According to Vaneck, high lipids used in large-scale adoption and decentralized derivative exchanges resulted in a significant increase in high lipid network revenues in July.

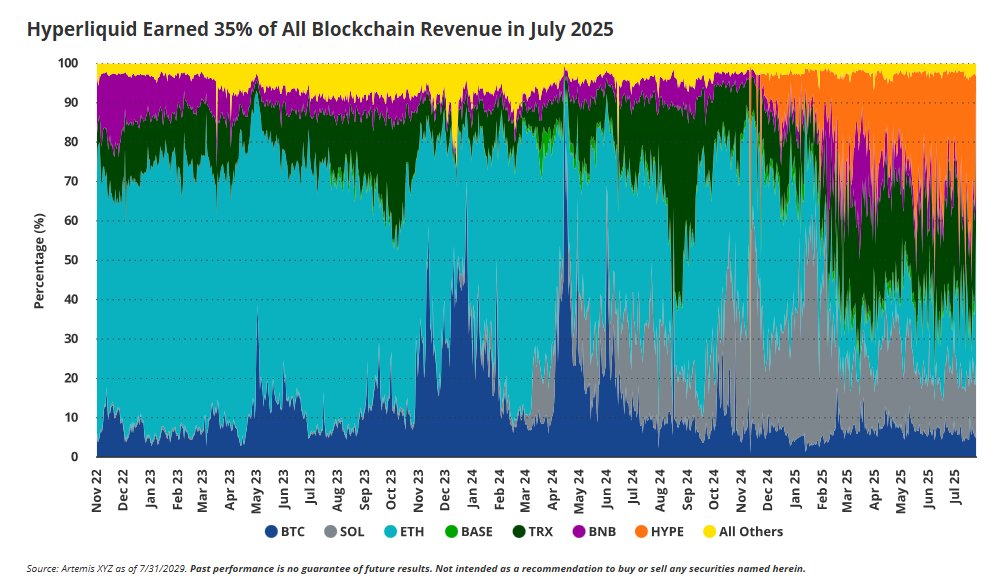

In July, Hyperliquid won 35% of all blockchain revenues, and achieved certain costs for Solana and the growth of Ethereum and BNB chains, Vaneck researchers wrote in their monthly Crypto Recap report.

“High lipids have been able to capture Solana's momentum, and perhaps Solana's market capitalization, because it offers a simple, highly functional product.”

“Hyperliquid poaches and holds high-value users of Solana.”

While Solana suffered from reliability issues and was unable to meet the production deadline for core software upgrades, Hyperliquid is taking advantage of these weaknesses by providing a superior user experience in derivative trading.

“Solana has not made any meaningful improvements to enhance the user experience, particularly in persistent futures (PERP) trading.

High lipids earned more than a third of all blockchain revenues in July. sauce: Vaneck

A rapid increase in open interest in high lipids

In a newsletter seen by Cointelegraph, he reported that “high lipids have emerged as the main Perps venue for Onchain Perps.”

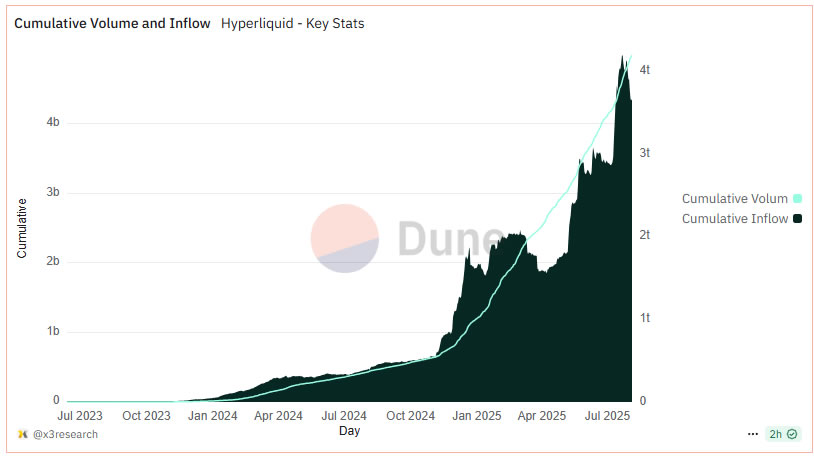

Open interest reached $15.3 billion in July, an increase of 369% since the start of the year, adding that it has embedded more than $5.1 billion in USDC (USDC).

The integration of Phantom Wallet, which offers in-app Perps, promoted high lipids in July with a volume of $2.666 billion, a $1.3 million fee, and 20,900 new users.

Related: Hyperliquid will refund Crypto traders $2 million after API suspension

Crypto Perpetual Futures is a derivative agreement that allows traders to infer about the price of cryptocurrency without expiration date.

High lipid accumulation and influx. sauce: Dune analysis

Hype price reached an all-time high in July

The platform's native tokens (hype) also recently recovered, hitting a record high of $49.75 on July 14th, from the April 14th low.

In comparison, Solana's native tokens (SOLs) have lost 44% since their all-time high in January. This was mainly driven by Memecoin Frenzy.

Hype had dropped 3% at $37.38 at the time of writing on the broader market retreat.

magazine: As salt traders brace at a 10% drop, ether could “rip” like in 2021: Corporate Secrets