Ethereum (ETH) continues to face resistance at $4,000 after multiple failed recovery attempts. Despite overall market stability, the second-largest cryptocurrency has struggled to convert this key psychological level into support.

Selling pressure from long-term holders (LTH) remains a major stumbling block, limiting Ethereum’s ability to regain upward momentum.

Ethereum holders are selling

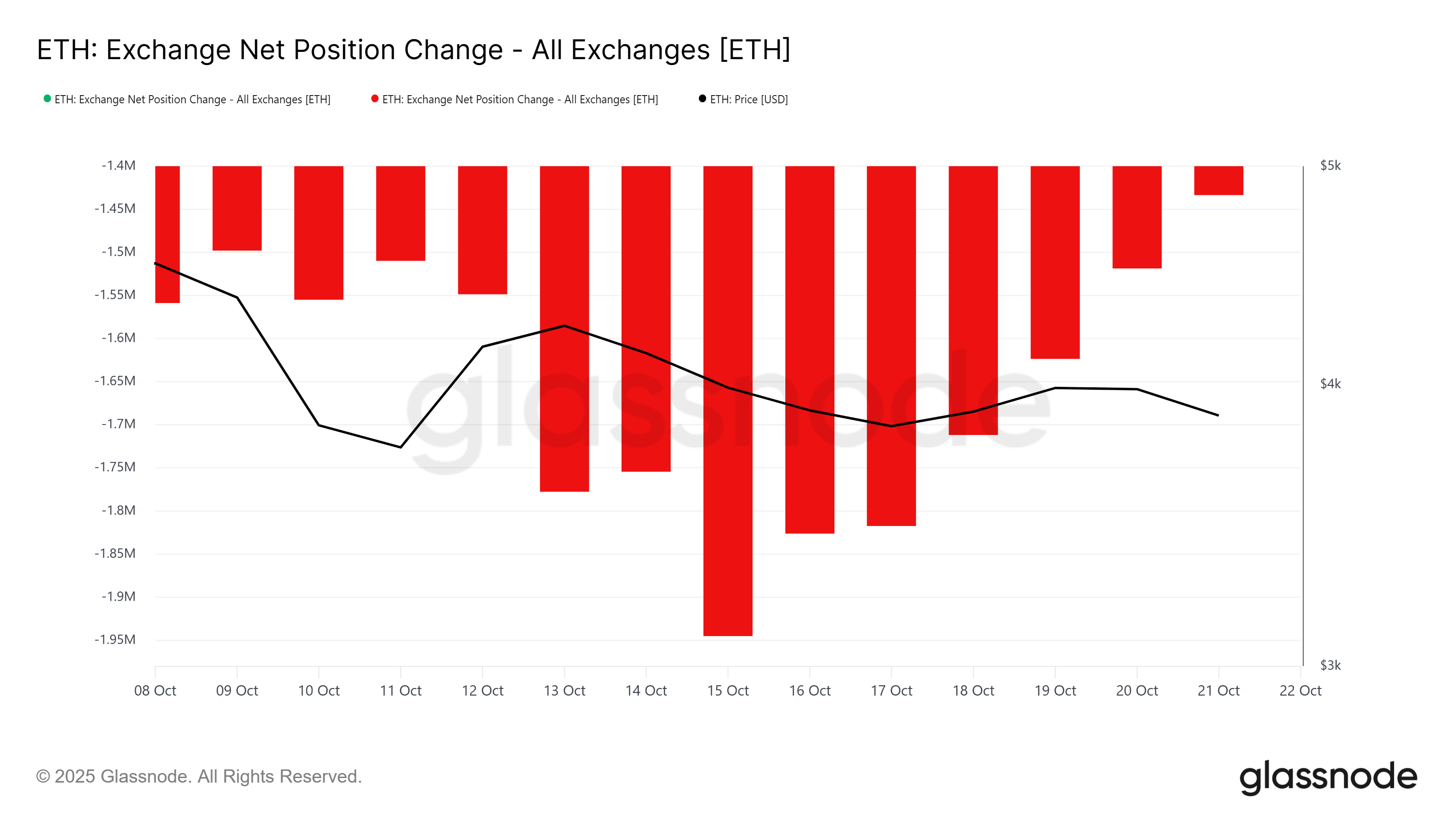

The exchange's net position data reveals a notable change in trader behavior over the past 10 days. Outflows from exchanges, which usually indicate accumulation, fell sharply. This slowdown suggests investors are holding off on buying, reflecting uncertainty about Ethereum’s near-term performance as the market digests recent price movements.

