An Ethereum ICO whale has resurfaced after more than a decade, moving 40,000 ETH directly to staking rather than transferring it to an exchange. This move comes after other major holders transferred large amounts of ETH to Kraken, causing the market to break through a key resistance level.

Ethereum ICO Whale Stakes raises 40,000 ETH after 10 years of silence

On-chain data shows that an initial Ethereum ICO wallet holding 40,000 ETH (worth about $120 million) has moved for the first time in more than a decade, with the funds sent to staking instead of an exchange.

Ethereum ICO wallet staking movement. sauce: look on chain

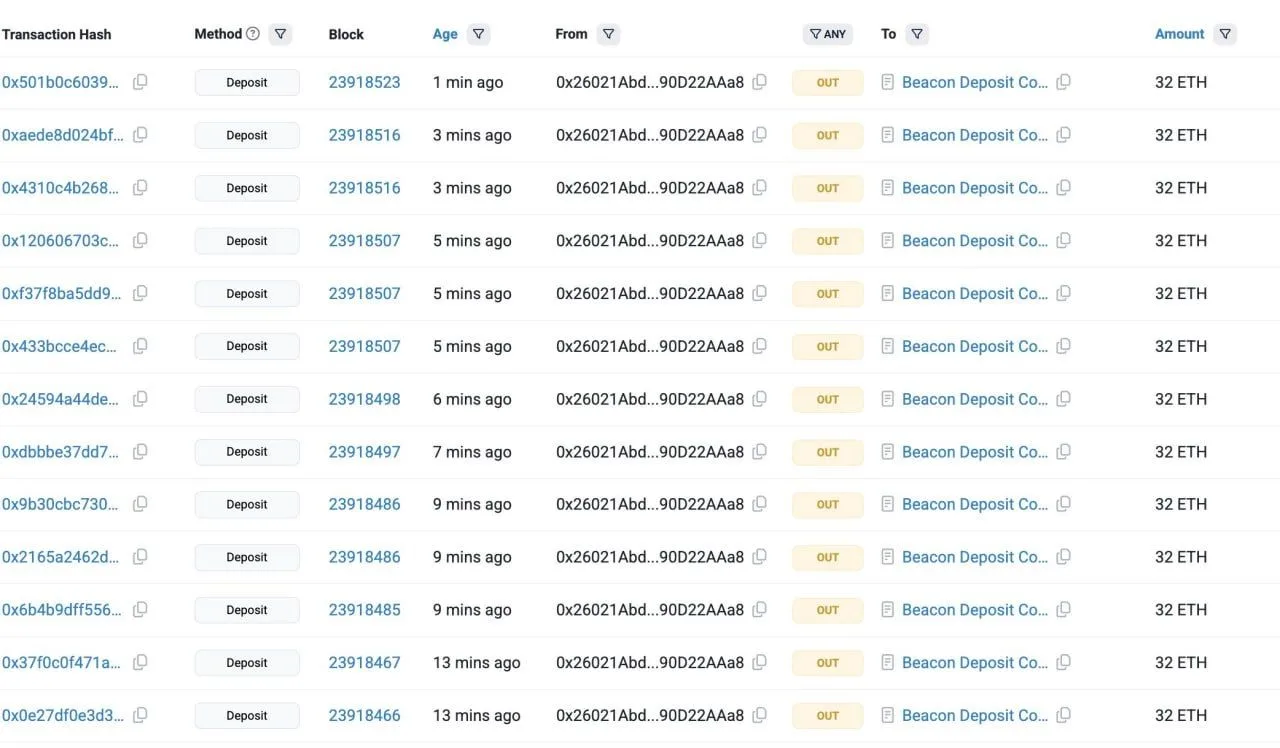

On-chain tracker Lookonchain reported that addresses starting with 0x2dCA woke up after a long hibernation and started transferring. Ethereum Move to new wallet in batches. From there, the coins were sent in multiple 32-ETH transactions to the Beacon Deposit contract, which is used to activate the Ethereum validator.

Each validator requires 32 ETH, so 40,000 ETH positions are enough to run around 1,250 validators. As the Etherscan screenshot shows, the new wallet repeatedly sent 32 ETH “deposit” transactions to the Beacon contract in the past few minutes.

The original wallet received ETH during Ethereum's initial coin offering in 2014 and had not shown any activity since. Now, instead of sending their coins to a trading venue, owners lock them in Ethereum's proof-of-stake system, moving funds from liquid supply to long-term staking.

Whale sends 10,176 ETH to Kraken after holding sETH for 100 days

According to on-chain data, Ethereum whales moved 10,176 ETH worth approximately $28.69 million to Kraken after liquidating a large stETH position. This address converted staked ETH (sETH) to ETH and then sent the entire stack to the exchange in two large deposits.

Deposit whale ETH to Kraken. sauce: on-chain lens

The wallet, tagged “Token Millionaire” and identified as 0xd908995fd431eb0078cd35e912ff14e45043818f, can be tracked for approximately five years, Nansen said. Back in 2019, the same entity withdrew 21,086 ETH worth $7.35 million and has been slowly returning the coins to exchanges ever since.

Now, with this latest transfer of 10,176 ETH after holding sETH for 100 days, the whale has pushed the majority of its historic stash back into the trading venue.

ETH breakout accelerates as price clears key resistance level

ethereum chart show The decisive breakout came after the stock regained two major horizontal zones that had limited price movement through the second half of the year. A move above the initial resistance around USD 3,000-3,100 changed momentum, while a clean break through the USD 3,600-3,700 band confirmed strength and removed the last major supply block ahead of a higher target.

Ethereum breakout structure. sauce: gordon gecko

This chart highlights how ETH built a base around USD 2,650, where buyers repeatedly absorbed selling pressure. That zone served as the main demand layer for the cycle. Each rebound from this area strengthened the structure, reducing the distance to overhead level.

When ETH passed the upper resistance, the candlestick extended vertically. This indicates active follow-through with little interruption between sessions. The current trend reflects strong market conviction as the breakout did not face significant rejection after retesting the range.

Gordon's post frames the move as preparation for a broader continuation of the rally. His chart highlights that ETH has removed a large visible barrier on the daily time frame. With both resistance shelves currently behind the price, the structure points to open air above, although traders are still focused on a potential retest or consolidation phase after such a surge.