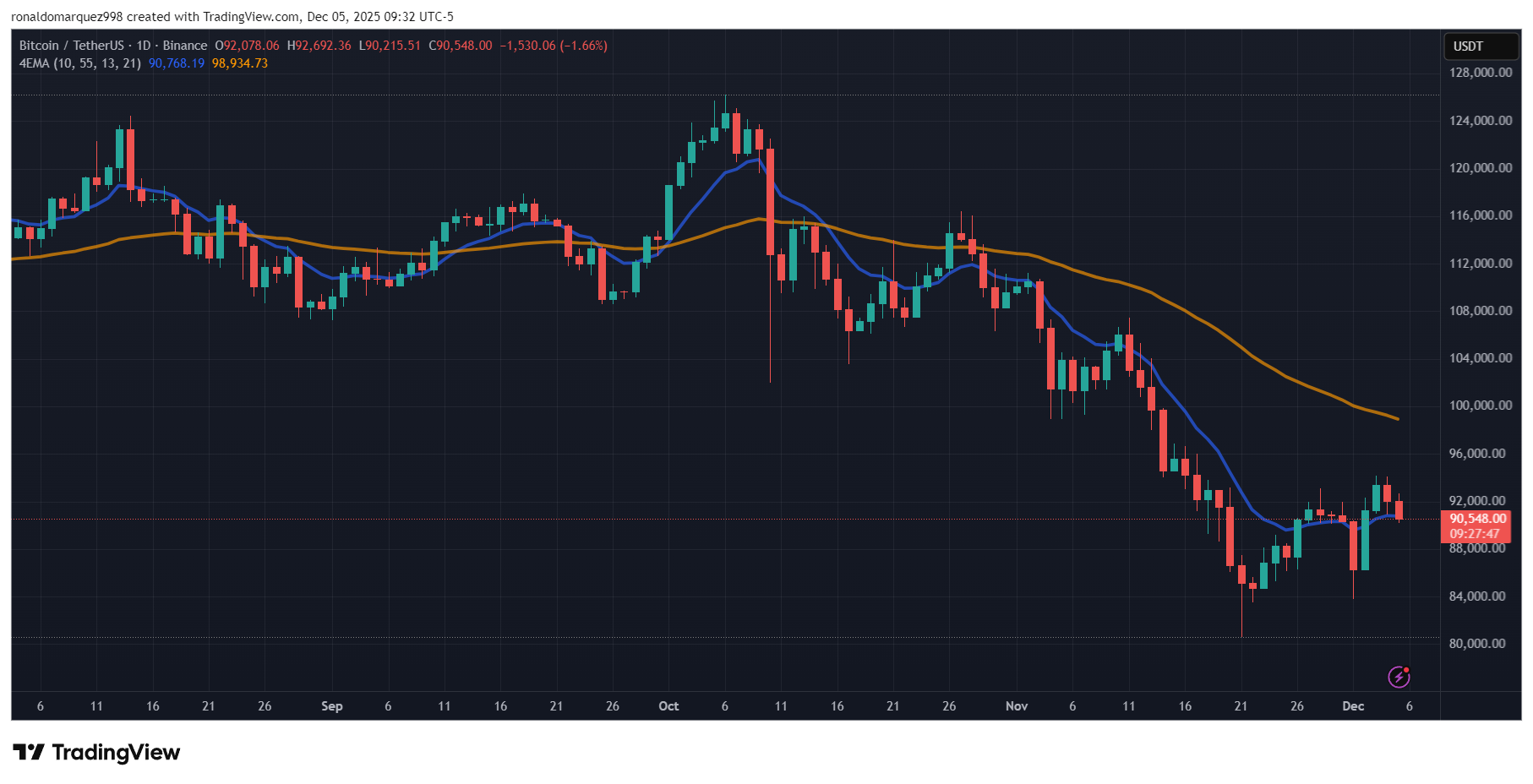

Even though Bitcoin price has recovered above $90,000, a key benchmark that has historically served as a support for the cryptocurrency, the market is showing signs that a further correction may be imminent.

Is Bitcoin price recovery in crisis?

Market expert Recht Fenser recently shared his insights on social media platform X (formerly known as Twitter). suggest Bitcoin's price may be forming what he calls a “massive bull trap.”

This term refers to a deceptive bullish signal in which the price briefly exceeds a resistance level (in this case, the $90,000 mark) before reversing and turning lower. Such a move could trap investors who bought in at the peak, resulting in large losses.

Fenser pointed to a troubling pattern reminiscent of early 2022, when Bitcoin regained its value. 50 week moving average (MA) – Currently sitting above $102,300, it has since experienced a significant decline of approximately 60%, falling below $20,000 by June of that year.

He noted that the recent price recovery after a significant drop to $84,000 should not be interpreted as a signal of short-term success, especially since Bitcoin prices are currently trading below their 50-week moving average.

If past trends repeat, this could mean a significant drop in Bitcoin, potentially reaching around $36,200, which could mark a low for Bitcoin. bearish cycle For cryptocurrencies. On the other hand, some analysts maintain a bullish outlook.

Is the bottom of BTC in sight?

Market researcher and analyst Miles Deutscher expressed confident sentiments, saying: I believe Based on his analysis of key trends, there is a 91.5% chance that Bitcoin price has hit its bottom.

He noted that recent weeks have been dominated by negative news stories, including concerns over Tether (USDT) and the impact of China's actions on cryptocurrencies, which he argues often signal a rock bottom for local prices.

Additionally, Deutscher pointed to a shift in market trends from primarily bearish to bullish. He explained that the trading environment has been on an upward trend again recently. Buying forcelarge investors, or “OG whales”, stopped selling. This change is reflected in the order book, indicating that market sentiment may stabilize.

Additionally, market conditions have tightened in recent months, and the liquidity situation appears to be changing. The potential appointment of a new Fed chair known for dovish policies, coupled with the formal end of quantitative tightening (QT), could further impact market dynamics in favor of buyers.

Mr. Deutscher concluded by emphasizing that given the extreme level of disaster: fear, anxiety, doubt He believes that the (FUD) market, coupled with improved trade flows, is likely to support the idea that Bitcoin prices have indeed hit bottom.

Featured image from DALL-E, chart from TradingView.com