Ethereum (ETH) began November on a note of quiet optimism, rising nearly 1% to trade around $3,875. Whale wallets are once again starting to increase their holdings, showing renewed confidence in the possibility of recovery.

But that optimism may not last long. An impending death cross could pose a challenge for buyers and could determine whether this early momentum is sustained or wanes.

Whales and retail investors fuel early optimism

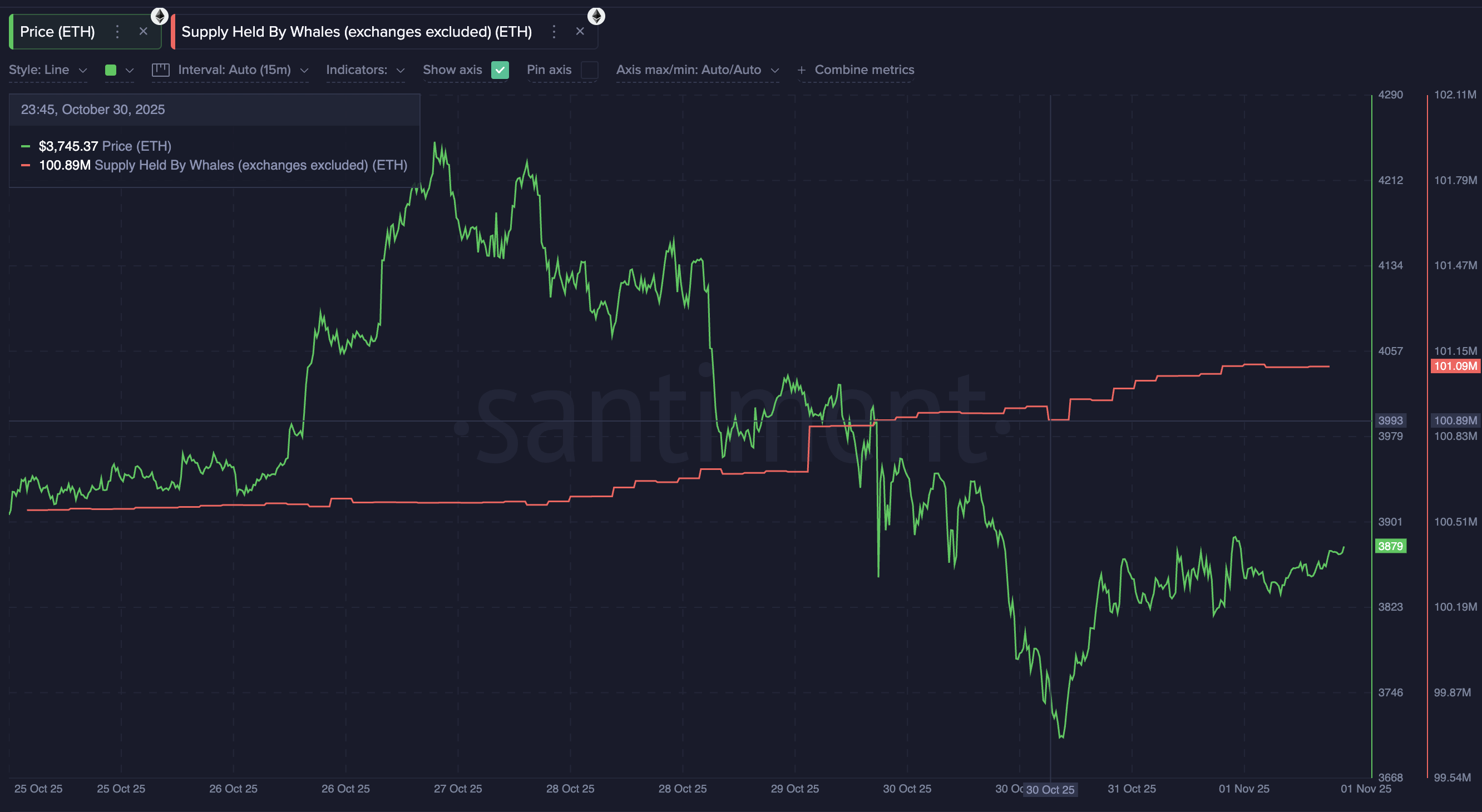

Ethereum whales are buying again and this pattern resumed just before Halloween. According to on-chain data, the combined holdings of both companies increased from 100.89 million ETH to 101.09 million ETH in the past 48 hours.

This corresponds to an increase of approximately 200,000 ETH, which is equivalent to approximately $775 million at current prices.

Ethereum Whales Buy Again: Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This new buying shows that major companies are starting to take positions early, expecting November to be stronger than October. Retail traders appear to share that view. The Money Flow Index (MFI), which measures the amount of money flowing into or out of an asset, has been rising since October 28.

Retail buyers are aggressive: TradingView

From October 22nd to October 28th, Ethereum price made lower lows, but MFI cut higher lows, creating a bullish divergence. This pattern means money is flowing in even as prices fall, and is often a sign that buyers are quietly absorbing supply. Whales and retail purchases combined have increased optimism, but long-term holders have started taking profits, slightly offsetting these inflows.

Looming death cross could pose a challenge to buyers

That optimism faces a serious threat on the charts. Ethereum’s 20-day exponential moving average (EMA), a trend indicator that smoothes price data to show short-term direction, is currently close to below the 100-day EMA, which tracks long-term momentum.

This setup where the short-term moving average is below the long-term moving average is called a death cross. It often indicates that the seller is in control.

This pattern is particularly significant as the previous fatal cross between the 20-day EMA and 50-day EMA in mid-October caused a 13.7% correction. If this pattern repeats, much of the whale-led optimism currently building could disappear.

Ethereum Price Faces Death Crossover: TradingView

If the 20-100 EMA cross is confirmed, Ethereum could fall lower, negating the cautious buying optimism seen this week. Pressure is amplified as long-term ETH holders continue to sell, a trend we have seen since late October, increasing downside risk and reinforcing the formation of a death cross.

However, if buying from whales and retail investors continues and ETH rises above the 100-day EMA, there is a possibility that the crossover will not even form. That would keep the market structure intact and give bulls a chance to extend the recovery.

Ethereum Price Prediction: Breakout or Breakdown?

Ethereum’s chart currently shows an unusually even balance of upside and downside potential. A 4.9% rise in either direction could determine its short-term direction.

If the death cross is confirmed and momentum weakens, ETH could fall 4.9% towards $3,680, followed by a possible fall to $3,446 if the sell-off accelerates.

However, if whale accumulation and retail inflows continue and the price rises, a 4.9% increase would take ETH to $4,069. A short-term breakout will be confirmed if the daily close is above that level. A daily close above that level would pave the way for $4,265 and $4,487, making November a potentially strong month for Ethereum.

Ethereum Price Analysis: TradingView

With support and resistance located roughly equidistant from the current ETH price, the coming days could determine whether Ethereum buyers manage to survive the death cross or get caught in it.

The post Ethereum whales are buying again — but can they survive the impending death cross? The post appeared first on BeInCrypto.