While outflows are decreasing, inflows are gaining momentum, indicating that more ETH is moving to exchanges for potential selling. This change often occurs before bearish pressure builds as traders seek to lock in profits or mitigate losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Changes in net positions on the Ethereum exchange. Source: Glassnode

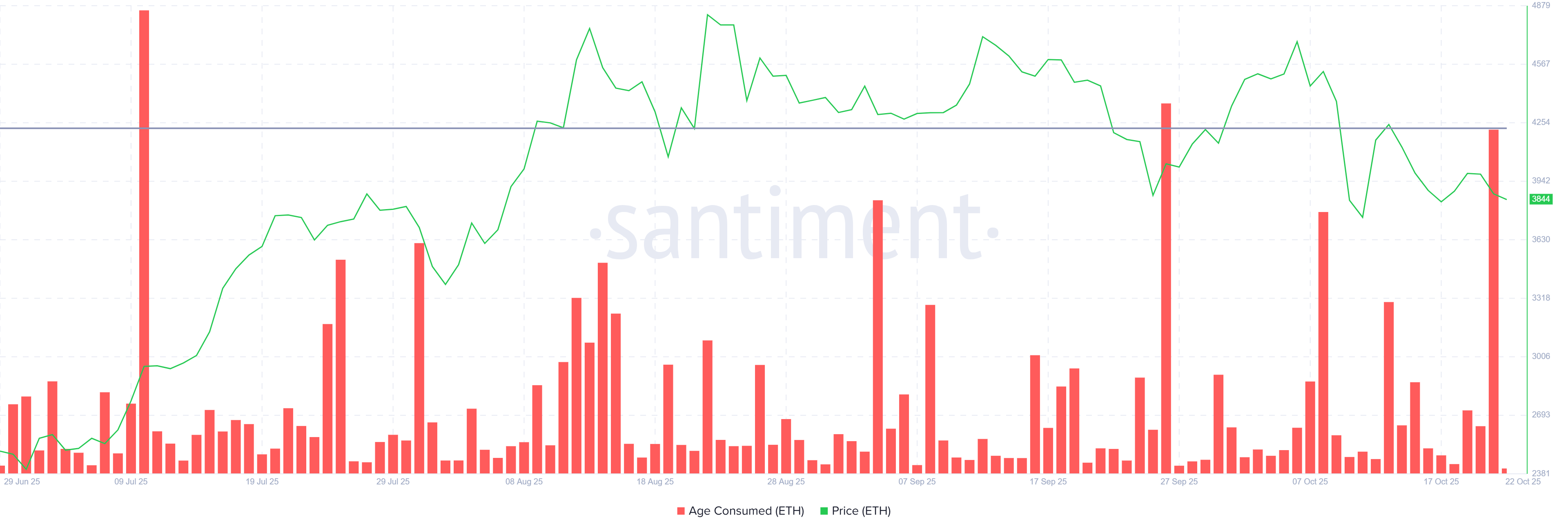

Ethereum on-chain data highlights weakening macro momentum. The spending age index (an indicator of the movement of dormant coins) has recorded a significant spike in the past 24 hours. The jump is the third biggest move in the past three months and suggests previously inactive long-term holders are starting to sell their assets.

This rise in consumption age typically signals a wave of profit taking and loss aversion. As LTH puts its holdings back into circulation, it shows growing impatience with price stagnation.

