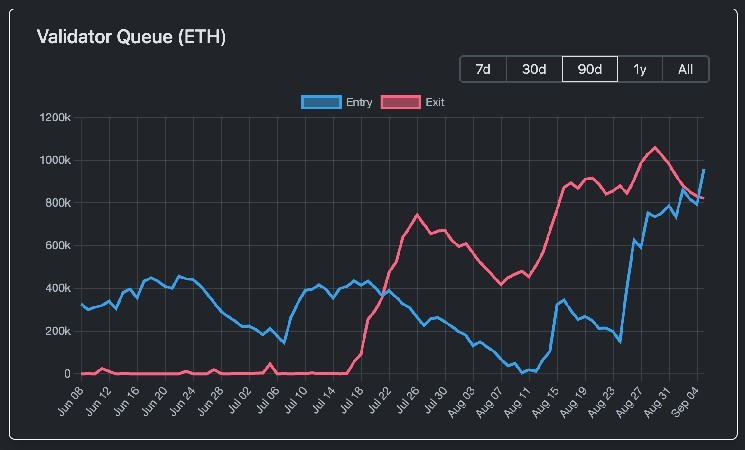

Ethereum's Validator entry queue has skyrocketed past the exit queue for the first time in weeks, updating demand for ether (ETH) just like the fear of a massive sale.

At the time of writing, 932,936 ETH ($4 billion) have appeared in the entry queue, compared to 791,405 ETH ($3.3 billion) of exit queues. Three weeks ago, the exit queue was present at 816,000 ETH, leading to concerns about whether the market could absorb the selling pressure when the token was unlocked.

The turnaround was partially fueled by Ethereum ICO participants who resurfaced after eight years of dormancy. The long-term holder moved 150,000 ETH ($645 million) to staking earlier this week.

Read more: Ethereum ICO Kudhistake $646 million after three years

Investors originally purchased 1,000,000 ETH for just $310,000 during Ethereum's 2014 token sale. Even after staking, the wallet holds 105,000 ETH ($451 million) in two wallets, with most of his holdings being untouched.

Ether has fallen about 4% since August 15, when exit queues reached 816,000, and despite a wider market draw, few sales have been predicted by many. During the same period, BTC dropped by 7%, while some Altcoins experienced double-digit declines.

Long-term bets

Ethereum's Shoof-of-stake system continues to function as both a release valve and a capital attractor. While last month's exit reflected tension, today's Entry Cue Flip highlights its confidence in long-term staking rewards and potential structural demand from ETFs.

Like Defi analysts, Ignas said in August:

Now, with the spike in outlet cooling and entries, the balance could be back to staking as a long-term bet on Ethereum's growth.