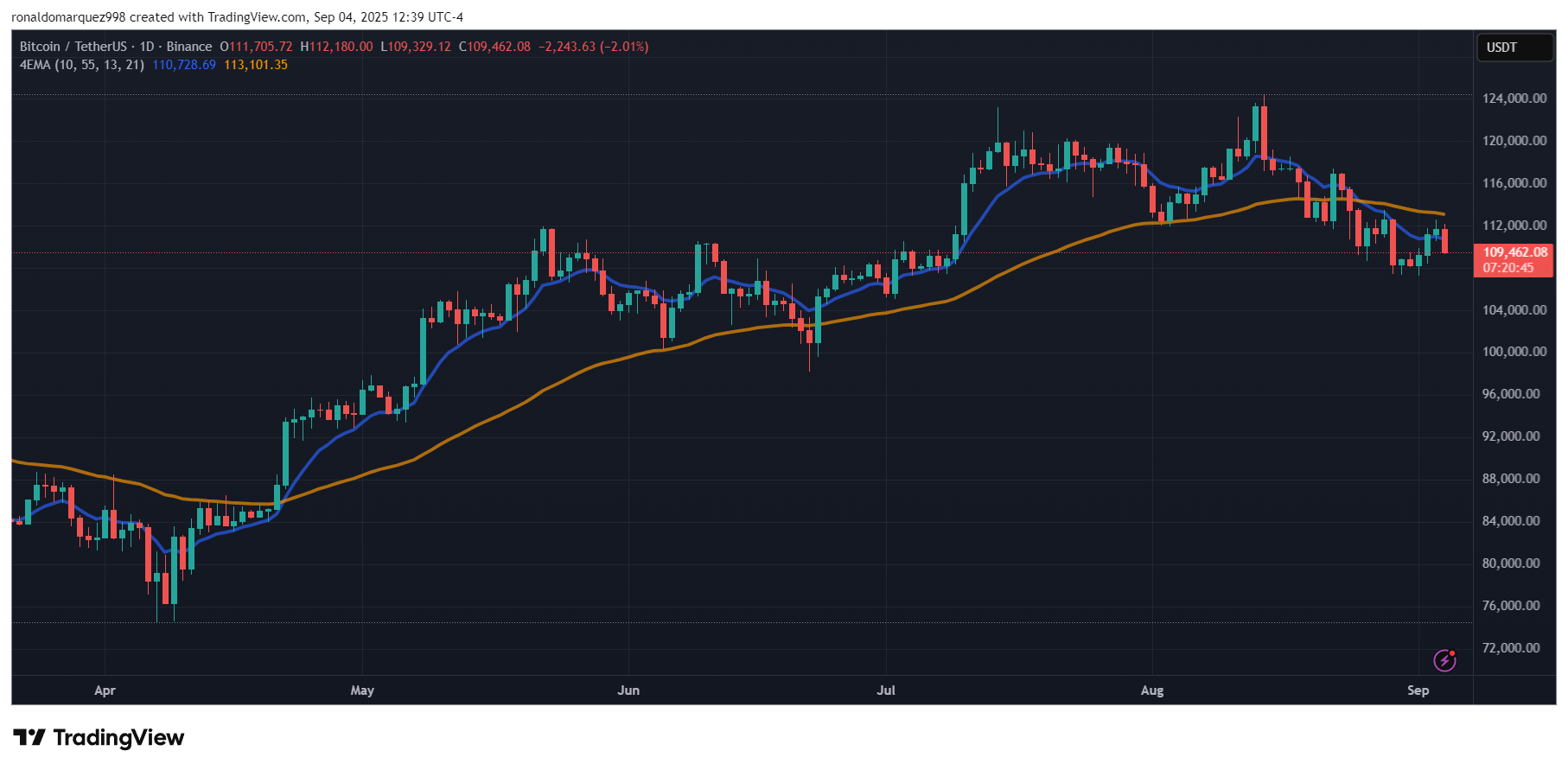

The recent price adjustment for Bitcoin (BTC) has caused a ripple of the broader cryptocurrency markets, pushing many assets into the red. On Tuesday, Bitcoin fell below $110,000, down 12% from an all-time high. Experts now warn that the situation could get worse as October approaches.

Crypto Market's imminent slump

Market analyst Oxpepesso took him to social media platform X (formerly Twitter) to explain his decision to liquidate all crypto holdings by October. He identified key factors based on historical patterns that influenced his decisions.

