According to the latest CME FedWatch tool data, the odds of a Fed rate reduction in July fell dramatically below 5% in a better than expected job report.

This shift can be a challenge for the crypto market. As the likelihood of low interest rates decreases, cryptocurrencies may become less attractive to investors.

Crypto faces new risks as FRB rate cut odds drop

A June US employment report released by the Bureau of Labor Statistics revealed that unemployment rate fell to 4.1%, down from 4.2% in May, below the forecasted 4.3%.

“The US unemployment rate fell to 4.1% in June, the lowest since February. It's well below the historic average of 5.7%,” writes Charlie Billero.

Employers added 147,000 jobs in June. This coincides with the average number of jobs added each month in the previous year (146,000).

The sector that saw employment growth was state government employment and healthcare. Meanwhile, the federal government has experienced job cuts.

“92% of the 147,000 jobs that were supposed to have been created in June were government, healthcare or social services. Manufacturing continues to lose jobs. These unproductive jobs create debt for our trade, leading to government debt and higher inflation. Investors will never be fooled.”

Despite criticism, the bond market responded quickly. After the release of the report, the Treasury yield rose to 4.36% in 2010. But why did this happen?

With the economy going well, investors aren't too worried about the future and are willing to invest in safer options like US government bonds. As more people buy bonds, interest rates (yields) rise.

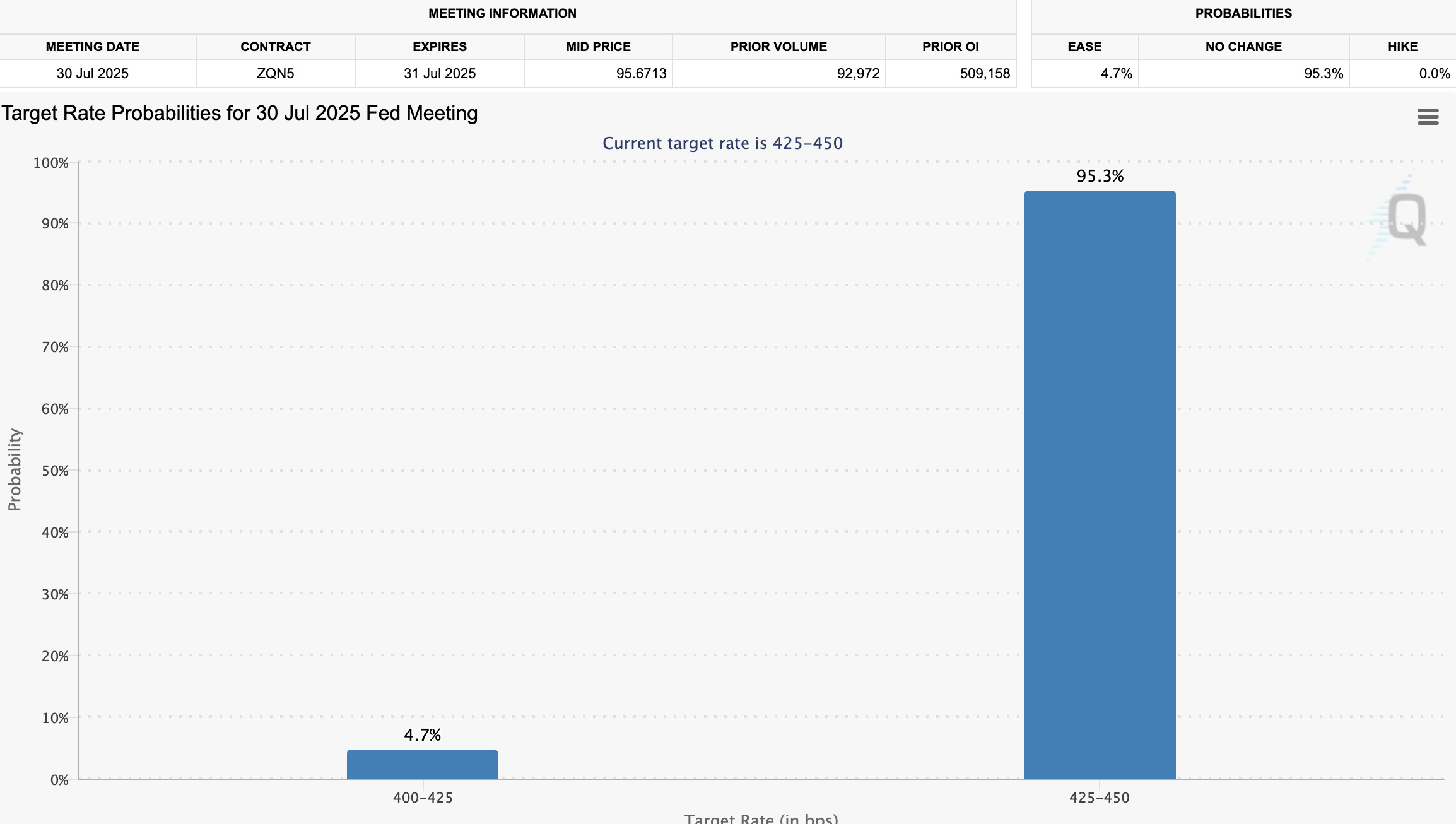

Furthermore, these strong economic indicators suggest that the Federal Reserve may have fewer reasons to cut interest rates in July. The CME FedWatch tool showed this shift. The probability of interest rate reductions in July fell to 4.7% from a 25% cut chance.

“The odds of reducing Fed rates in July collapsed – from 25% to under 5% overnight.

Probability of Fed interest rate reductions in July 2025. Source: CME FedWatch

Since December, the Federal Reserve has stabilized interest rates between 4.25% and 4.5%. This attracted backlash from President Trump. But Powell was in his position.

Meanwhile, this shift in rate expectations could create headwinds in the crypto market. Higher interest rates can be more attractive traditional investments like bonds, and can distract you from risky assets such as cryptocurrencies. Therefore, a decline in demand can put pressure on prices.

Despite the challenges in the current economic environment, some bullish catalysts remain in the market, especially Bitcoin. According to Cryptosrus, global money supply has recently skyrocketed to $55.48 trillion. Furthermore, the US dollar performed its worst in the first half (H1) since 1973.

According to forecast platform Kalshi, the forecasting platform, the US total debt is projected to reach an astonishing $40 trillion this year.

Therefore, concerns about national debt and inflation and government spending could make BTC an increasingly attractive hedge.

“On the other hand, the Bitcoin chart looks like it's locked at $170,000. It knows what's coming. Fiat is expanding. BTC is focusing on escape speeds,” Cryptosrus said.

As traditional financial systems face pressure, Bitcoin and other digital assets could present attractive options for investors seeking diversification and protection against economic instability.