In a major move, Grayscale's Solana Trust ETF has been approved for listing on NYSE Arca. The highly anticipated ETF product is scheduled to begin operations today, October 29, 2025. The company applied to convert Solana Trust into an ETF earlier this year. If approved, this asset could shake up the market, as we have seen with several other crypto-based ETF products.

Will Solana rise to new highs after the ETF conversion is approved?

ETFs play an important role in the current market cycle. Bitcoin (BTC) hit multiple all-time highs after the SEC approved 11 spot ETFs last year. Ethereum (ETH) also hit new highs earlier this year due to increased ETF inflows. Solana (SOL) could follow a similar pattern given its incredible popularity.

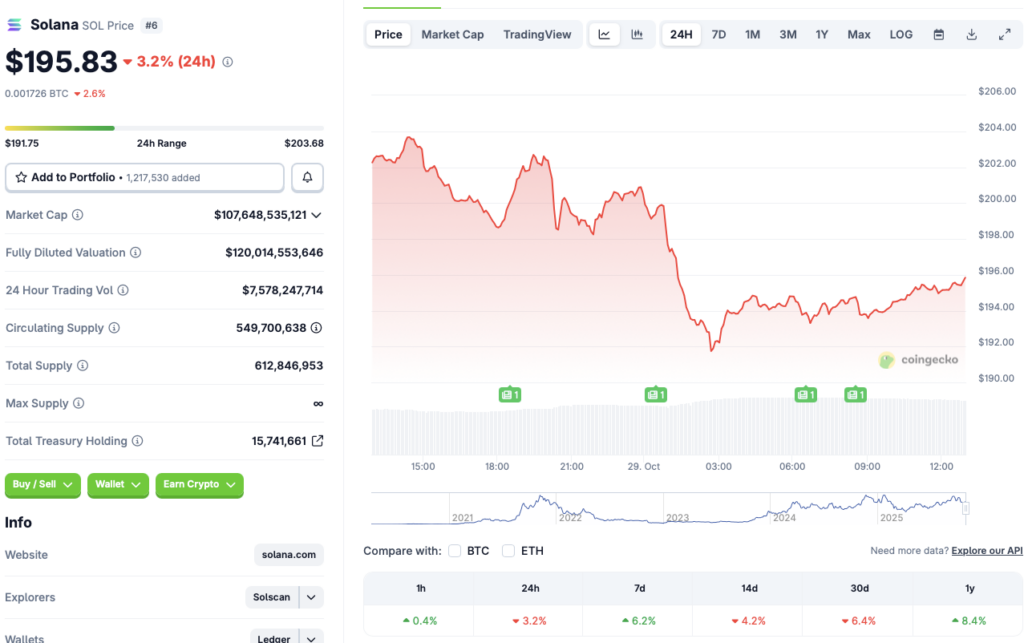

Despite being approved for ETF conversion, Solana (SOL) continues to glow red on most charts. According to CoinGecko data, SOL is down 3.2% on the daily chart, 4.2% on the 14-day chart, and 6.4% month-on-month. Despite the sharp correction, SOL rose 6.2% last month and 8.4% since late October 2024.

Also read: Western Union to launch stablecoin in Solana in 2026

ETFs may help Solana's price recover, but it's still unclear whether it can reach new all-time highs. The cryptocurrency market is still very weak. Bitcoin (BTC) has struggled to gain traction, with most major assets facing price corrections. SOL is currently down 33.3% from its all-time high of $293.31. But Solana (SOL)'s future is probably very bright. This asset has made a name for itself as one of the most resilient cryptocurrencies on the market. After the FTX collapse in 2022, the price of SOL fell below $9. Since the 2022 low, SOL has hit multiple highs. A similar trajectory could emerge if the market finds the right footing.