Spark (SPK), a cryptocurrency inherent to the Spark Decentralized Finance (DEFI) protocol, has risen about 100% over the past week amid rising expectations for the second phase of ignition airdrop.

In addition to the surge in prices, the protocol has also experienced significant growth, with its total value (TVL) reaching its all-time high (ATH).

Why are Spark (SPK) prices soaring?

Beincrypto data showed that SPK prices have risen by about 100% in the past week, reaching the last seen high at startup. The token's market capitalization has doubled from about $30 million to more than $62 million.

In the past day alone, the price has been highly rated at 45.73%, with SPK trading at $0.061. It also highlighted the activity of strong investors as trading volumes skyrocketed to 403.90% to $486 million.

Spark (SPK) price performance. Source: Beincrypto

The surge in activity appears to be driven primarily by project airdrops. Phase 1 of Airdrop, which allows users to claim tokens, concludes today.

The next phase, “overdrive,” is also approaching a critical deadline. At this stage, participants will have the opportunity to qualify for a second airdrop.

“Overdrive is for those who bet, stay and believe. It is the second phase of airdrop where you can wager SPK via @symbioticfi and earn a share of the unclaimed ignition SPK,” the protocol posted.

According to the official announcement, users will bet on Ignition Airdrop by July 29, 2025 and must maintain it until August 12, 2025 to earn rewards. Additionally, those who continue to save at least $1,000 in USDS or USDC during this period will get double boost on their overdrive units.

Staking requirements, a key component of the overdrive initiative, appear to be a key factor behind recent price pumps as users rush to meet deadlines. Staking tokens reduces circulation supply.

This puts upward pressure on the price. The excitement surrounding airdrops can boost market sentiment and bring interest in tokens. This probably explains the latest behavior of the SPK.

However, once the staking period ends and the tokens are distributed, some recipients may sell them. This could lead to sales pressure from August 12th, potentially lowering prices in the short term. A similar pattern was observed when the token was released in June.

Nevertheless, some analysts are increasingly optimistic about the SPK outlook.

“There's still a lot of room for growth. I think Spark's growth trajectory could reach $0.10-0.15 within next year, reaching over $0.50 over the next two to three years, as we expand our partnerships, explore cross-chain opportunities and develop new Defi products.

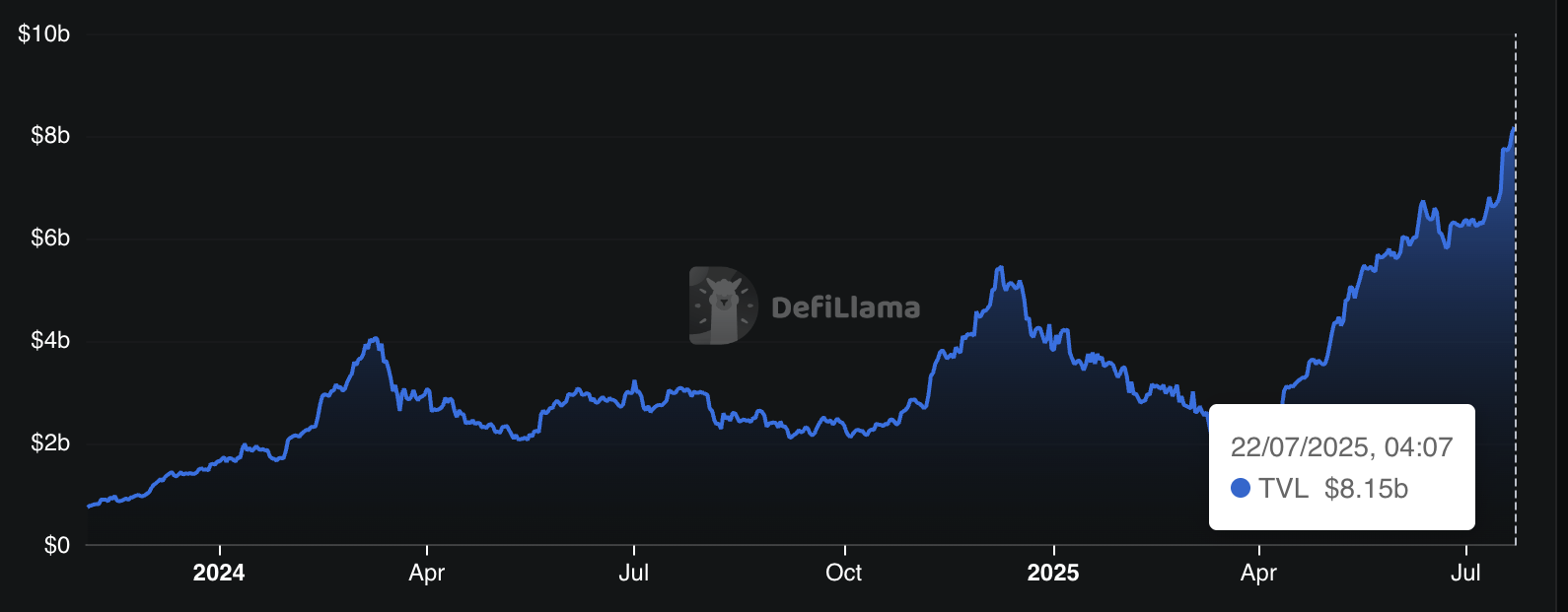

Spark TVL is the best ever

On the other hand, growth is not just limited to prices. Spark's TVL today reached a new peak of $8.15 billion, according to data from Defilama.

Spark TVL performance. Source: Defilama

The billing is led by products from platforms such as Spark Savings, which offers 4.5% APY, and Sparklend, which currently owns $4.9 billion in TVL.

Spark Ryofidity Layer (SLL), responsible for managing liquidity, also has $3.98 billion in allocated assets. Additionally, token terminal data showed that the market-wide active loan value reached a new high in July. Spark, in particular, ranks third in the field alongside Aave and Morpho.

These metrics highlight the growing demand for distributed solutions and the role that platforms like Spark play in supporting the broader resistance ecosystem.