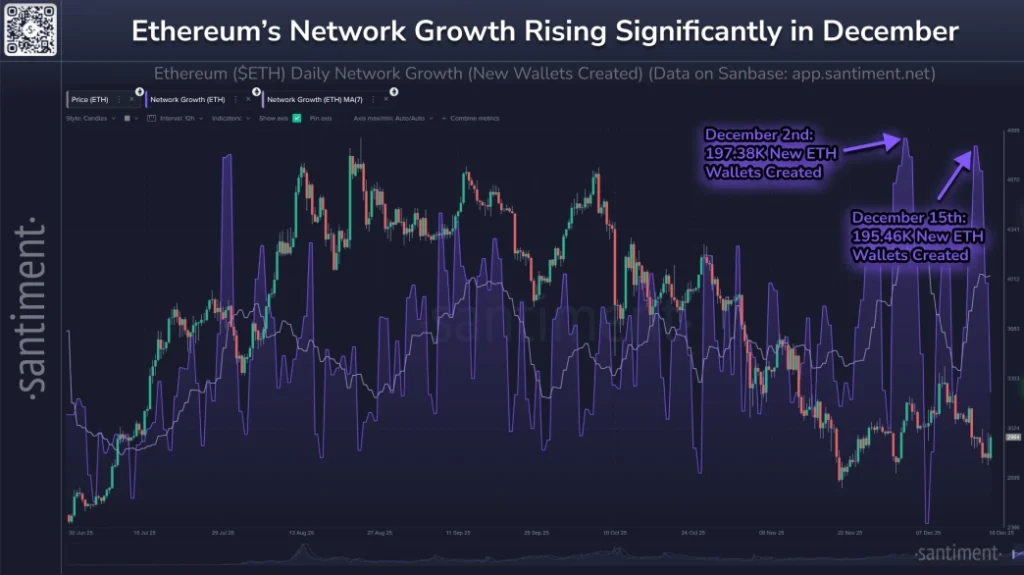

- Ethereum has recorded a steady increase in active addresses, with an average of 163,000 new addresses being created per day, according to on-chain data.

- The Bank of Japan raised its policy interest rate to 0.75%, the highest level since 1995, as part of its financial normalization efforts.

ETH, the native cryptocurrency of the Ethereum ecosystem, surged 5.3% during Friday's US market session, reaching $2,977. The buying pressure followed market optimism that Japan's interest rates would normalize due to global risk appetite without immediately squeezing liquidity. In addition to broad market support, Ethereum’s price rose further as the network recorded a surge in new wallet creations.

ETH rises 5% due to macro easing, Bank of Japan raises interest rate to 0.75%

On Monday, December 19th, the Bank of Japan raised interest rates to 0.75%, marking the highest level since 1995. The measure was a further step in ongoing efforts to normalize the situation amid inflation exceeding the 2% target. There was a reaction as government bond yields rose, with 10-year bonds exceeding 2%.

The digital asset market recorded gains soon after. Ethereum rose more than 5% during the trading session, approaching $2,975-$2,976. Broader cryptocurrencies also showed an upward trend with heavy trading volumes.

On-chain metrics showed an increase in activity on the Ethereum blockchain during December. According to Santiment's analysis, the number of new address creations is increasing significantly every day, reaching 197,380 on December 2nd and 195,460 on December 15th. The average number of daily creations reached approximately 163,000, significantly higher than the 124,000 recorded in July.

Diverse views were expressed in discussions among market participants. Some commentary focused on the pattern of weakening peaks on price charts and the prospect of a correction in traditional equities impacting high-risk holdings.

This policy adjustment comes as tensions in international trade relations have eased and external pressures have subsided to some extent. The yen came under pressure after this announcement. Japan's stock index was making progress.

Main support for Ethereum price in current correction

Over the past four months, Ethereum price witnessed a sharp correction from $4,955 to the current trading price of $2,967. This downswing is shown with a fresh low-high formation and increased volume, highlighting strong seller conviction.

As shown in the chart below, the decline in ETH price has started to stabilize above $2,700. A deeper analysis of the technical charts shows that this price decline has developed into a head and shoulders pattern. This chart setup is displayed with three peaks: left shoulder, long head, and right shoulder.

If this pattern holds, Ethereum price could fall by 6% and challenge the bottom support of the neckline towards a bearish break. The drop in the momentum indicator RSI to 45% highlighted the overall bearish sentiment in prices confirming a long-term downtrend. After the stock price falls, the remaining 25% may fall and reach the psychological support of $2,000.

Conversely, if the coin price can demonstrate persistence above neckline support, buyers may regain control over this asset.

Also read: Tron integrates with Base to power TRX cross-chain access