The odds of a December quarterly rate cut rose sharply this Thanksgiving, with prediction markets and interest rate tracking tools showing traders are almost completely confident the Federal Reserve will cut interest rates.

25bps cut in December now the market's dominant bet ahead of Fed meeting

Forecasting platforms are now beaming with overwhelming confidence in a 25 basis point rate cut, turning what was once a cautious trend into something closer to a holiday certainty.

According to Polymarket's main contract, the probability of a 25 basis points cut is 84%, up from 66% just five days ago. In the platform's alternative market (which tracks policymaking and Fed dissent combined), two or more votes against the Fed would result in a 25bps rate cut at 63%, while two or fewer votes would result in a rate cut of nearly 60%. The “no change” camp has decisively slipped into long-term territory, with market-wide rates between 12% and 16%.

Mr. Kalsi echoed the same belief, pegging the quarter-point cut at 84% as of Thursday. The platform assigns a probability of just 18% to holding interest rates, and any movement above the standard 25 bps remains at the level of a statistical footnote. U.S. traders may be busy carving the turkey, but pricing suggests they are just as confident in charting the course for monetary policy.

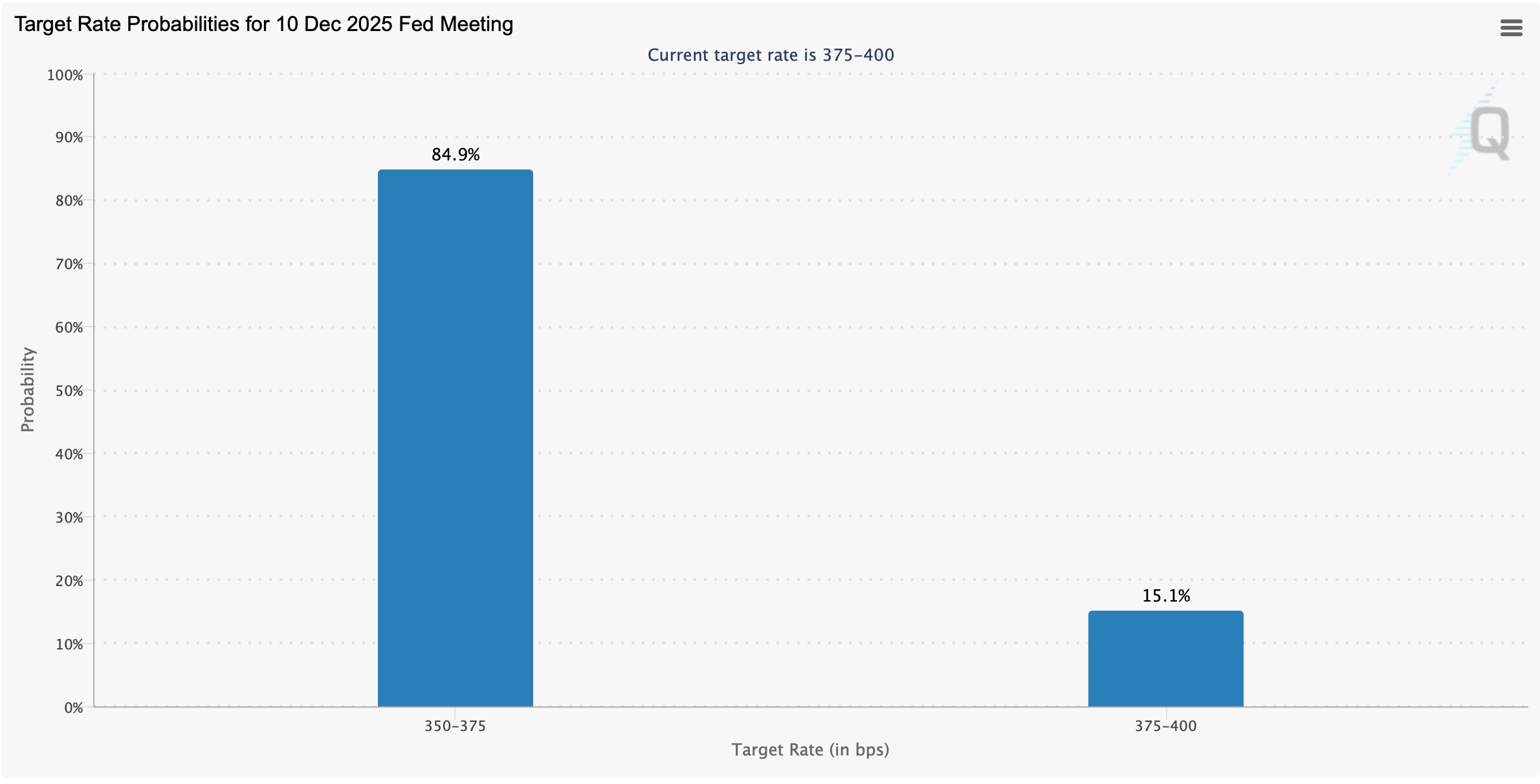

CME Fedwatch Tools November 27, 2025.

Meanwhile, CME's Fedwatch tool takes this story even further. FedWatch indicates there is an 84.9% chance that the target range will be revised downward from the current 375-400 basis points to 350-375 basis points for the December 10 policy meeting. Only 15.1% of the tool weights support rate hold. This change represents a significant increase from the 71% probability FedWatch showed last week.

Also read: Fed Director Stephen Milan calls for 'significant' interest rate cuts as unemployment rises

Consistent alignment across multiple platforms highlights a clear market message. Despite months of mixed signals and policy caution, traders now expect the central bank to proceed with modest interest rate cuts. With liquidity, holiday trading, and macro uncertainty all smoldering, even the standard quarter-point rate cut has become mainstream.

It remains to be seen whether the Fed will oblige, but the market seems confident enough to bet early, at least for today, with stuffiness and confidence on its side.

Frequently asked questions ❓

- What do traders expect from the December Fed meeting? Most prediction markets have an 84% chance of a 25 basis point (bp) cut.

- How does it compare to CME FedWatch? FedWatch puts the probability of a rate cut in December at nearly 85%.

- Do rate hold odds still matter? Odds of no market change have dropped to the low teens.

- Which platforms are driving excitement today? Polymarket, Calci, and CME Fedwatch all indicate strong support for a rate cut in December.