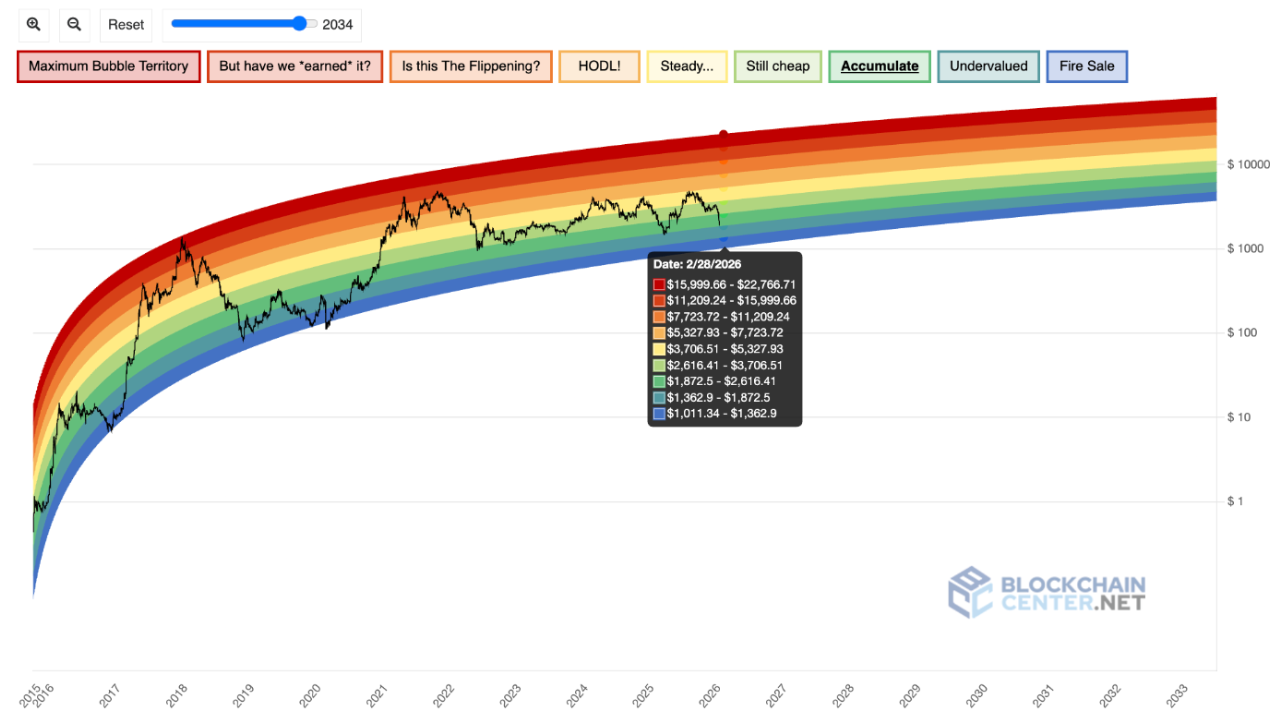

As Ethereum ($ETH) The Ethereum rainbow chart has given us a glimpse of how the asset will trade at the end of this month as it looks to recover from its recent sell-off.

In particular, the chart overlay is $ETHPast price action on a logarithmic growth curve categorizes future valuations into color-coded sentiment bands ranging from extreme overvaluation to significant undervaluation.

Ethereum has since regained the $2,000 support zone, and at the time of writing, the cryptocurrency is trading at $2,009, up more than 4% in the past 24 hours. However, on the weekly chart, the asset is still in the red, down more than 13%.

$ETH price prediction

Based on the February 28, 2026 reading on the chart, Ethereum could trade between approximately $1,011 and $22,767 depending on market conditions.

The upper “maximum bubble region” ranges from $15,999.66 to $22,766.71, indicating extreme speculative excess and historically elevated correction risk. Just below that, the “But Did We Earn It?” band ranging from $11,209.24 to $15,999.66 reflects aggressive upside where price appreciation could outweigh fundamentals.

The next zone, “Is this a ‘flippening’?”, lies between $7,723.72 and $11,209.24 and represents a strong bull market phase where Ethereum often significantly outperforms the broader crypto market.

Intermediate valuations are classified as “HODL!” The $5,327.93 to $7,723.72 band, a zone historically associated with sustained uptrends, tends to keep long-term holders confident. The “Steady…” band below covers $3,706.51 to $5,327.93, suggesting steady growth in line with long-term adoption trends.

The “still cheap” band between $2,616.41 and $3,706.51 means that Ethereum is still undervalued relative to its historical growth curve. Deeper value territory appears in the “accumulate” band of $1,872.50 to $2,616.41, which is typically considered an attractive long-term entry zone.

Further down, the “undervalue” band ranges from $1,362.90 to $1,872.50, and the lowest zone, “fire sale”, ranges from $1,011.34 to $1,362.90 and is historically associated with capitulation phases.

Possible price range for Ethereum

Ethereum is trading at around $2,000 as of February 8th, and the token currently sits within the “accumulation” band.

if $ETH We will continue to track the median historical trajectory of the Rainbow Chart until late February 2026, when it transitions to “Steady…” or “HODL!” The zone possibility is plausible, suggesting a potential price range of about $4,000 to $6,000.

However, stronger-than-expected adoption, increased network usage, or a new crypto bull cycle could push Ether into higher bands, while broader market weakness could push the price closer to the lower valuation range outlined in the model.

Featured image via Shutterstock