The combined value of gold and Bitcoin is approaching historic levels compared to the US money supply M2.

One top market analyst is now suggesting that the upside potential of using these assets as a hedge against a weak dollar and inflation may be nearing its limit. Julian Timmer, director of global macro at Fidelity, shared his analysis on X (formerly Twitter) on Friday.

End of easy run?

Gold and Bitcoin are widely seen as key inflation hedges due to their limited supply. According to data from CoinGecko, both assets have seen strong gains this year, with gold up 54.83% and Bitcoin up 12.98%.

But Timmer argues that this rally may be nearing a ceiling. He compares current market conditions to those seen at the peak of high inflation in 1980.

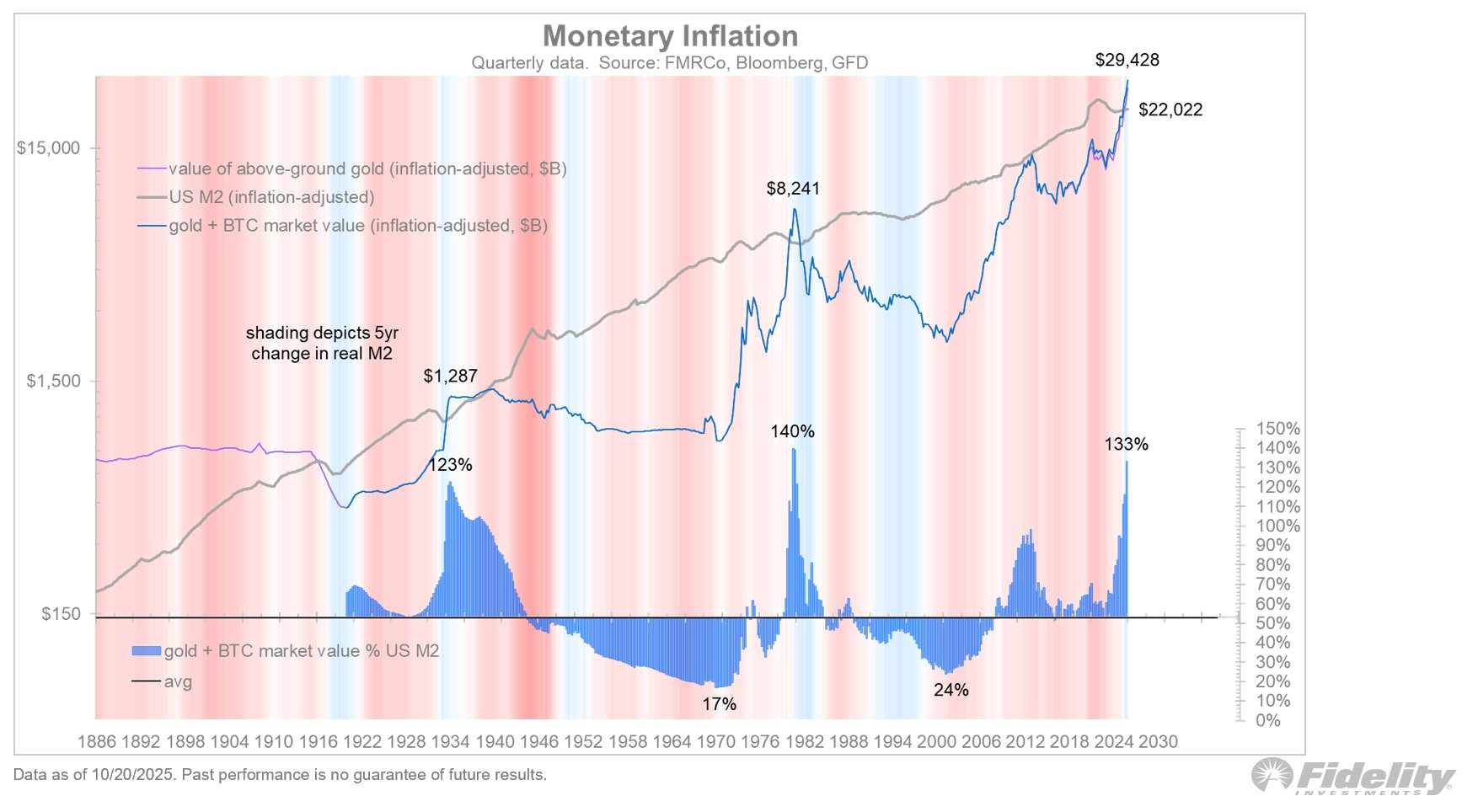

monetary inflation. Source: X by Julian Timmer

Comparison of values with US M2

Timmer's analysis aggregates the inflation-adjusted market values of gold and bitcoin and compares that sum to the U.S. money supply, M2, a broad measure of currency in circulation.

Historically, rapid expansions in M2 (monetary inflation) have coincided with large increases in the value of hard assets such as gold. According to Timmer, both gold and Bitcoin serve as primary forms of “hard money” and provide protection from currency crashes.

historic ceiling

Timmer highlights two notable moments in the past century when gold's value skyrocketed due to inflation: 1933 and 1980. During these peaks, the total market value of gold amounted to 123% and 140% of the US M2 money supply, respectively.

Currently, the combined value of gold and Bitcoin is approximately $29 trillion, representing 133% of the M2 money supply. This number is above the 1933 peak and just below the 1980 high.

Mr Timmer said this valuation was a “key point” to consider following gold's recent aggressive rally.

“One reason to consider ringing the gold bell is that if gold is a play on U.S. fiscal superiority, you can argue that the policy is already done,” he concluded.

This suggests that the massive rally in gold and Bitcoin, driven primarily by concerns about financial expansion, may be losing momentum. Both assets remain structurally sound as long-term hedges, but Timmer cautions that the “easy returns” fueled by inflation concerns may have already been realized.

The post Close Historical Valuations of Gold and Bitcoin Compared to US Money Supply appeared first on BeInCrypto.