As the price of gold soars to $5,300 this week, Tether and Coinbase, two of the companies behind the world's largest USD-denominated stablecoins, are taking different approaches to gaining exposure to the precious metal.

Spot gold rose above $5,300 an ounce on Wednesday, hitting a record high of $5,311 as of 3:30 a.m. UTC, according to TradingView data.

Amid the rally, Tether, the issuer of the world's largest stablecoin, USDt (USDT), doubled its gold accumulation, while Coinbase, the main partner of the world's largest stablecoin, USDt (USDT), doubled its gold accumulation. $USDC ($USDC) Stablecoin consortium facilitated access to gold futures on the platform.

According to CoinGecko, the contrasting strategies illustrate how crypto companies are positioning themselves amidst the gold boom and Bitcoin (BTC)'s continued slump, trading below $90,000.

Tether stores 130 tons of gold and aims to become a “gold central bank”

Tether, which also issues the gold-backed stablecoin XAUt (XAUT), has been accumulating gold as part of its reserves for some time, with a reported $12 billion exposure as of September 2025.

The company holds 520,089 troy ounces (approximately 16.2 tonnes) of gold for XAUT, separate from 130 tonnes of wider reserves, valued at approximately $22 billion at current prices.

“Tether maintains approximately 130 tons of physical gold, and the gold backing each XAUT token is held separately and is therefore subject to physical delivery,” a Tether spokesperson told Cointelegraph.

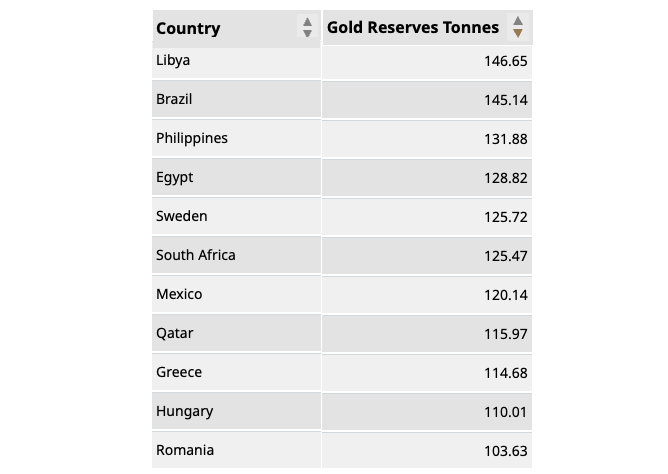

Countries with between 100 and 200 tonnes of gold as of Q3 2025. source: world gold council

With this much gold, Tether is comparable to the central banks of countries such as Mexico, South Africa and Sweden, according to reserve data from the World Gold Council.

“We are quickly becoming basically one of the world's largest central banks of gold,” Tether CEO Paolo Ardoino said in an interview with Bloomberg on Wednesday.

Coinbase highlights gold futures trading amid bullion market rally

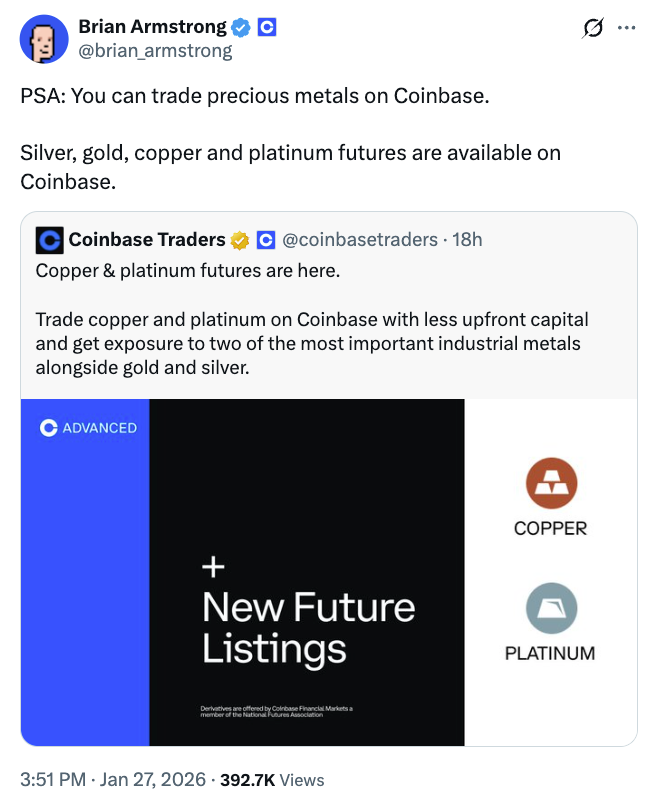

Meanwhile, Coinbase is highlighting its commodity futures product as a gold rally, reminding users that the platform allows trading in multiple metals, including gold and silver.

“You can trade precious metals on Coinbase,” Coinbase CEO Brian Armstrong said in an X post on Tuesday. “Silver, gold, copper and platinum futures are available on Coinbase,” he added.

sauce: brian armstrong

Commenters noted that futures trading does not involve physical delivery, and one said the post was a “great signal” for traders and could suggest the market has peaked.

Related: Tucker Carlson presses Peter Schiff on Bitcoin as the new global currency

Binance, the world's largest cryptocurrency exchange by reported trading volume, also launched perpetual futures related to gold and silver in early January.

The recent price surge has seen physical gold rise 90% over the past year, while Bitcoin is down 13%, trading at $89,351 at the time of writing.

The U.S. dollar index is down about 10.7% over the same period, making gold even more attractive as a hedge.

magazine: GameStop 'may sell' Bitcoin holdings, Ethereum prepares for quantum: Hodler's Digest, January 18-24