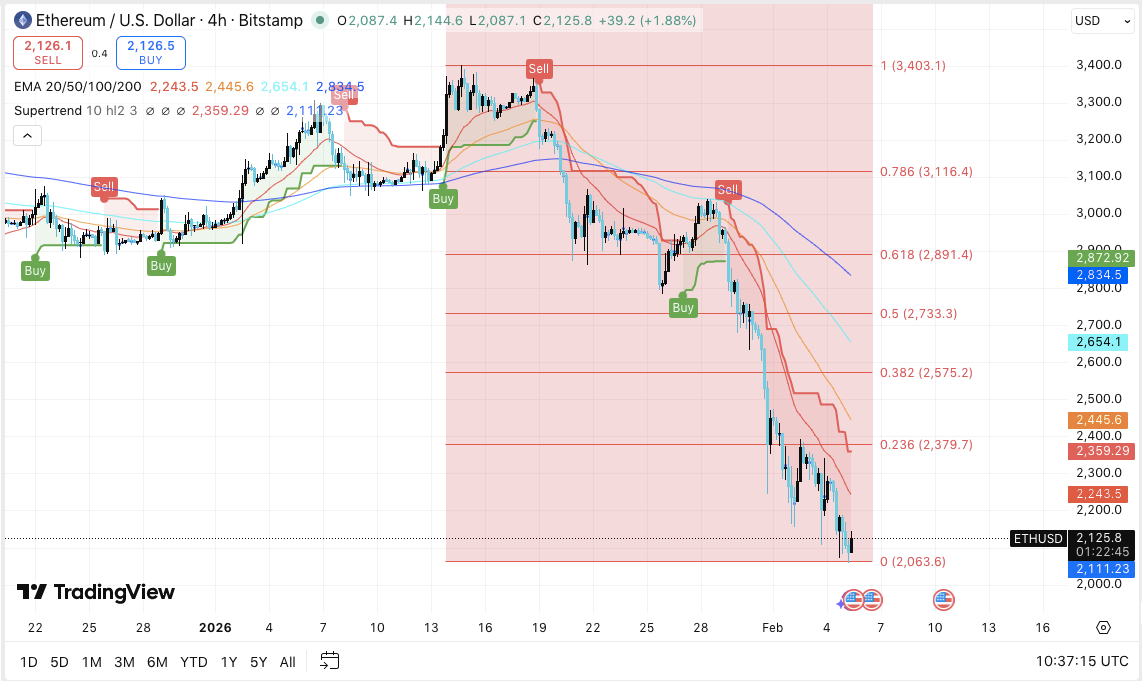

Ethereum continues to face technical pressures as the short-term price structure weakens and overall market confidence remains fragile. On the 4 hour chart, $ETH A clear bearish trend remains, with lower highs and lower lows guiding price action.

A recent recovery attempt towards the $2,125 area failed to change this structure, reinforcing the view that the move lacks conviction. Therefore, traders remain cautious as the price remains below the key resistance zone.

Bearish structure dominates 4H chart

Ethereum is trading below all major exponential moving averages including the 20, 50, 100, and 200 EMAs. These levels are currently sloping downwards, placing a cap on any upward movement. Additionally, trend indicators continue to favor sellers, indicating limited momentum from buyers.

A broader decline then accelerated. $ETH We lost key Fibonacci levels and each breakdown increased selling pressure. As a result, prices are currently hovering around the key demand zone between $2,063 and $2,080.

$ETH Price dynamics (Source: Trading View)

This area represents the last visible short-term support. A clear break below this range could expose the psychological $2,000 level. In addition to its psychological importance, the zone often causes increased volatility.

Related: Bitcoin ($BTC) Price prediction: $BTC Derivatives fall below key levels amid cooling…

If sellers push through, there could be downside liquidity between $1,920 and $1,880. On the positive side, $ETH The $2,245-$2,260 area needs to be regained before the recovery takes off.

