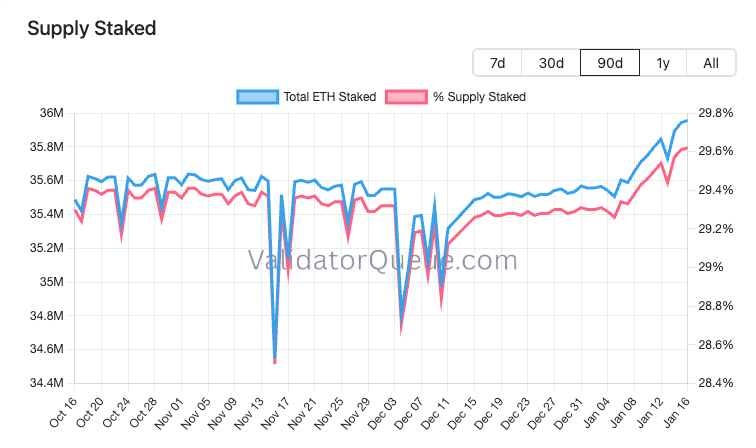

Over 36 million Ethereum is currently staked in Ethereum's proof-of-stake system, with nearly 30% of the circulating supply valued at over $118 billion at recent prices.

This headline number sounds like a clean vote of confidence. Holders are locking up their funds. Ethereum This is to secure your network, collect revenue, and let them know you are in no rush to sell. The problem with using “confidence” as a metric is that it counts coins, not motives, and it treats one whale the same as a million retail users.

Ethereum's staking record is also much larger and more complex, with the cast list becoming more focused, more corporate, and more strategic.

A very naive way to understand this is to imagine Ethereum as a nightclub with a strict door policy. The room is the most packed it's ever been, there's a line outside to get in, and almost no one leaves. That looks bullish until we see who is cutting the line and who owns the building.

Question mark behind new staking milestone

Staking can be thought of as Ethereum's deposit system. Validator locks up Ethereumrun software that proposes and proves blocks, and earn rewards for doing the job correctly. The incentive here is simple. If you act, you will be rewarded, or if you misbehave, you will be punished.

At today's scale, the most useful data points are not round numbers that people quote in tweets (like 30% of stakes). They are the mechanisms that determine who can participate, how quickly they can participate, and how quickly the staking crowd can change their mind.

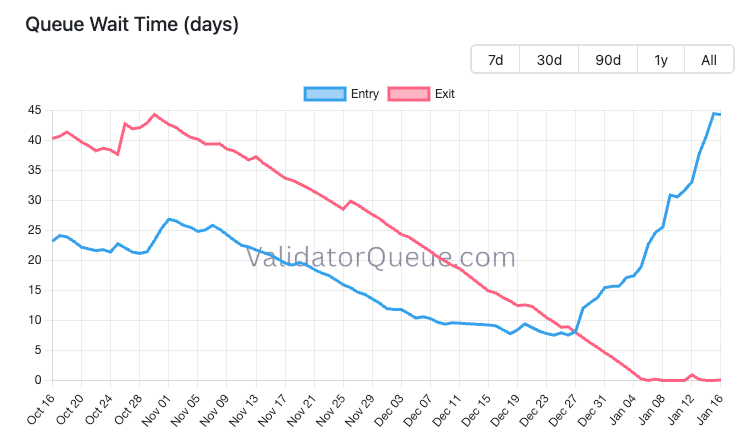

With nearly 1 million active validators currently running on the network, the entry queue is swollen enough that new stake activations can be delayed by weeks. In contrast, exits are thin in recent snapshots, with some trackers showing small exit lines and short latencies.

This gap is important because it turns staking into a kind of slow-moving indicator. There may be a surge in demand even now, and it may still be several weeks before we see any active validators.

This is where the 30% number starts to be misleading. Records may come from a wide, long-term following, or from a few large holders with a plan. Both are pushing the numbers up, but only one says a lot about the beliefs of the average investor.

Even the “community” path can have a concentration of influence. Liquid staking protocols pool deposits and pass tradable tokens to users representing claims against staking Ethereum. While this is convenient, it also routes much of Ethereum's security through a few major pipes. Although this is very efficient, it introduces obvious problems.

Participation in staking is increasing, and the share of staking carried out through a small number of channels is also increasing. These channels don't have to fail to be important. If it's big enough, it's good enough.

About liquidity

lock up 36 million people Ethereum If it sounds like supply is leaving the market, that's because in a sense it is. Piling out Ethereum are not left on an exchange waiting to be sold, withdrawals are governed by protocol rules and queue dynamics.

But “locked” is a tricky word in Ethereum, as staking can and often is packaged into whatever you transact.

