Ethereum's mainnet set a new record this week with 2.2 million transactions in a single day, while fees dropped to an average of just 17 cents.

The layer 1 blockchain recorded a new transaction milestone on Tuesday, according to block exploration firm EtherScan. Trading fees have also dropped significantly over time.

Ethereum's highest transaction fee was recorded in May 2022, when users had to spend more than $200 per transaction.

However, continued upgrades have brought prices down significantly, even as network usage continues to increase.

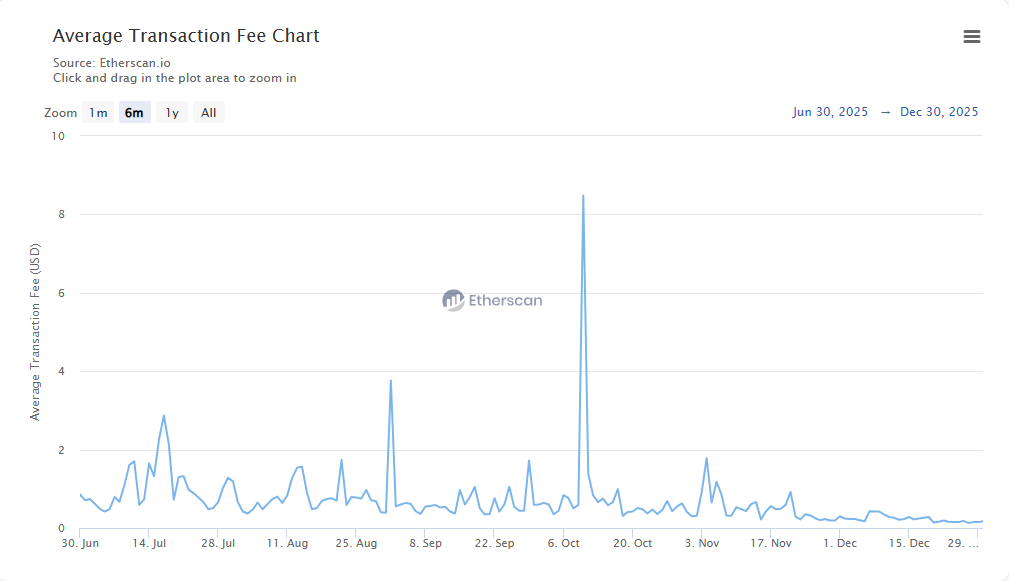

Fees have also been on a downward trend since October 10, when they fell to about $8.48 during a major liquidation event that bled the entire market.

Ethereum transaction fees have dropped significantly over time. sauce: ether scan

While rising Ethereum fees have traditionally steered users towards cheaper alternatives such as Layer 2, the increase in transactions on mainnet signals a return to Layer 1 blockchains and increased usage among crypto users.

Meanwhile, developers are increasingly choosing Ethereum as their payment layer, with the number of new smart contracts created and published on the Ethereum blockchain reaching a high of 8.7 million in the fourth quarter, according to data from Token Terminal.

Two major upgrades to Ethereum in 2025

The Ethereum blockchain underwent significant changes in 2025, with two upgrades likely contributing to the spike in transactions and lower fees.

Related: BitMine accumulates $98 million ETH as year-end sales cap increases: Tom Lee

In May, Pectra focused on improving validators, ensuring flexibility, and preparing Ethereum for future scalability features.

Fusaka was designed to increase gas limits from 45 million to 60 million and significantly improve scalability, data processing, and network efficiency. In February, more than 50% of Ethereum validators expressed support for increasing the network's gas limits, increasing the maximum amount of gas that can be used for transactions in a single Ethereum block.

Meanwhile, Ethereum's staking queue reversed its exit line for the first time in six months on Monday, with nearly twice as much ETH currently lined up for staking as there is about to leave the network.

Unstaking is seen as a sign that a validator is willing to release Ether for sale, while staking is seen as a sign of confidence in locking up Ether for long-term holding.

magazine: Pectra hard fork explained — will it get Ethereum back on track?