ETH price cannot reverse this resistance

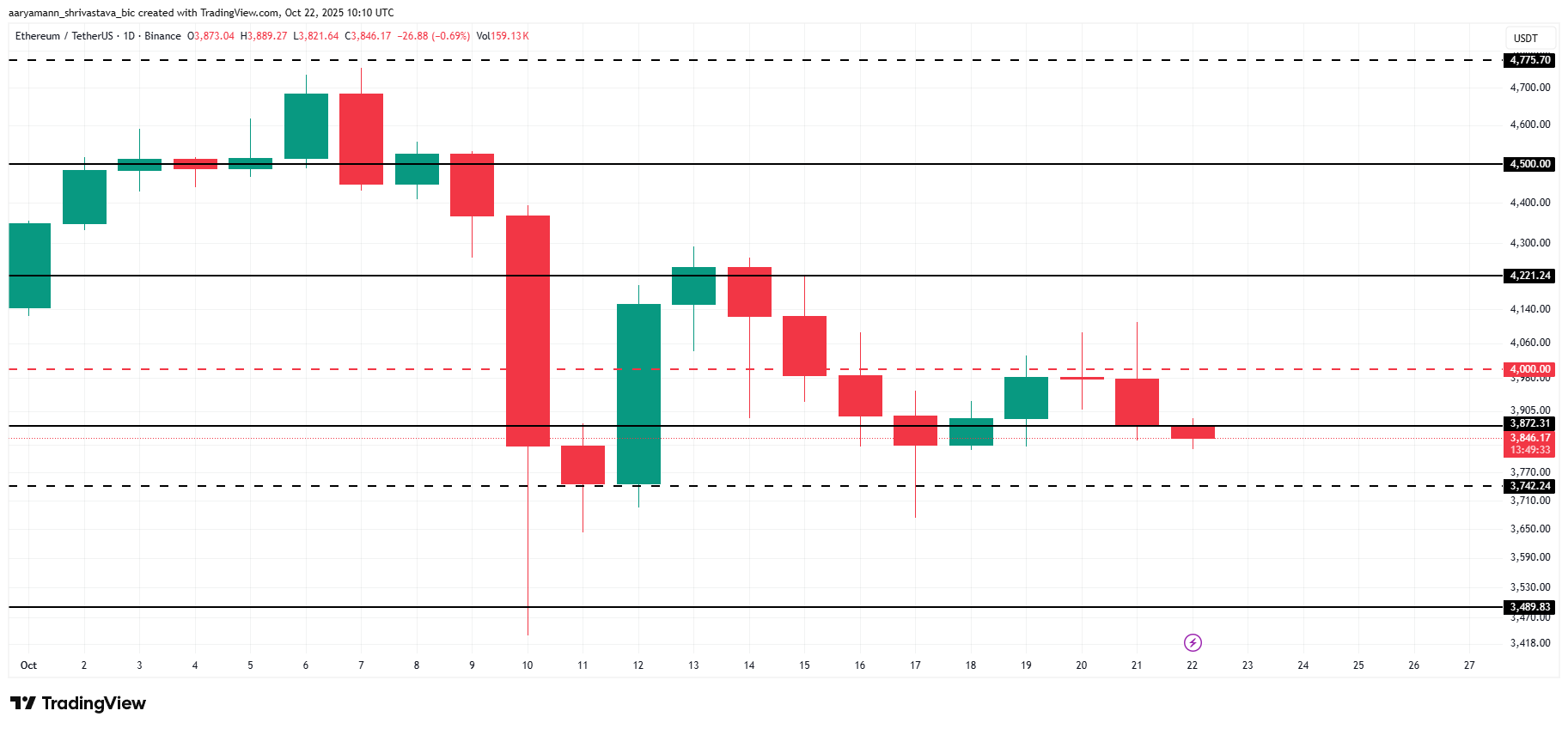

Ethereum price is trading at $3,846 at the time of writing, below the support level of $3,872. The king of altcoins has been stuck below $4,000 for almost a week, reflecting waning momentum and reduced volatility in the broader crypto market.

Considering the prevailing selling pressure and weak inflows, Ethereum price could fall further towards the $3,742 support zone. If this level cannot be sustained, a deeper correction could continue and ETH could fall to $3,489. Such a decline would strengthen the current bearish outlook.

ETH price analysis. Source: TradingView

However, if Ethereum holders curb their selling and demand strengthens, ETH could recover to levels above $4,000. A decisive break through this resistance could send the price higher towards $4,221, indicating renewed optimism and potentially overriding the prevailing bear market.

The post “Ethereum Price Struggle to Recover $4,000 Amid Long-Term Holder Pressure” first appeared on BeInCrypto.