Over the past month, global interest in purchasing assets has skyrocketed, jumping nearly 20 times as Ethereum's (ETH) prices have ripped beyond key resistance levels.

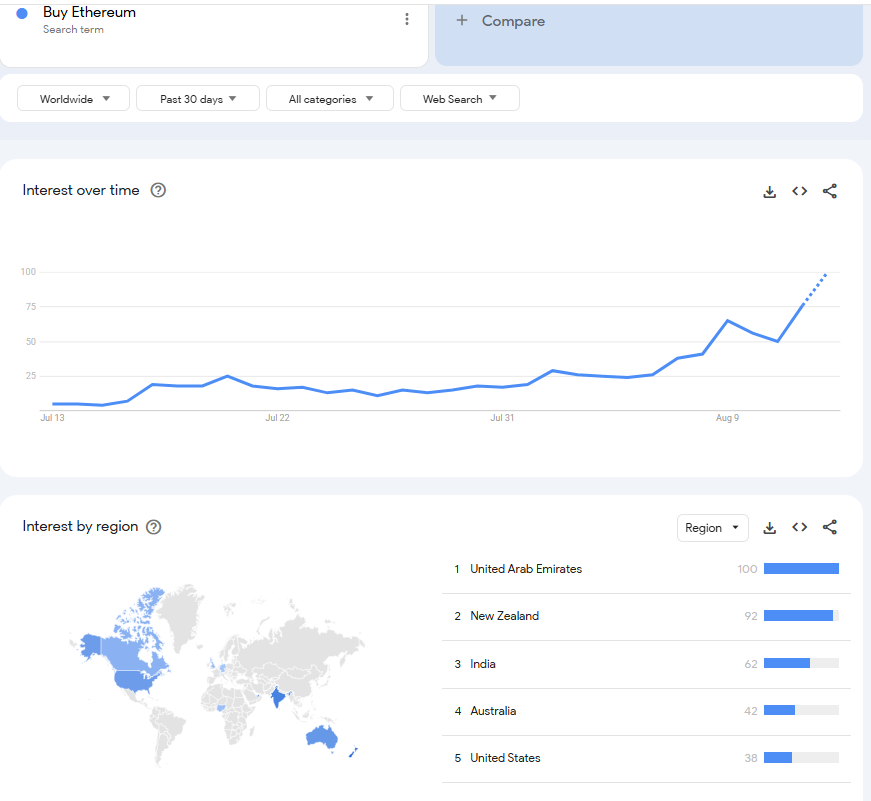

On July 13th, there was five searching interest on Google's 0-100 scale. By August 13, it is projected to reach 100, the highest level in at least a year, marking a 1,900% increase. Google Trends Data retrieved by Finbold.

Geographically, the United Arab Emirates recorded the highest interest with a score of 100, followed by New Zealand (92), India (62), Australia (42), and the United States (38).

It is worth noting that search interests are not directly converted into purchasing activities. However, such a surge in online attention often precedes a period of increased market volatility.

If the trend continues, Ethereum may face an increase in upward pressure and may test critical resistance levels in potentially close conditions.

ETH Price Analysis

This surge comes after Ethereum has gathered beyond the $4,600 mark. As of press time, ETH traded at $4,618, up over 6% over the last 24 hours. On the weekly chart, assets are up 27%.

Furthermore, the technical setup suggests that Ethereum can expand this momentum. Specifically, an analysis by Gert Van Lagen, shared on the X Post on August 13, shows that the second-largest cryptocurrency by market capitalization is split from a four-year reverse head and shoulder pattern, potentially paving the way for a rally to $22,000.

According to analysts, Ethereum is on track to complete the 2019-2025 bull market cycle, with textbooks expanding their diagonal formation. This bullish structure maintained an upward possibility if the pattern continued as expected.

At the same time, for sustained momentum, Ethereum may require continuous inflows from institutional investors through exchange-traded funds (ETFs).

in this regard, Coinglass Data obtained by Finbold on August 13 shows that Ethereum Spot ETF recorded a net inflow of $523.9 million on August 12, with BlackRock's ETHA led at $318.7 million and Fidelity's FETH led at $144.9 million.

Grayscale's ETH and ETHE products added $44.3 million and $9.3 million, respectively, while other publishers recorded less profits. The day before, we saw even more inflows of $1.02 billion.

If these influx continues and a support level of $4,500 is retained, Ethereum could go well to target the $5,000 mark.

Featured Images via ShutterStock