Ethereum fell below the $4,000 level for the first time this month and is trading around $3,727 at the time of writing.

This decline reflects the lack of widespread market support that has affected most major cryptocurrencies. Still, investors appear to be stepping in, suggesting a recovery could occur in the coming days.

Ethereum investors express support

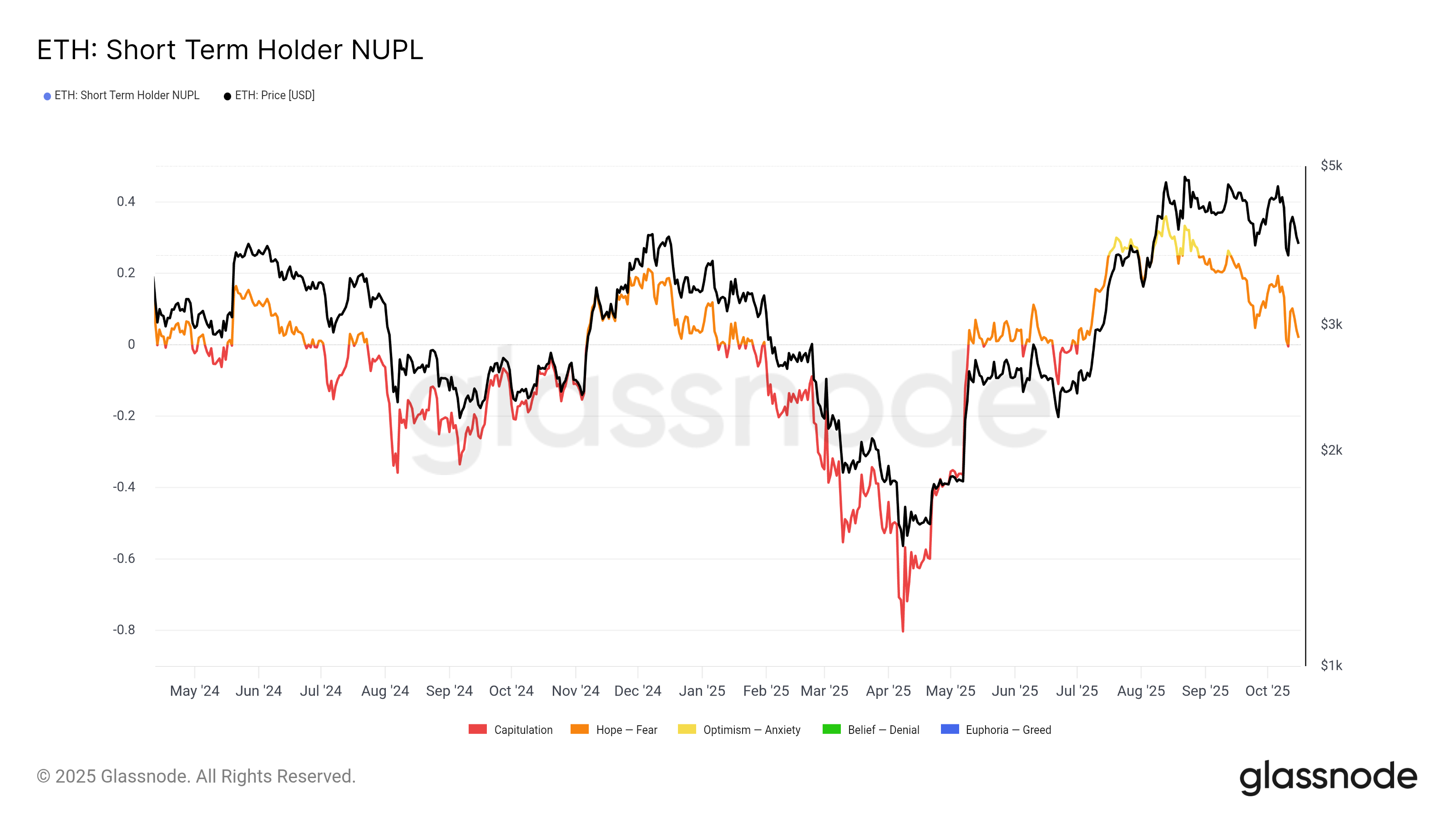

The short-term holders' net unrealized gains and losses (STH-NUPL) ratio has recently fallen into the surrender zone, indicating that most short-term holders are now realizing losses. Historically, this stage often precedes a market rebound as selling pressure eases and new demand begins to build. Ethereum’s current position reflects past cycles where such loss situations caused price reversals.

