Ethereum has experienced a significant drop since the beginning of the year, with AltCoin falling below the $1,500 level.

This recent decline may be a concern for some, but many investors see it as an opportunity. Low prices are captivating newcomers and fostering optimism for a potential recovery.

Ethereum investors find opportunities

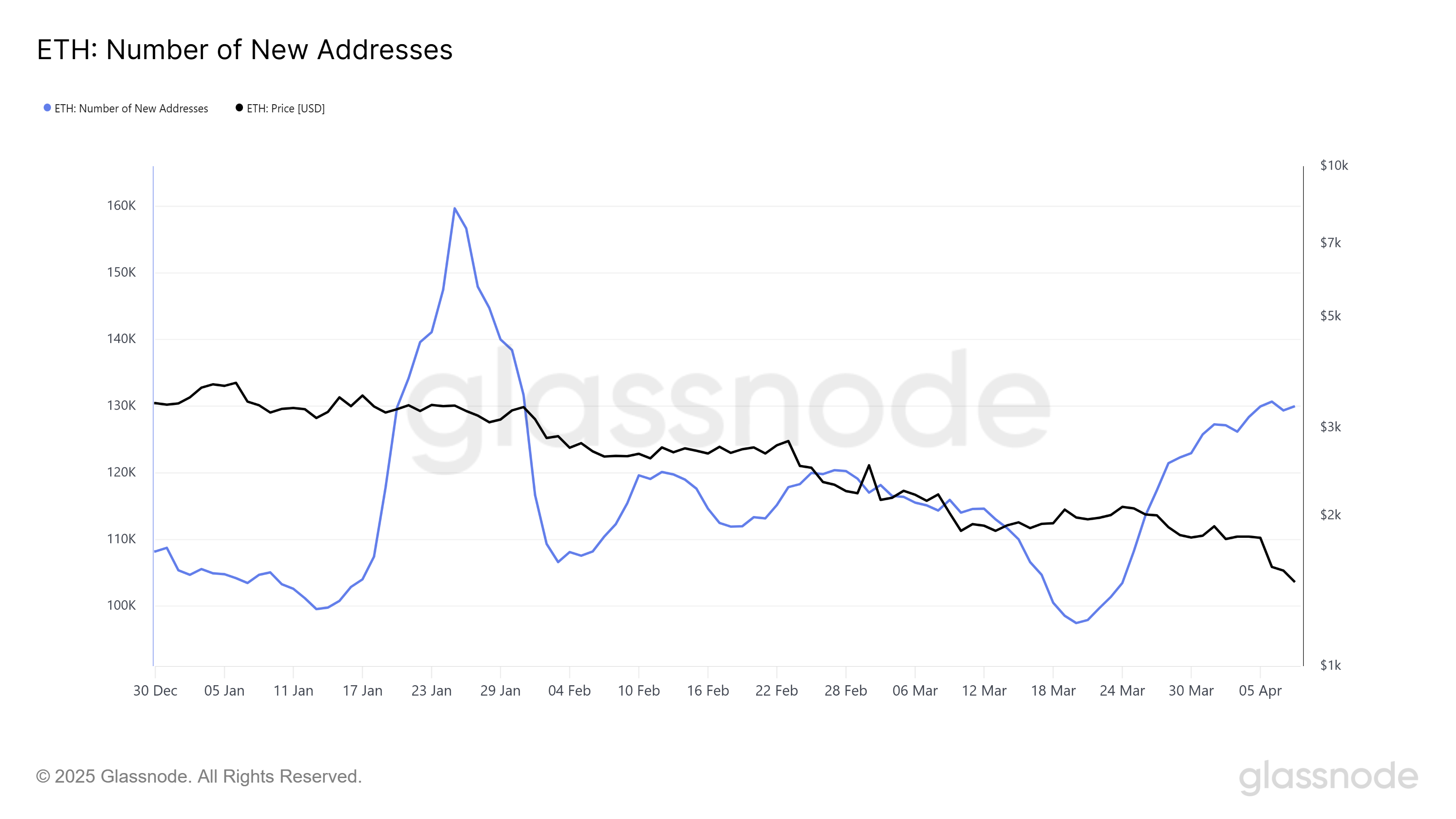

Ethereum's price dip fell below $1,500, with new addresses surged, reaching two months' heights. This increase in new investors suggests increased confidence in Ethereum's future, particularly at these low-price levels. Recent price drops could make Ethereum more accessible and encourage fresh investments.

