Electric vehicle company Volcon has announced changes to its corporate strategy and has revealed plans to adopt Bitcoin Treasury.

The company has disclosed through this major development press releaseit confirmed it has secured more than $500 million in private placement offerings to support a new Bitcoin-centric financial approach.

Volcon adopts Bitcoin Treasury for $500 million

According to the release, Volcon has reached purchase agreements with several institutions and accredited investors, selling over 50 million shares At the price of $10 each.

Meanwhile, to drive the move, Volcon has partnered with Gemini Nustar, an affiliate of Gemini Trust Company, for digital asset services.

In addition to this change, Volcon has changed several leadership. Ryan Lane, co-founder of Emperry, has been appointed co-CEO and chairman of the board. Specifically, three other executives of the emperor joined the board and oversee the implementation of the new strategy.

VLCN Stock Spikes

Volcon also pointed out that it will focus on a capital-efficient Bitcoin strategy while maintaining its electric vehicle business through its asset current model. CO-CEO John Kim highlighted the move as a future-looking decision to protect shareholder value In the era of Rising concerns about the collapse of the Fiat currency.

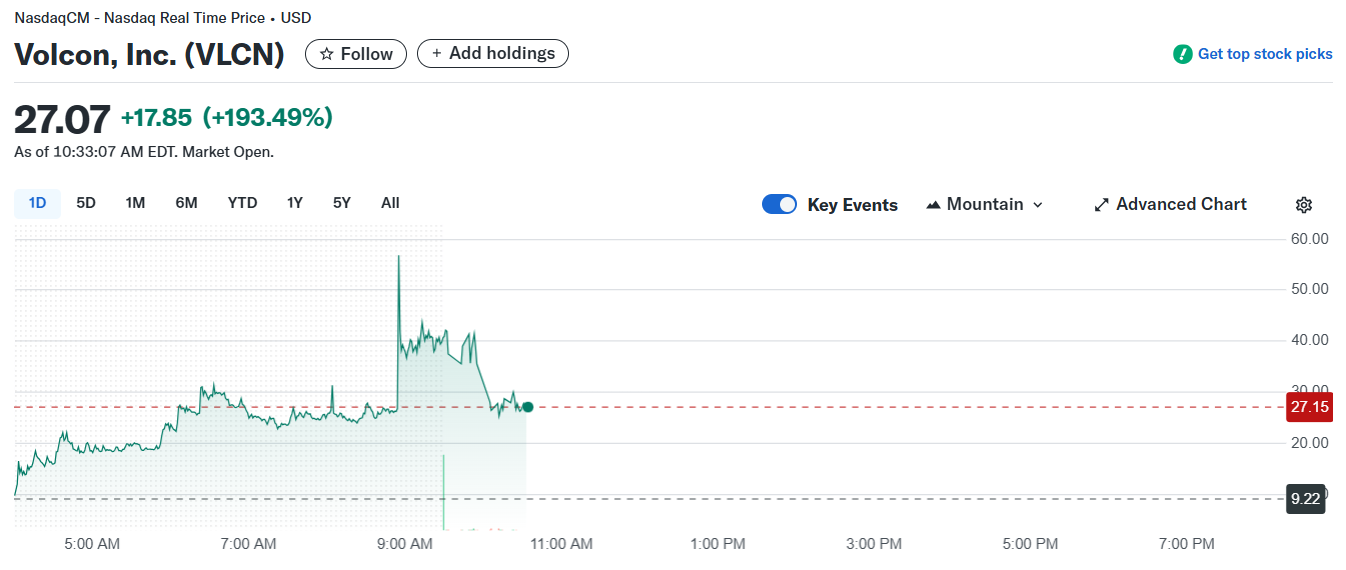

Volcon's announcement had an immediate impact on inventory. The company's stock (VLTN) surged 366%, rising from $9.22 to a high of $43.38. This pattern has I played alongside other Bitcoin Treasury Firms In the past. VLTN later pulled back to around $27.07, but the stock price is up 193%.

Volcon Stock Spike in Bitcoin Financial Planning

Growth trends in Bitcoin finance companies

Surprisingly, recent moves have placed Volcon within a growth group of companies that have integrated Bitcoin into their financial strategy. This year alone, several well-known companies have joined the trend. This is the move that attracted attention on MicroStrategy's now-famous Bitcoin Playbook.

2025, Business Like Trump Media & Technology Group, GameStopand twenty one capital They have each one It was revealed Bitcoin financial plan. In addition, other Less known names such as green minerals also participated in the conversation.

According to data from Bitcoin Treasuries, 272 large entities hold Bitcoin, with public companies leading the pack. Currently, 154 public companies jointly own more than 860,000 BTC, worth more than $101 billion.

MicroStrategy is now rebranded strategy601,550 BTC continues to control the list at nearly $71 billion. Marathon Digital continues at 50,000 BTC, while Twenty One Capital and Riot Platform hold 19,225 BTC and 16,352 BTC each.