FTX may be using SOL unlock to compensate creditors. After the latest unlock, the FTX-related wallet received nearly $40 million in SOL.

FTX may continue to put pressure on the SOL as it undergoes normal unlocking. One of the latest transactions shows that the wallet linked to the broken exchange received nearly $40 million in SOL. Sunil Kavuri, who communicates the creditor's compensation process, suggested that FTX could continue to liquidate the crypto to continue its spending.

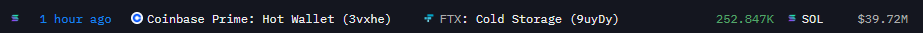

FTX has withdrawn the $40 million Solana, which has been stained from Coinbase.

They will return the funds to the FTX creditors, so it is likely that they will sell as quickly as possible.

Most of the FTX Solana holdings are already on sale pic.twitter.com/jkqrptgoa

– Sunil (FTX Creditor Champion) (@sunil_trades) June 16, 2025

FTX used Coinbase Prime to save SOL with additional staking rewards. Exchange's SOL portfolio is valued at $10 billion, but Exchange operators had to liquidate most of their portfolios at a 70% discount.

FTX received another tranche of unlocked sol. This will likely be sold in OTC transactions to cover outstanding payments to creditors. |Source: Arkham Intelligence

During previous unlocking, FTX regularly sold tokens at various SOL levels. The latest sales took place on June 13th $31 million. Some of FTX's biggest repayments have already been in the past, with more than $5 billion in cash being distributed for May's repayments.

Some of the SOL sales were carried out in the OTC market, avoiding a direct impact on the exchange. However, previous SOL sales coincided with a substantial price decline.

For now, SOL has absorbed most of the major unlocks, especially the unlock of the 11.16m Sol in March. We expect that there will be far fewer unlocks in the coming months. Nevertheless, the FTX still sits in some of the remaining reserves. The exchange would settle most unlocks for the entire year 2024. Creditor.

Is FTX unlocking SOL's bullish lock?

Sol Ecosystem shows that it can absorb sales from many whales, seniors and profitable apps.

The question remains whether unlocking is bullish for SOL. For FTX, SOL is the key to compensate for a variety of users. In other words, liquidators are interested in rising SOL market prices.

Galaxy Digital is tasked with selling SOL to compensate creditors, and researchers have found previous evidence of price pumps, especially during the most active sales of 2024. SOL has grown with a full meme ecosystem and growth since its low $9. However, unlocking still aims to achieve the highest possible market price for SOL, which could lead to fierce price pressure.

Only the latest SOL sales from FTX were in the higher price range. Under the bankruptcy agreement, FTX has It sold The prices are low at $21, $69 and $73, and creditors get much lower coverage. Some early FTX traders and Sol Buyers are bullish in the ecosystem and could return to Solana due to their new features.

After the recent unlock, Sol traded for $157.41, but can't flip BNB. SOL is bound by scope despite applications for up to eight ETFs and news about the construction of the Ministry of Corporate Finance.

Sol remains a critically demanded asset for staking, liquid staking, general trading and meme token activity. Sol Open Interes has approached a higher range at around $3.5 billion over the past six months.