The investment race of 2025: Gold shines brightest

As we approach the final quarter of 2025, investors are looking back on a volatile but revealing year for global markets. The latest comparative performance charts show how different asset classes have evolved since January, and the results may surprise even the most experienced traders.

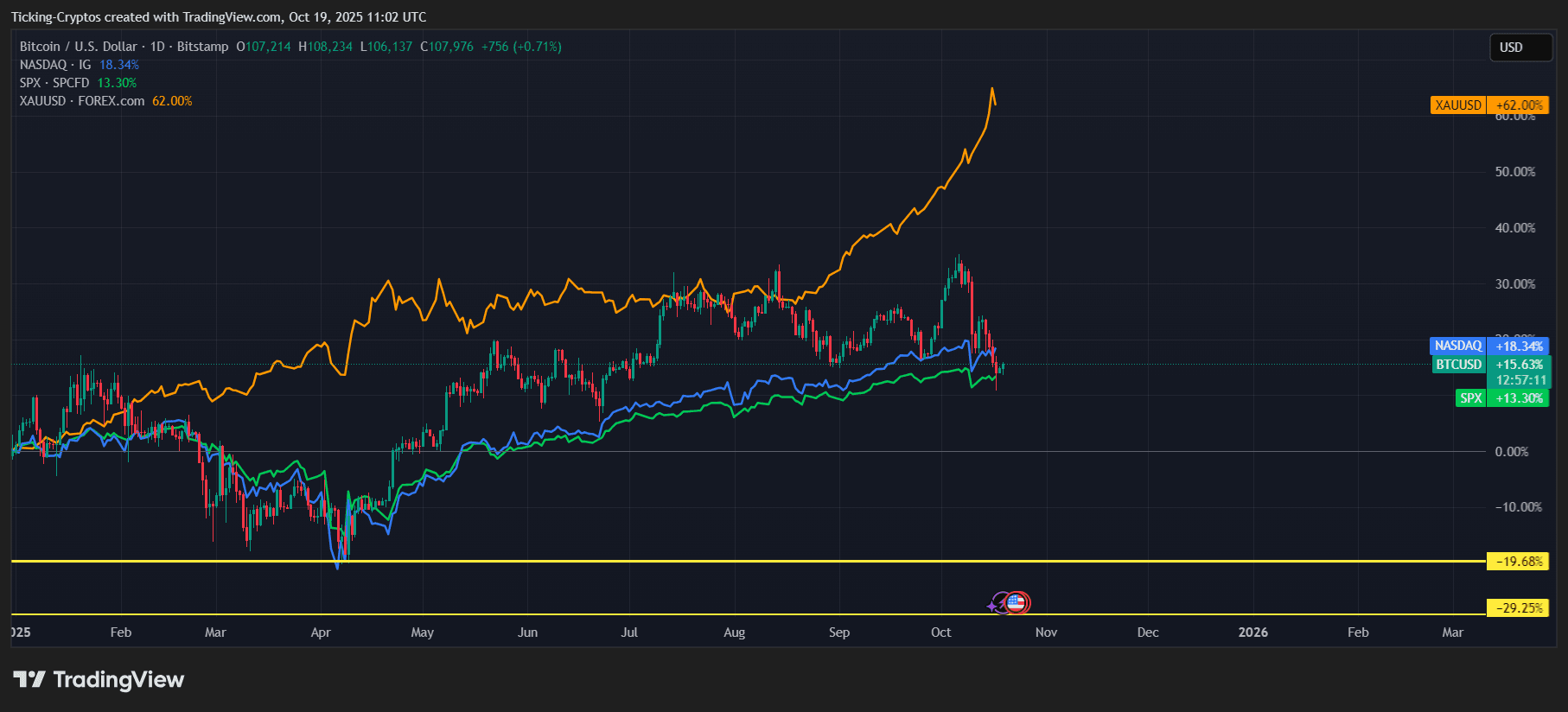

According to the data:

- Gold (XAU/USD) I'm awake 62% Since January.

- Nasdaq I'm awake 18.34%.

- Bitcoin (BTC/USD) got it 15.58%.

- S&P500 (SPX) strictly follow 13.30%.

While all four assets posted positive returns overall, the magnitude of the differences reveals a deeper story, including macro uncertainty, changes in monetary policy, and the new importance of monetary policy. Diversification.

Gold: The Return of the Ultimate Safe Haven

$Gold has been an outstanding performer this year, rising over 60% and outperforming nearly every major index. The reason is obvious. With central banks around the world cutting interest rates, geopolitical tensions rising and inflation still lingering, investors are turning once again to non-default metals.

The yellow line on the chart has been steadily rising, largely unfazed by corrections in other markets. This consistency emphasizes gold's traditional role. Hedging against systemic risk and currency depreciation.

Institutional investors such as central banks and sovereign funds are significantly increasing their gold allocations in 2025, with several Asian countries leading the charge amid growing concerns about the long-term stability of the US dollar.

Bitcoin: a high-volatility digital hedge

$Bitcoin remained respectable despite its reputation for high volatility. +15.58% Performance from the beginning of the year to date. But a comparison to gold's rise highlights an important narrative shift. Although cryptocurrencies are maturing, they are still tied to risk sentiment.

The $BTC chart closely mirrors the Nasdaq and how institutional investors have integrated it into the broader financial system. Bitcoin is currently moving more in tandem with tech stocks than traditional hedges like gold.

Nevertheless, each market decline in 2025 saw new accumulations, especially from corporate treasuries and long-term holders. Bitcoin’s long-term fundamentals (limited supply, increasing scarcity, and increasing network usage) remain intact. But its price is still reacting Liquidity flows, interest rate policy, and investor risk appetite.

Nasdaq and S&P: traditional markets show resilience

Despite the macro turmoil, U.S. stocks maintained steady gains this year. of 18% of Nasdaq This profit reflects strong performance in the AI, semiconductor and software sectors, but S&P 13% The increase signals broader economic resilience.

However, these gains were subject to significant fluctuations, particularly during mid-year trade tensions and volatile inflation data. Investors who maintained diversification across stocks and commodities were able to offset these fluctuations and earn consistent returns.

Examples of diversification in 2025

The key takeaway from this graph is simple but powerful. No single asset dominates the entire environment.

- gold When fear grows, it grows.

- Bitcoin As liquidity expands and the innovation story grows, performance improves.

- stock Leading in terms of economic optimism and policy easing.

By combining these assets, investors can reduce overall risk while maintaining upside exposure. A balanced allocation (for example, 40% stocks, 30% gold, 20% Bitcoin, and 10% cash or bonds) has historically outperformed single-asset portfolios in volatile cycles.

The best investment strategy: balancing risk and reward

Looking ahead to 2026, investors face both opportunity and uncertainty. Interest rate policy, political elections and continued geopolitical instability will continue to shape asset performance.

Gold could retain its leadership if inflation continues, while Bitcoin could show new strength if global liquidity improves. Meanwhile, stocks could benefit from easing credit conditions and a recovery in corporate earnings.

The lesson is clear. In an unpredictable world, Diversification is not just a strategy, it's survival.