Many speculative holders who entered during the recent rally are now facing losses, but this may not be entirely negative. These market conditions typically lead to renewed optimism as investors look to re-accumulate at lower levels. The same pattern could soon hold true for Ethereum, with long-term holders increasing confidence in the market.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum STH NUPL.Source: Glassnode

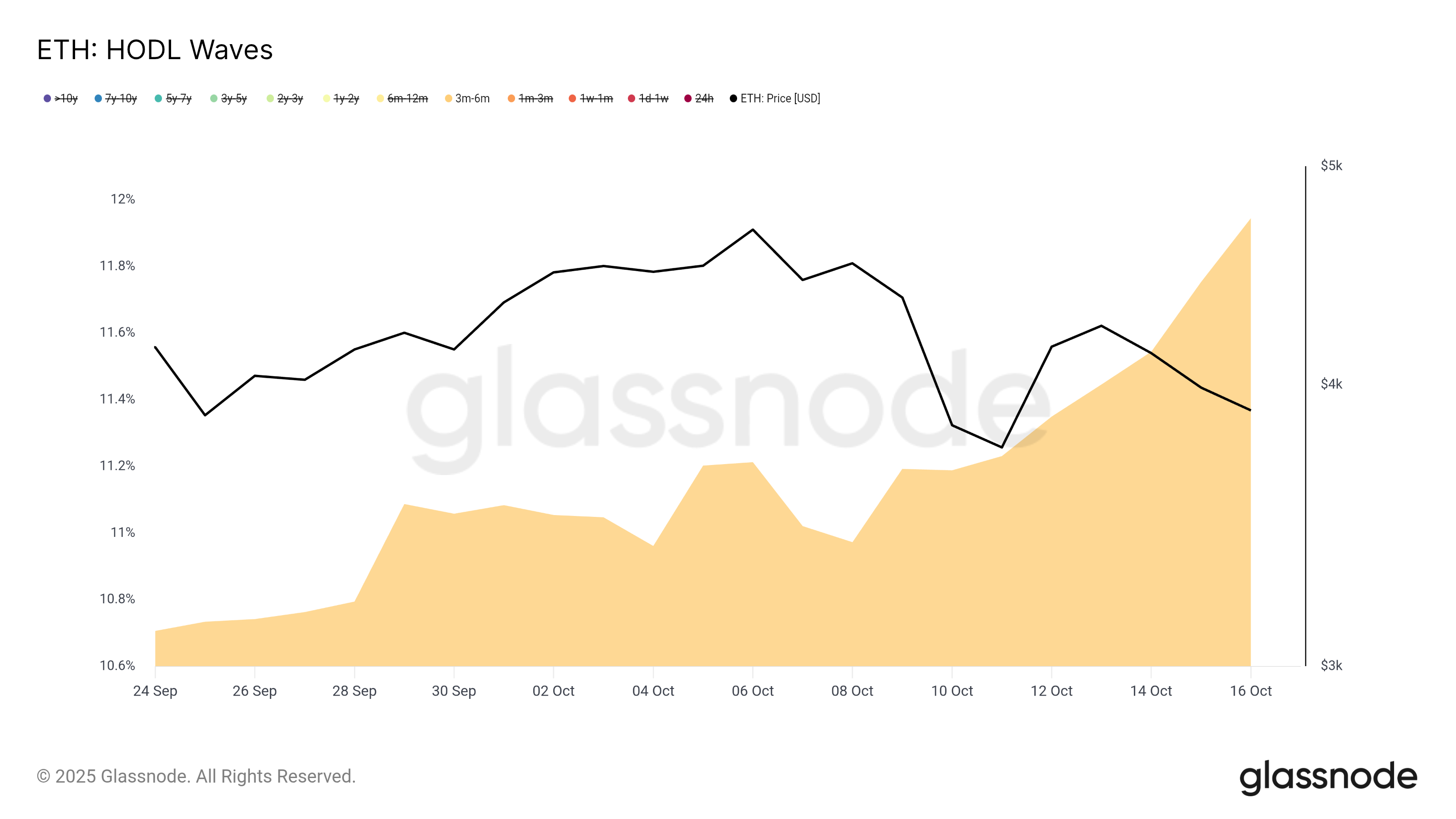

Despite the recent pullback, Ethereum’s on-chain data reflects the resilience of its holders. A HODL wave indicates that the majority of investors are holding on to their positions rather than exiting. This suggests growing confidence that Ethereum remains on a medium-term recovery trajectory.

Interestingly, many short-term holders have moved into 3-6 month holdings and now control 11.94% of the total ETH supply. Such accumulation typically supports market stability and serves as a basis for upside.

Ethereum HODL Wave. Source: Glassnode

ETH price may rebound

Ethereum price is currently $3,727, down from $4,000 in the past 48 hours. However, technical indicators suggest that the altcoin could soon reverse as investors prepare to defend key support levels.

If Ethereum bounces off the support at $3,742, it could move towards $4,000. If this barrier is successfully breached, ETH will rise further and once again target the $4,221 level. This move would be consistent with the historical recovery trend seen after periods of capitulation.

ETH price analysis. Source: TradingView

Still, if investors fail to maintain momentum, it could trigger an even deeper correction. If market sentiment turns bearish, Ethereum could fall towards $3,489. A break below this level would invalidate the near-term bullish outlook and delay any potential recovery.

The post “Ethereum price dips below $4,000 again, but a reversal awaits” was first published on BeInCrypto.