According to the on -chain data, Ether Leeum Whale has recently increased the accumulation, a signal that can be optimistic for asset prices.

Ether Leeum Whale is purchased greatly

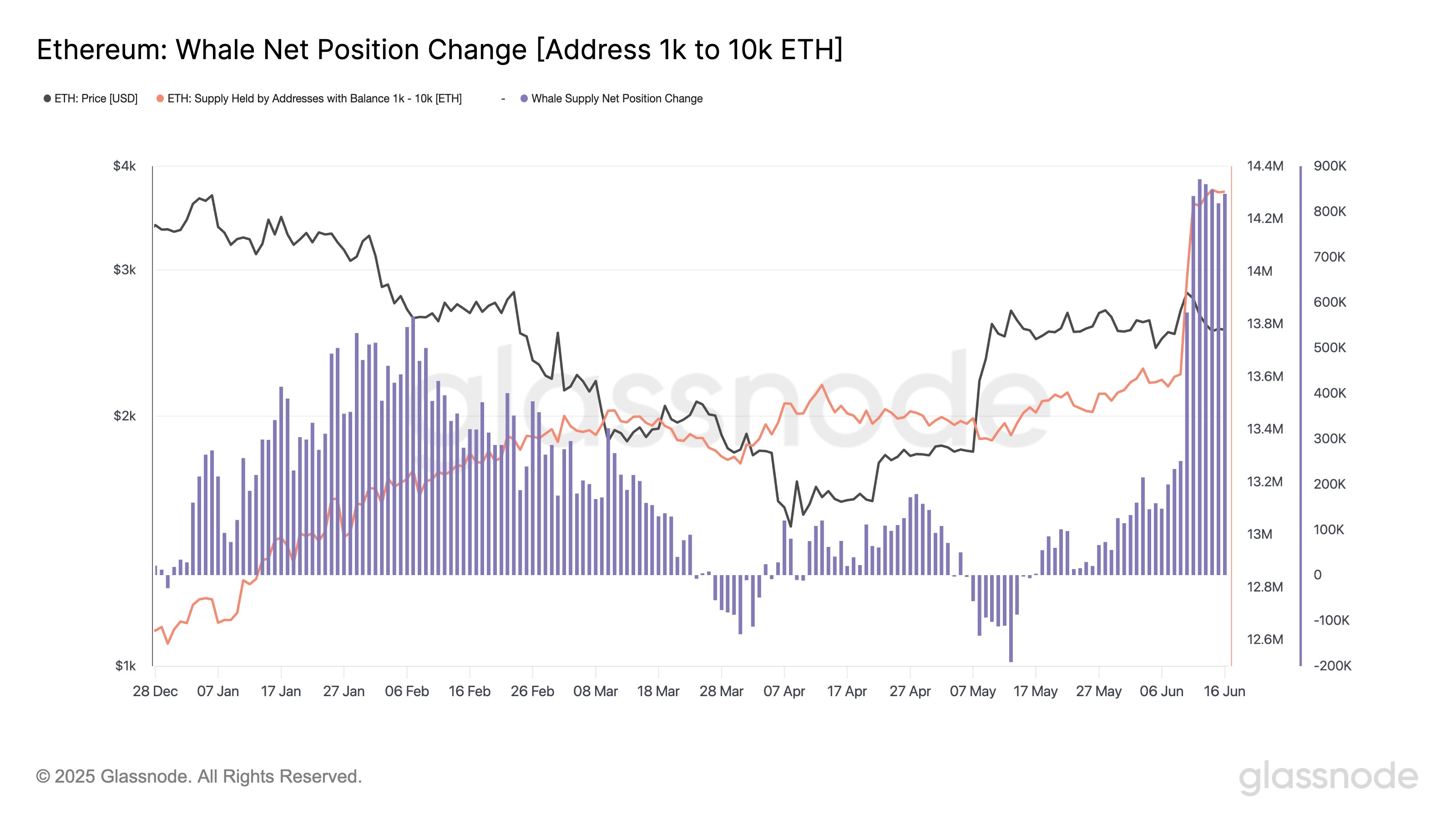

According to the data from GlassNode, a thermal chain analysis company, Ethereum Whales participates in a significant amount of accumulation last week.

'Whale' represents an ethical investor with 1,000 to 10,000 cryptocurrency tokens. In the current exchange, this range is about $ 2.5 million at the bottom and $ 25 million from the top.

This range does not deal with the absolute end of the market, but it contains a huge investor that can still be considered a key part of the ecosystem. Therefore, considering this role, the movement related to these holders is worth monitoring.

One way to see the behavior of the whale is to through the total amount of Etherrium supply owned by the whale. Below is a chart shared by GlassNode, which shows the trend of this metrics for the last few months.

The value of the metric appears to have seen a steep climb in recent days | Source: Glassnode on X

As you can see in the graph, the supply of Ether Leeum Whales has recently been shot, and it is a sign that large -money investors have accumulated cryptocurrency. The analyst said, “For almost a week, the whale accumulation exceeded 800K ETH for almost a week, promoting a 1k ~ 10K wallet of 14.3m IT.

On the chart, on June 12, a large spike occurred. On this date, ETH Whales added more than 871,000 ETHs to their retention, the highest inflow of Cohort.

The latest accumulation acts are not notable in this year's point of view, but also impressive in historical contexts. GlassNode said, “This scale has not been seen since 2017. Of course, this can be a potential sign that these special purchases are convinced of the future of the coin.

This powerful accumulation was found in the chain, but in another aspect of this sector, SPOT Exchange-Traded Funds (ETF) saw demand. The SPOT ETF provides a way for investors to be exposed to Ether Lum without investors directly owned their assets.

SPOT ETFs are traded on existing exchanges, so holders who are not familiar with cryptocurrency wallets and exchange can be more easily invested through coins.

The Netflow chart shared by GlassNode in the X post showcase was highly demand for the US ETH spot ETF.

The trend in the netflow of the US ETH spot ETFs since their inception | Source: Glassnode on X

The analyst said, “We saw 195.32K ETH flowing in 195.32K ETH ETF last week.

ETH price

Ether Lee has watched $ 2,700 on Monday, but since the price has been traded for about $ 2,470 since then, the price has been weak.

Looks like the price of the coin has plunged over the last 24 hours | Source: ETHUSDT on TradingView

DALL-E, GlassNode.com's main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor's team. This process ensures the integrity, relevance and value of the reader's content.