Ethereum is trading at $2,818 this Sunday, but the quiet spot price movement is largely out of sync with what is happening internally. Derivatives traders are resizing and taking positions across the halls, loading up ahead of a cluster of expirations that could force Ethereum out of its holding pattern sooner or later.

Ethereum derivatives market says something big is about to happen

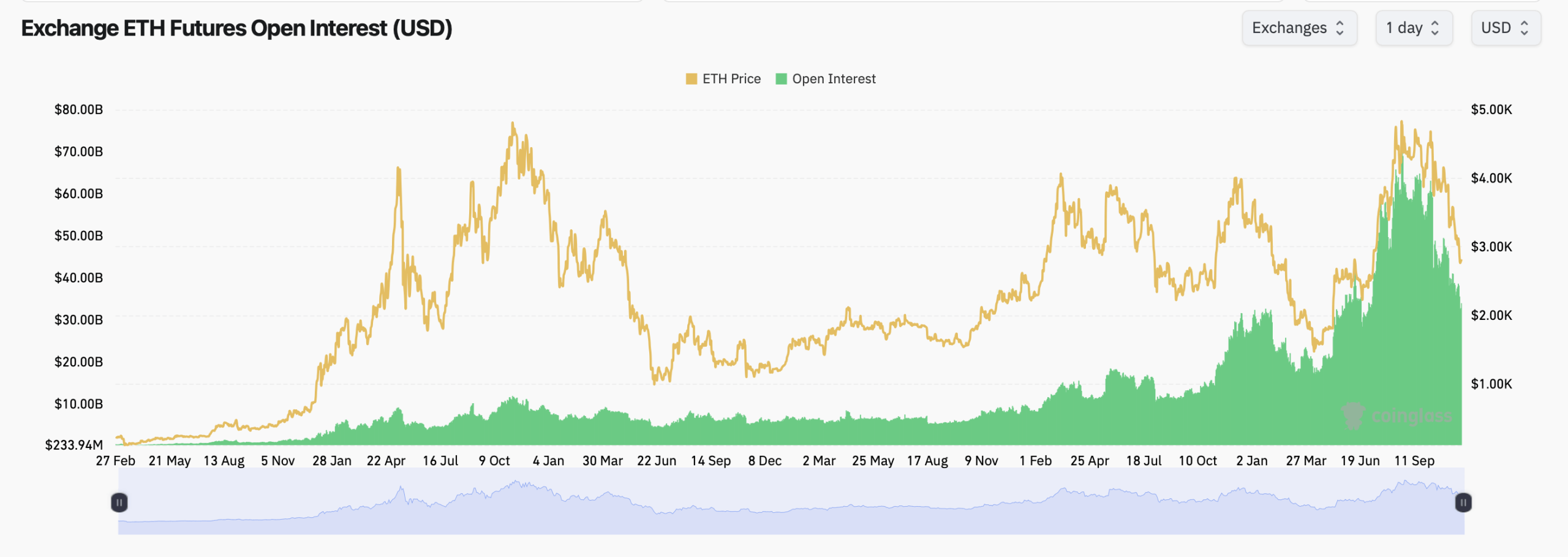

Coinglass.com statistics show that futures open interest remains high, showing that the market refuses to retreat even as spot momentum cools. The total value of Ethereum futures OI reaches $34 billion, with over 12 million ETH stored in contracts on CME, Binance, OKX, Bybit, Kucoin, Gate, and more.

Binance currently leads with open interest of approximately 2.48 million ETH, while CME’s 2.1 million ETH still represents solid institutional exposure. After-hours trading was mixed, with Binance falling, OKX falling, and Gates seeing increased outflows. However, Bybit inched up and showed selective bullish positioning. Over the past 24 hours, the mood has brightened significantly, with Bybit up over 5%, Kucoin up nearly 4%, Gate up over 5%, and futures OI total up 3.13% in one day.

ETH futures open interest as of November 23, 2025, according to Coinglass statistics.