According to For analysts, many traders mistakenly believe that the upcoming Altcoin season will last six to eight months. Oxpepesso's analysis shows that the Altcoin season is expected to start from late September to early October.

He points out that while Bitcoin has lost its advantage, the revival and momentum of Ethereum (ETH) ecological memokine is showing a shift in market dynamics.

The technical setup also appears to match the macroeconomic trends, suggesting that the market is approaching the “overheating stage.” He warns that this peak will result in a “uncontrolled collapse” that could lead to a massive loss of altcoins.

Analysts also highlight various uses Indicatorand measures market overheating and overselling conditions, such as extreme oscillators. The indicator is currently located at 1-2, suggesting that the market has not yet reached overheating, but there is a risk of a recession.

Another tool in Oxpepesso's analytical arsenal is the MVRV band, which evaluates the realised value and ratio of Bitcoin's market value. When this metric approaches the upper band, Crypto Market It's overheating and the risk of a price drop is increasing.

Though today's measurements are below important levels, analysts claim there are indications that the market is heading that direction. This could worsen the retracement of the broader crypto market as the October deadline approaches.

Analysts predict a decline in Bitcoin prices

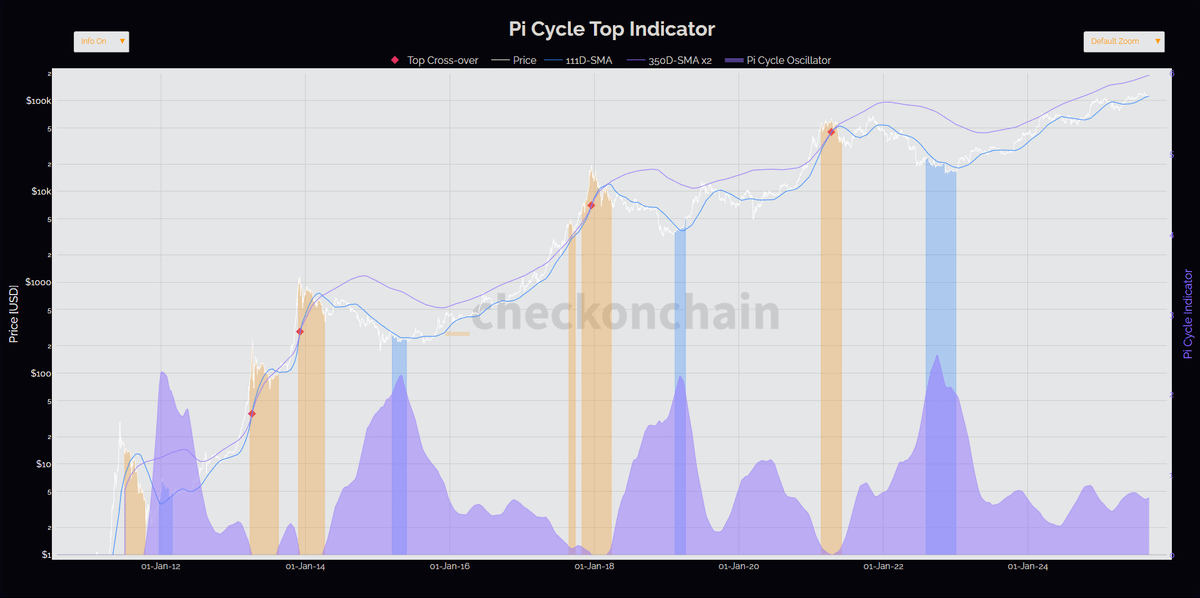

The Pi cycle top indicator tracking crossovers of 111 and 350-day moving averages is another focus of Oxpepesso's analysis. The lines have not yet crossed, but the chart below shows that the gap is closing rapidly; Market Top It could be imminent.

Additionally, on-chain original pricing models are being monitored to reflect investor behavior, establish the value range of Bitcoin, and identify support and overheating levels that indicate the current phase of the crypto cycle.

In light of these indicators, Oxpepesso points out that the current cycle is approaching its final stage. This feeling is echo His bearish attitude has recently been strengthened by the interests of his fellow market analyst.

Initially, he predicted that the market's major crypto would reach a new all-time high after reaching the $90,000-$95,000 range. But he now considers the possibility of a lower price range and says he doesn't think he's mostly bullish.

Dall-E featured images, charts on tradingView.com