- Key catalysts include spot ETF influx in June, $888 million stability growth at Ethereum for a week, and a shrinking amount.

- Larger holders have accumulated ETH at the fastest pace since 2017, even amidst a fall in prices.

Ethereum (ETH) prices are once again showing strength, earning 6% in the last 24 hours and moving to $2,600. More importantly, today's ETH rally has seen daily trading volumes increase by 79% to $27.58 billion. Additionally, Coinglass data shows open interest on ETH futures is up 7.56% to $34.4 billion, highlighting strong bullish sentiment among traders.

After a major 45% crash in the first quarter, ETH prices recovered sharply in the second quarter with a profit of 36.5%. As Q3 begins, Ethereum is building a fresh momentum. As we've earned 5% in the past week, as mentioned in a previous story, bullish sentiment appears to be back, with strong breakouts exceeding $2,544.

Crypto Market analyst Eric Connor said multiple bull factors were being adjusted, potentially making ETH even higher. Let's take a look at four factors that can drive the ETH rally even further.

1. Stablecoin Growth can provide the increased liquidity required for Ethereum Rally

Ethereum remains the foundation of the Stablecoin ecosystem. As reported in Crypto News Flash, the network's Stablecoin market capitalization peaked at $251 billion, but it still holds $1263.1 billion today, up $888.92 million over the past week alone.

Tether led at $6.412 billion, followed by USDC at 38.10B and Ethena's USDE at $50.9 billion. The stable demand reflects robust on-chain activity and continued trust in Ethereum's infrastructure.

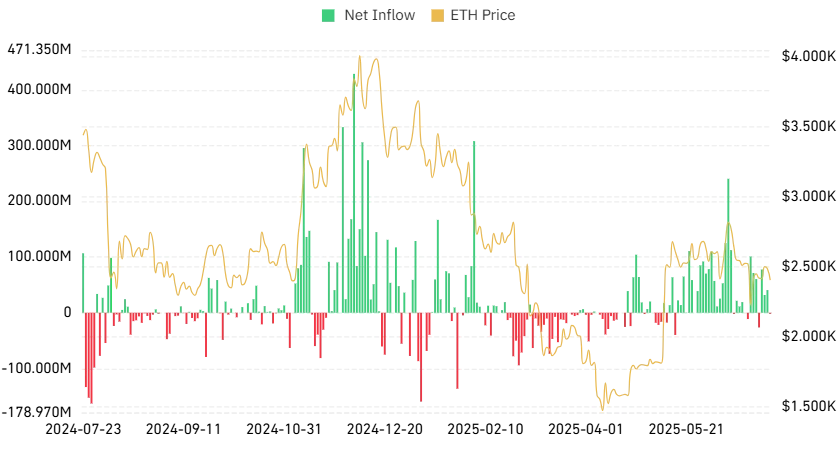

2. An increase in Ethereum ETF inflow indicates that institutional interest remains strong

The influx of spots to Ethereum ETFs has skyrocketed significantly over the past month. In June, the ETH investment product saw net inflows of over $1.17 billion recorded in June alone.

The positive trend continued into July, with BlackRock's ETHA adding $54.8 million on July 1st and Grayscale's Ethe added $10 million. This steady demand from traditional finance shows that it increases institutional confidence in the long-term potential of Ethereum.

Source: Coinglass

As reported by CNF, BlackRock's iShares Ethereum Trust (ETHA) has emerged as the forefront of the US spot Ether ETF market, with net inflows of over $5.3 billion so far.

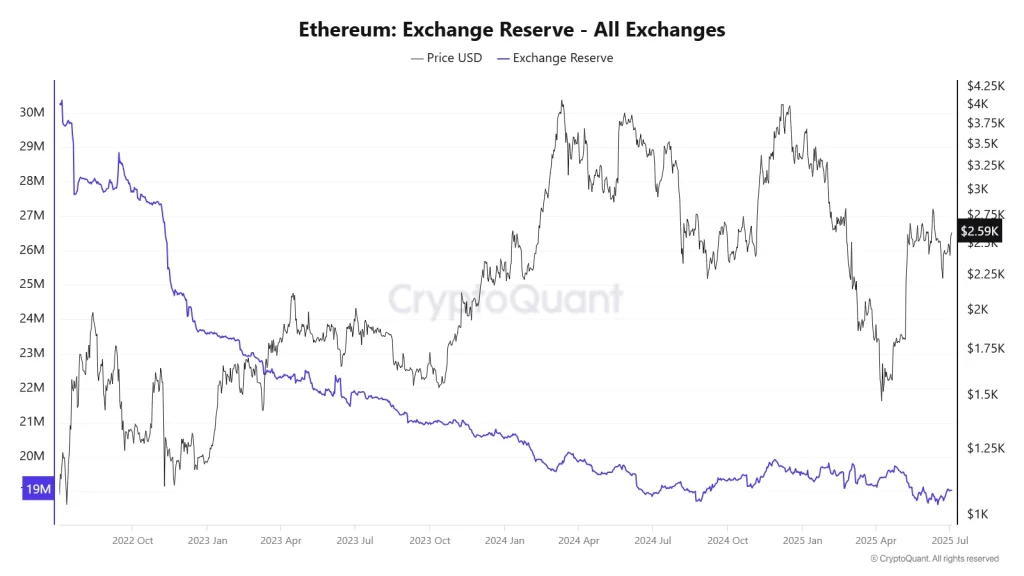

3. Ethereum Exchange reserves are falling

Encrypted data shows that centralized exchange ETH supply has steadily declined from 19.51 million at the start of 2025 to 19.03 million now. This decline indicates a drop in sales pressure and creates conditions where updated demand can drive faster price breakouts.

Source: Cryptoquant

4. ETH whale activity on the rise

Holding 1,000-10,000 ETH, the wallet has accumulated over 800,000 ETH daily in a week since 2017, marking the most aggressive purchases since 2017. This strong accumulation shows an increase in large investor convictions despite the price of ETH falling 1.62%.

With ETF influx, stubcoin activity climbing, exchange reserves falling, and whales piled up, Ethereum appears poised for a big breakout. A clean move above $2,600 resistance could lead to a sudden upward rally