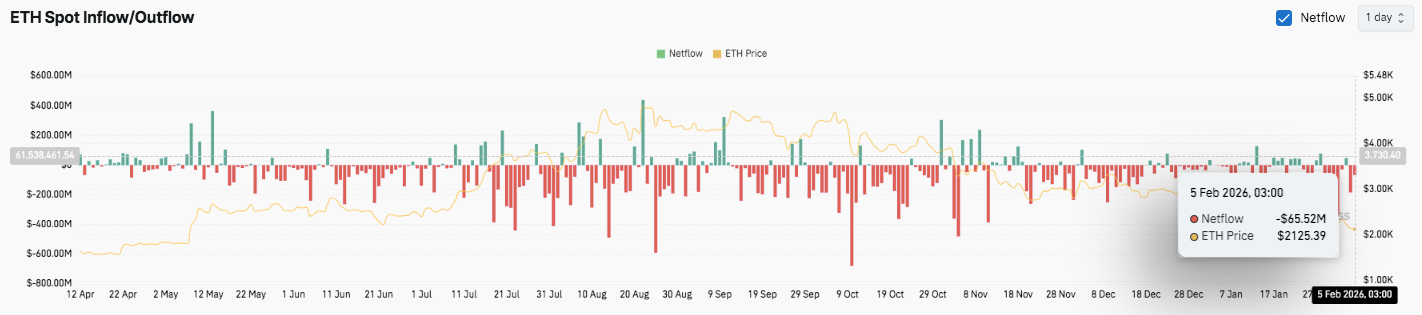

Derivatives and spot data signal market reset

The Ethereum derivatives market reflects a widespread reset of speculative positions. Open interest expanded aggressively during the initial rally, peaking at over $60 billion as leverage increased rapidly.

Each economic expansion ended in a sharp contraction, highlighting forced liquidations during the adjustment. Recently, open interest has declined towards the mid-$20 billion range, suggesting widespread deleveraging. Additionally, this reduction reduces short-term volatility while removing excess risk from the system.

Source: Coinglass

Spot flow data adds further context. Ethereum has experienced a long period of net outflows, indicating continued circulation. A temporary burst of inflow occurred during a brief rebound, but follow-through was lacking.

Related: World Mobile Token (WMTX) Price Prediction 2026-2030

Importantly, recent flows have shown contraction on both sides, suggesting indecision and weakness in spot demand. The market now appears to be waiting for a clearer accumulation signal.

Innovation debate creates long-term uncertainty

Beyond price trends, strategic concerns are also entering the conversation. Ethereum co-founder Vitalik Buterin recently appealed to developers to rethink current architectural trends.

I've been following the reactions to something I said about L2 about 1.5 days ago.

One of the key things I believe is “create yet another EVM chain and add an optimistic bridge to Ethereum with a one week delay”. This is to explain how Compound forks into governance. This is what we did…

— vitalik.eth (@VitalikButerin) February 5, 2026

He warned that repeatedly deploying similar EVM chains and familiar scaling designs risks delaying meaningful progress. Instead, it encouraged exploration of new execution models, privacy systems, and low-latency architectures.

Technical outlook for Ethereum price

Ethereum’s key levels remain well-defined as price trades near key inflection points for the upcoming session.

On the upside, the first resistance cluster exists between $2,245 and $2,260. A break above this range could open the way to strong resistance at the EMA at $2,360-$2,380 and then $2,445-$2,460. A sustained recovery above $2,575 (0.382 Fibonacci) would be needed to signal a broader trend change and restore medium-term bullish momentum.

On the downside, immediate support lies between $2,063 and $2,080, which is acting as a short-term demand zone. Failure to sustain this area increases downside risk towards the psychological level of $2,000. Below $2,000, the next pocket of liquidity is between $1,920 and $1,880, where buyers may try to stabilize the price.

The technical structure suggests that Ethereum remains under bearish control, with the price below the major moving averages. This compression signals increased volatility going forward.

Will Ethereum go up?

near future $ETH The price outlook depends on whether buyers can sustain the $2,060 area long enough to counter the overhead resistance. Increased inflows and increased open interest will support a recovery towards above $2,360.

However, if the current support is not sustained, there is a risk that the downtrend will extend below $2,000. For now, Ethereum is still in a decisive zone and requires confirmation before its next directional move.

Related: XRP Price Prediction: Token crashes to post-election low $1.43 as $1 target comes into view

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.