GlassNode data can mean that Etherrium price epidemiology is more affected by derivatives and other off chain markets than Bitcoin.

CBD data shows the release of the spot activity of Bitcoin & Ethereum.

In the new post of X, GlassNode, an on-chain analytics company, recently talked about how the cost standard distribution (CBD) between Bitcoin and Ethereum branched.

CBD indicates an indicator of the amount of an asset given a given value or investor at each price level visited by the price level visited by the password.

This metrics are useful because investors tend to make a special emphasis on the breakthrough level and have some kind of movement when a re -test occurs. The higher the amount of assets purchased at a specific level, the stronger the reaction to the re -test.

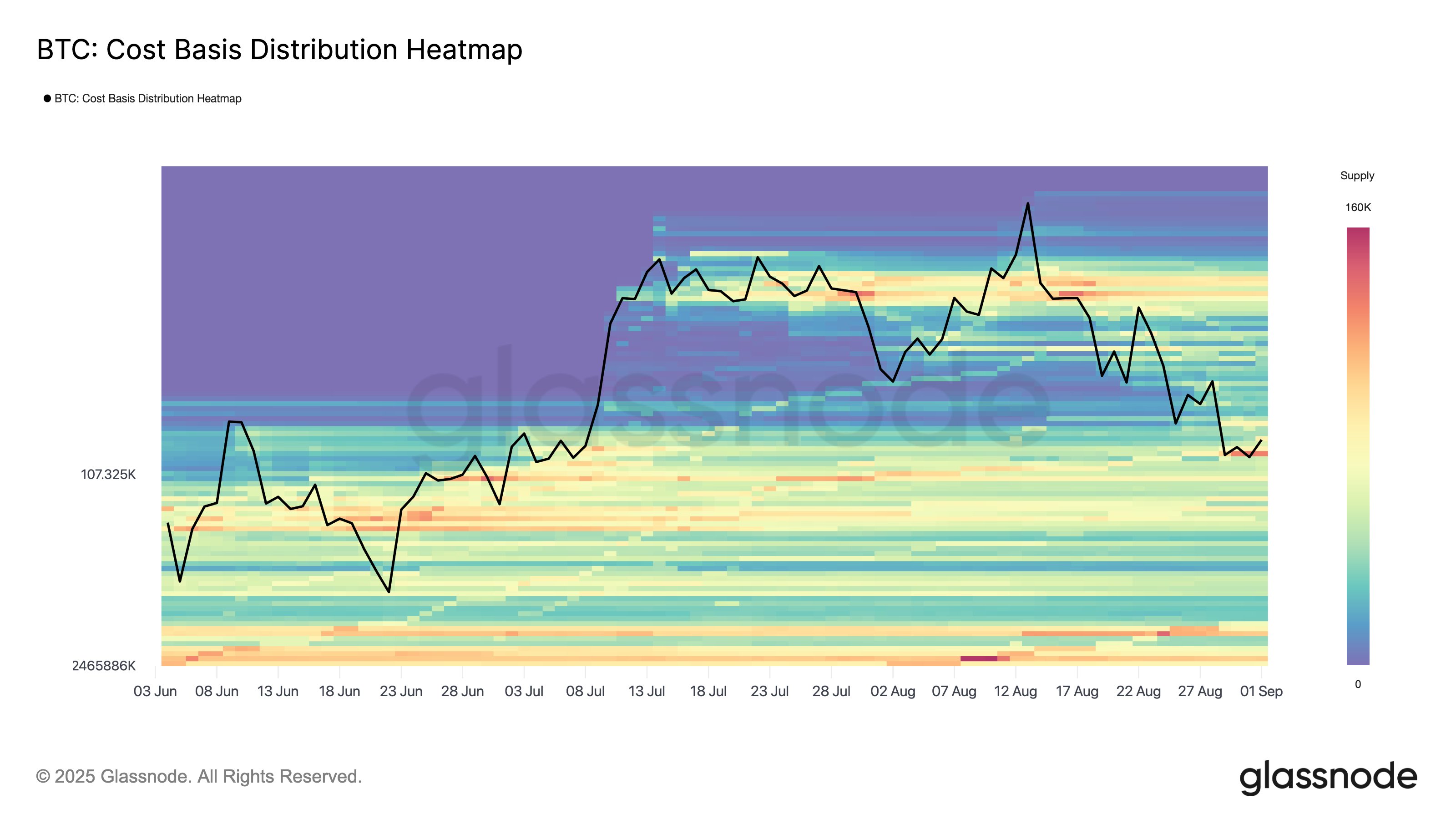

First, there is a chart that shows Bitcoin's CBD trend over the last few months.

Looks like BTC is currently retesting a major demand zone | Source: Glassnode on X

As shown in the graph above, Bitcoin CBD won a big “air gap” when Bitcoin saw an explosive rally in July. Because the BTC was too fast to buy and sell the price, the coin could not be received based on the cost.

After the rally cooling, the BTC began to be filled with supply. The same was true at the latest decline, and now the previous air gap has disappeared. This shows that the demand for spot transactions has been maintained for cryptocurrency.