Liquid staking is the main reason. Rather than staking directly and waiting for a withdrawal, investors stake through a protocol or platform that issues tokens that represent their claims. This token can be used elsewhere, including as collateral for loans, liquidity for trading pools, and as a component of structured products. pure uncut Ethereum is dedicated to staking, but holders still end up with something they can sell, borrow, or loop around.

It creates a mirage of liquidity that can fool both bulls and bears.

Bulls focus on rising staking ratios and perceive scarcity, and therefore less liquidity. Ethereumthe float becomes thinner and there is a sharp movement as demand returns. Bears look at Liquid Staking to see leverage: Charges for staking Ethereum Used as collateral, risk-off moves could force an unwind that appears far from the staking dashboard. Depending on the location of the position, both can be true at the same time.

A clear way to map an ecosystem is to divide it into three camps.

The first is a direct staker who runs a validator or stakes through a custodian and does not turn his position into tradable tokens. their Ethereum It gets really low on liquid and takes a long time to finish.

The second is a liquid staker who holds staking derivative tokens and treats them as a yield position. As long as derivatives markets function, exposures remain flexible.

The third is a yield stacker that uses these derivative tokens to borrow and repackage exposure. A rise can create liquidity and a decline can create vulnerability. That's where margin calls exist, and that's where drama comes in times of stress.

So what does the staking record mean? It suggests a larger share. Ethereum is routed through staking, and an important part of that staking Ethereum It's wrapped in a rotating token. The net effect is not just reduced supply to the market. This is a real change in market structure. Ethereum is increasingly treated as productive collateral, and the liquidity of that collateral depends on the plumbing.

But plumbing here is becoming increasingly institutionalized. Financial institutions like staking because it gives them the appearance of operationalizing their returns, including storage, control, auditing, and predictable rules. They also tend to accept lower yields in exchange for scale and security. This is important because the reward rate is compressed as it increases Ethereum is staked and the reward pie is divided in many more ways.

Ethereum is slowly starting to resemble a massive interest accrual system. There, the marginal buyer is no longer a retail yield chaser, but a financial manager seeking baseline returns in a compliance wrapper.

Additionally, there are details that make staking records feel less like a crowd and more like a few powerful patrons sorting through a room.

BitMine and the rise of the enterprise validator class

If Ethereum staking is a nightclub, BitMine is the group that shows up with reservations, security details, and plans to buy the space next door.

BitMine has promoted itself as an aggressive company Ethereum It's an agency of the Treasury Department, and its recent disclosures are voluminous even by cryptocurrency standards. The company announced that it held approximately 4,168,000 shares as of January 11th. Ethereumapproximately 1,256,083 items Ethereum I bet.

He also mentioned the stakes. Ethereum That's an increase of nearly 600,000 in one week. This is a big enough burst to show up in the queue data, and it begs the obvious question: how much of this network reliability that everyone is talking about is actually one strategy being executed?

When compared with the record, it is approximately 36 million Ethereum You can bet on the entire network. A single company staked over $1.25 million Ethereum does not explain milestones, but it changes how you should read them.

If a small number of parties are able to sway participation at a meaningful rate, the fact that the stakes are up is no longer entirely representative of broader sentiment. The question becomes who is implementing what plans and why now?

BitMine also outlined plans to launch a commercial staking solution branded the Made in America Validator Network, targeted for 2026. The name sounds like a policy memo that was decided to become a product, and that's exactly why it's important.

As staking scales up, geography, regulation, and identity begin to enter into what was previously a purely technical undertaking.

None of this is automatically bad for Ethereum. Large professional operators can improve uptime, diversify their infrastructure, and make staking accessible even to holders who have never run a validator. Institutional participation could become even wider. Ethereumstrengthens its investor base and strengthens the link between the protocol economy and traditional capital markets.

But that brings a trade-off that doesn't show up in that celebration percentage.

One is concentration of influence. Although Ethereum’s governance is social and technical, validators still shape outcomes through software choices, upgrades, and crisis response. A network secured by many independent operators is resilient in a sense. A network protected by a few large operators is resilient in other networks until a shared failure mode appears.

The other is correlated behavior. When large stakers change strategies, change balances, or face constraints, the impact can ripple through queues and liquidity. Long entry queues and thin exit queues seem stable, but stability depends on whether a small number of large players can remain happy.

A delicate issue is the market signal itself. Cryptocurrencies love simple metrics: increasing staking, decreasing trading balances, and increasing inflows. While these can still be useful, Ethereum's staking record now blends personal beliefs, fluid staking designs, and corporate finance choices. The signal contains more noise because the incentives are more diverse.

Staking is becoming the default endgame as shares grow. EthereumI support this view. Ethereum As productive collateral rather than purely speculative tokens. Fluidity isn't disappearing, it's shifting to rappers and venues with different rules. And composition is important. Records can be driven by the crowd, by the pipes, by corporate finance, or by all three at the same time.

Ethereum staking milestones are real. The underlying story is where the edges are and where the surprises tend to lie.