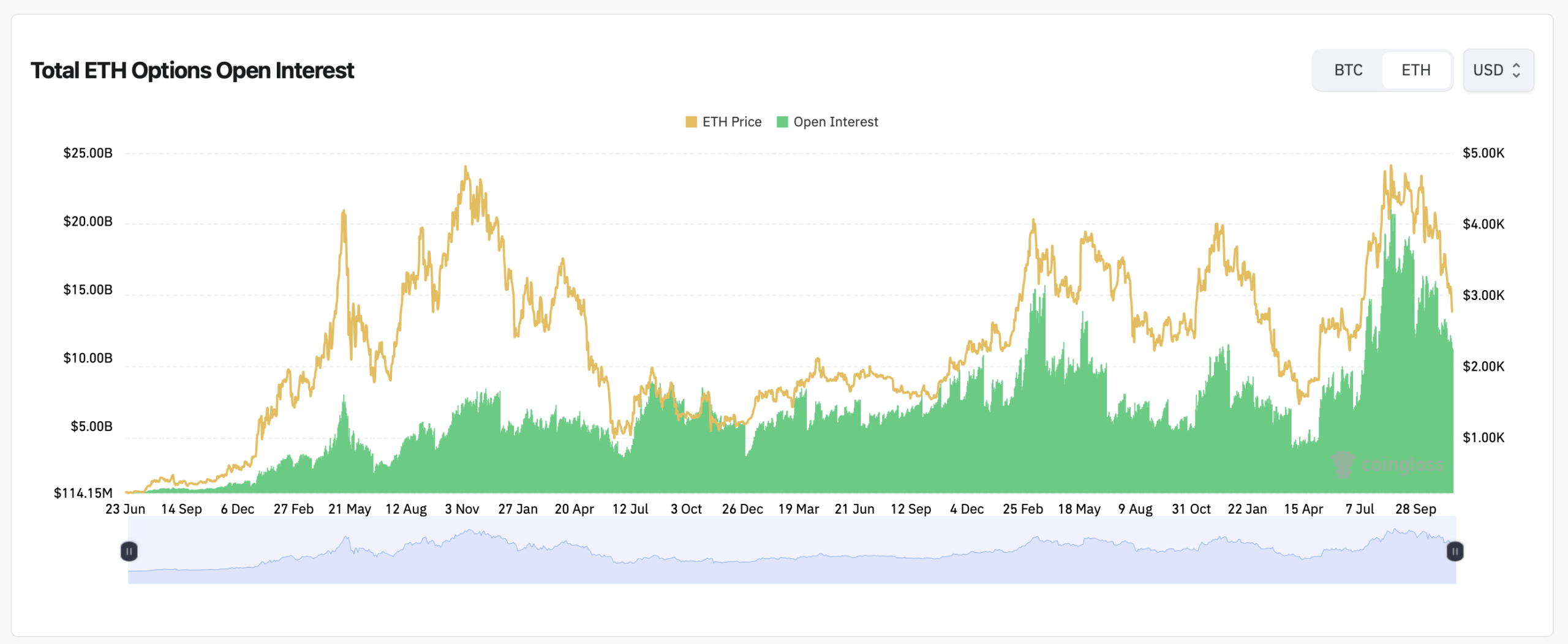

Option traders were even more interested. Ethereum options open interest is over 3.46 million ETH, with calls accounting for 65.80% of the stack. Puts remain active, but are clearly in the minority at just over 34%. In the past 24 hours, calls accounted for 60% of the trading volume (over 105,000 ETH) and puts accounted for approximately 70,000 ETH. Traders are not showing fear here. They express confidence, even if it's wrapped in cautious short-term pricing.

ETH options open interest as of November 23, 2025, according to Coinglass statistics.

Deribit handles larger flows and deeper books than any other exchange, and continues to hold the largest share of the Ethereum options market. Most of the activity is centered around the key maturities of December 2025 and March 2026, with traders aggressively betting on higher price levels. Some of the largest call positions hold more than 60,000 ETH each and are targeting significant price milestones in the second half of next year.

On a daily basis, the biggest players are making large bets confident that Ethereum will not approach its current levels by the end of 2025. The max pain metric tells its own story. At Deribit, short-term maturities are concentrated in the high $2,000s to low $3,000s, while larger maturities in December are spread out into the high $4,000s region.

read more: Saylor says Bitcoin has found a bottom, says 'most of the liquidation selling is outside the system'

Binance’s curve is in a similar lane, with short-term maturities concentrated around $3,000-$3,600 and late 2025 near $4,000. OKX maintains the steepest outlook, starting around $2,700 to $3,200 for an early expiry, but rising toward and above the $5,000 zone for a mid-2026 contract. Zooming out, short-term expectations look cautious, but long-term positioning leans significantly more optimistic.

The depth of futures in USD terms further reinforces that theme. Despite Ethereum falling from the $4,000 level earlier this fall, traders continue to expand their positions rather than exit them. The steady rise in futures OI over the summer and fall suggests the market is preparing for volatility rather than avoiding it.

Ethereum may seem frozen at $2,818 right now, but the derivatives market is intentionally buoyant. Calls dominate the options ledger, futures OI continues to perform well across institutional and retail hubs, and the Max Payne curve reveals a market conservative in the short term but surprisingly confident about the future. Traders are clearly positioning for a move as large amounts approach expiration. And when derivatives traders start leaning this hard in one direction, Ethereum is unlikely to be silent for long.

Frequently asked questions 💡

- What is the price of Ethereum today?Ethereum is trading at $2,818 after the market consolidated over the weekend.

- How active is the open interest in ETH futures currently?Futures open interest has reached nearly $34 billion, with many participants including Binance, CME, and OKX.

- Are traders favoring calls or puts in the Ethereum options market?Calls account for over 65% of total open interest and over 60% of recent volume.

- What does ETH's maximum pain level suggest?Short-term maturities center around $2,700 to $3,300, while long-term maturities range from $4,000 to $5,000.