Bitcoin has seen this trend, but CBD acted differently in the second largest asset in Ether Leeum.

How the CBD has changed for ETH over the past few months | Source: Glassnode on X

In this chart, Ether Lee's rally also made an air gap, but unlike Bitcoin, it was not filled with any level as a notable level due to the slowing stage. GlassNode said, “This suggests that ETH price epidemiology can be more affected by the off chain market, such as derivatives.

Historically, price behavior based on products such as derivatives has often been proven to be more volatile. Given that Ether Lee does not observe a high -level spot purchase, you can see what the fate of bull run is.

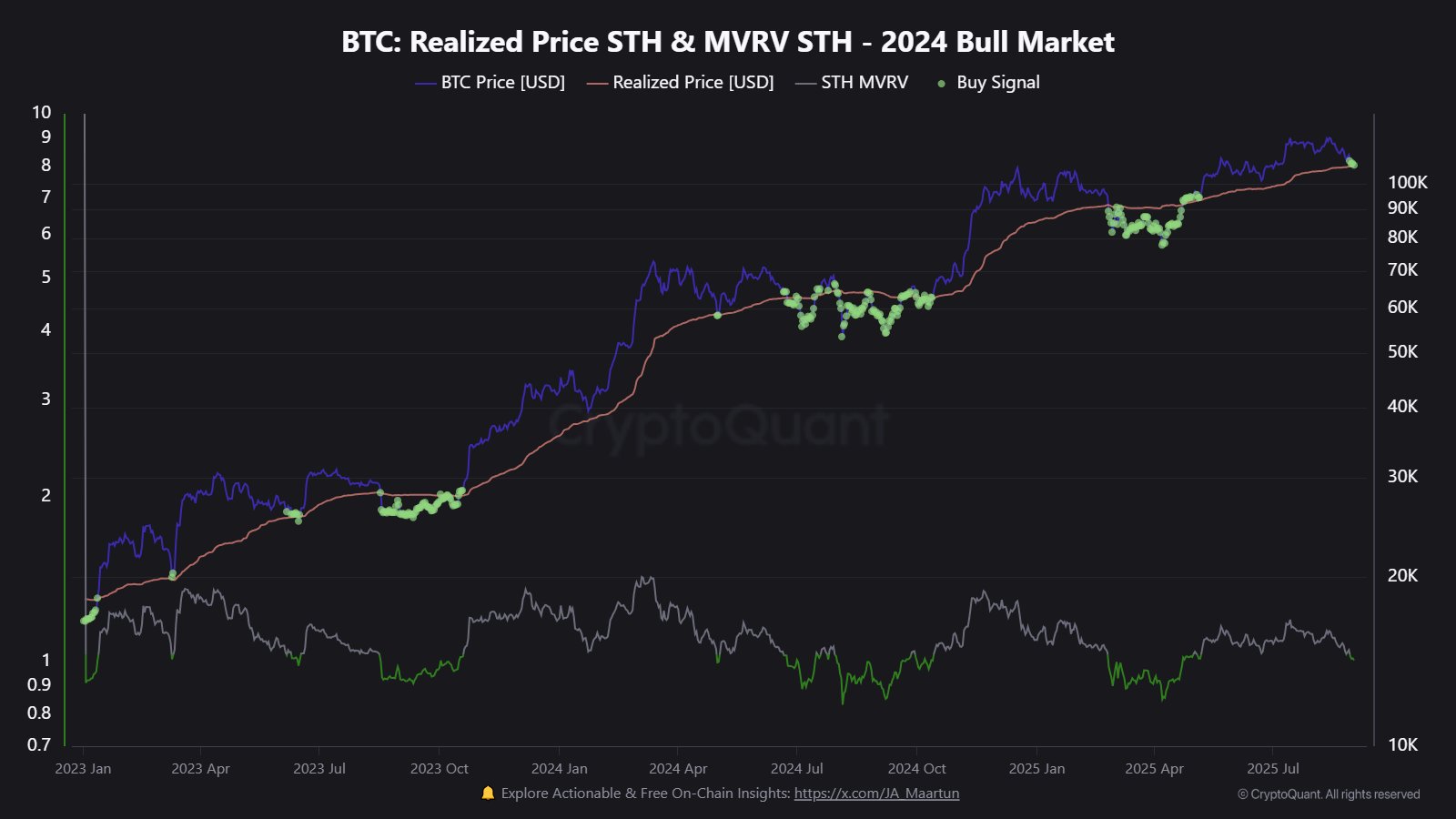

In other news, Bitcoin is trading near the level of important hot chain costs after the recent drop in the price, as the encryption author Maartunn pointed out in the X Post.

The trend in the Realized Price of the BTC short-term holders | Source: @JA_Maartun on X

This level is the average cost of short -term holders who have purchased Bitcoin for the last 155 days. In the past, short -term shifts occurred after losing the level.

ETH price

Ether Lee has recently declined as the price fell to $ 4,270 with a full back of 6%per share.

The price of the coin appears to have gone down recently | Source: ETHUSDT on TradingView

Dall-E, Cryptoquant.com, GlassNode.com, TradingView.com

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor's team. This process ensures the integrity, relevance and value of the reader's content.