The increase in new addresses also indicates that investors are positioning themselves for potential rebounds. Prices are now lower than at the beginning of the year, so some people view this as a purchase opportunity.

New address for Ethereum. Source: GlassNode

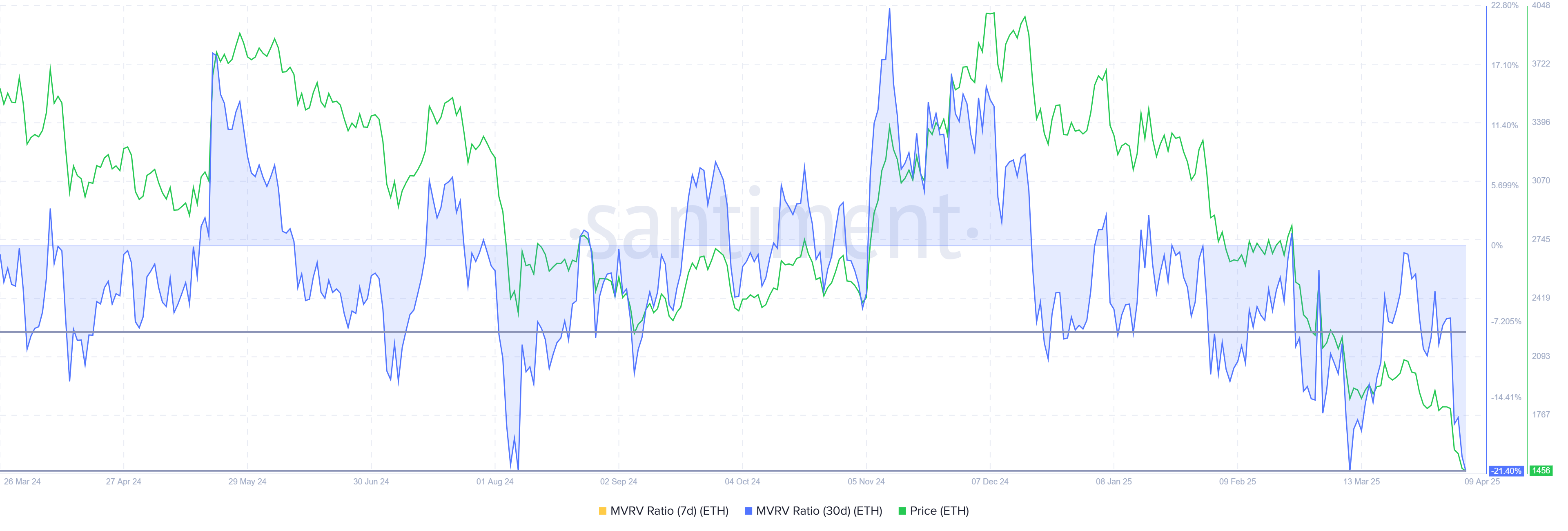

The MVRV ratio, which measures market value to realised value, is currently in the “opportunity zone” from -8% to -21%. This range shows that Ethereum is undervalued as prices have fallen to a level where investors typically intervene. Historically, such conditions have led to a reversal of price trends.

This low MVRV ratio reinforces the belief that Ethereum is in a major accumulation stage. If the MVRV ratio is in this zone, it indicates that investors who purchase during this period are likely to see positive returns in the future.

Ethereum MVRV ratio. Source: Santiment

ETH prices are aiming to recover

Ethereum prices have fallen nearly 19% in the last 48 hours, reaching an annual low of $1,375. At the time of writing, Altcoin is trading for $1,467. We lost key support of $1,533 and fell below $1,500. Despite the losses, Ethereum could recover given its resilient historic performance and new investor interest.

If Ethereum can regain a support level of $1,533, it could pave the way for it to recover to $1,745. A break above $1,745 will end the downtrend for four months and see a reversal.

Ethereum price analysis. Source: TradingView

However, if the bearish trend continues, Ethereum could drop even further, potentially testing levels with support levels below $1,429. If it breaks past $1,375, a bearish paper will be validated and Altcoin could experience a long-term decline.