Bitcoin's decline widens: What's going on?

Bitcoin has struggled recently, falling more than 20% last month and more than 40% from its early October high of more than $126,000.

November was the worst month in recent memory since June 2022, with severe market turmoil.

The recent drop into the $80,000 area marks a seven-month low. Even with a modest recovery since then, the broader chart still reflects a clear downward trend.

There has also been a noticeable change in seller behavior. Bitcoin, for example, reached a point last week where negative selling pressure on the spot market and perpetual futures halted the price decline.

Liquidity remains above the $92,000 level, indicating that some investors are still willing to sell bullishly. But it no longer overwhelms the market like it did during the sell-off in early November.

At the moment, the bear appears to be absorbing pressure rather than exerting it. Eventually one side will give way, and the current structure suggests a stalemate, with an opportunity for the bulls to regain control if momentum continues.

Institutional support for BTC continues

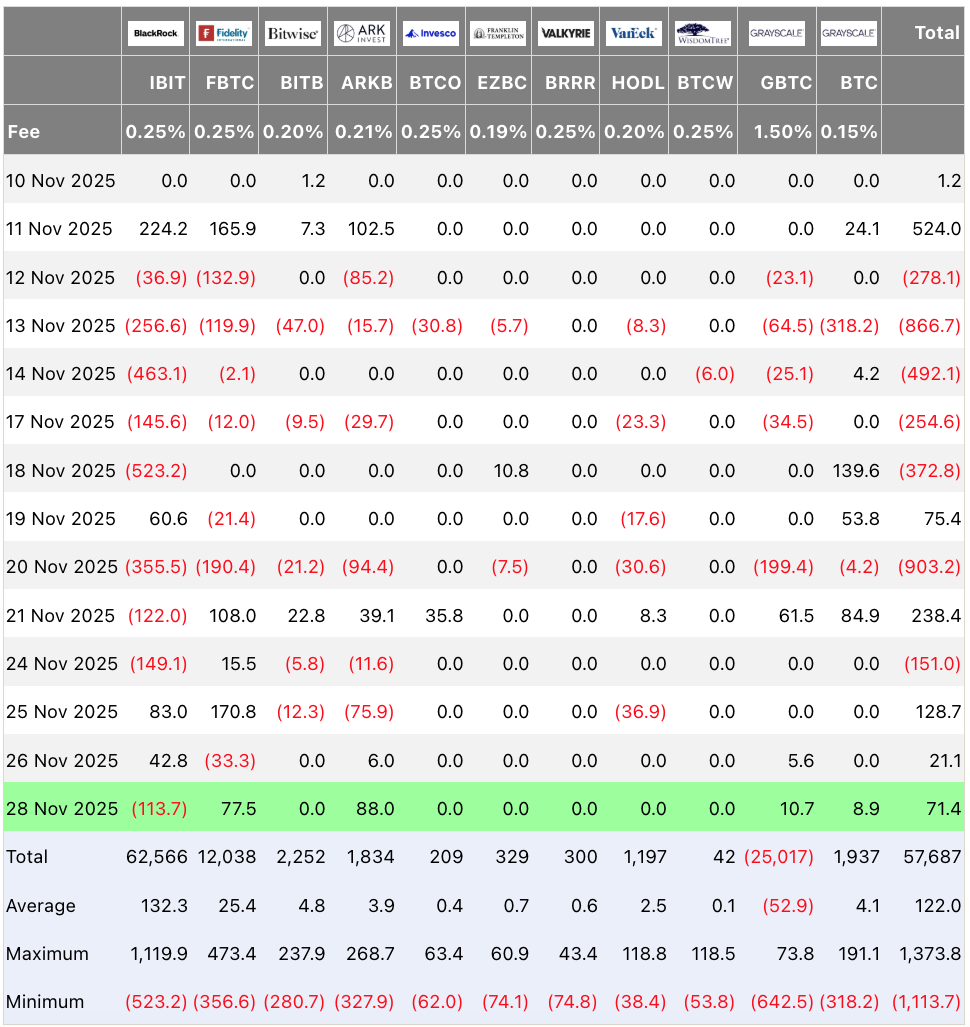

Institutional flows remain a major part of the story. The iShares Bitcoin Trust ETF recorded approximately $2.2 billion in outflows in November.

Centra analysts say ETF redemptions are now acting as a mechanical force that pushes Bitcoin into the support zone and accelerates the decline by creating stress across the market.

JP Morgan recently noted that macroeconomic conditions are becoming a more dominant factor in crypto prices than traditional four-year halving cycles. The bank also highlighted that early-stage projects used to rely heavily on large private financing rounds, with private buyers coming in later at higher valuations.

Since then, individual participation has waned, and institutional investors now play a major role in bringing depth and stability to the market.

Some companies remain confident. ARK Invest increased its exposure to the ARK 21Shares Bitcoin ETF, purchasing over 70,000 shares. This move appears to reflect ARK's long-term bullish view on Bitcoin even in a difficult environment.

The big news this month was that JPMorgan is preparing to issue structured notes tied to the performance of BlackRock's Bitcoin ETF IBIT. Some investors see this as a sign of a speculative short-term strategy.

Meanwhile, Anthony Scaramucci sees huge potential for Bitcoin, with major investment banks launching Bitcoin-based derivatives products.

I don't think people fully understand how big of a deal it is that JPMorgan is now offering Bitcoin-backed bonds.

— Anthony Scaramucci (@Scaramucci) November 26, 2025

strategic issues

In a recent report, JPMorgan estimated that Strategy (formerly MicroStrategy) could face up to $2.8 billion in outflows if MSCI removes the company from major stock indexes. When this happens, it becomes difficult for companies to continue to grow sustainably.

About $9 billion of the strategy's $50 billion market value is tied to passive funds that track these indexes. Despite this, Strategy did not back down after a $19 billion liquidation event in October.

Some traders even see JPMorgan's sudden change in stance on its strategy as a major contributing factor to October's flash crash.

In response to the JPMorgan report, CEO Michael Saylor argued that Strategy should not be considered a fund or holding company.

Dealing with the MSCI index problem

Strategy is not a fund, trust or holding company. We are a publicly traded company with a $500 million software business and a unique financial strategy that uses Bitcoin as production capital.

It was completed only this year…

— Michael Saylor (@saylor) November 21, 2025

He described it as an operational business with a large software division and a financial approach that treats Bitcoin as productive capital. The message here is clear. Despite the volatile market, the strategy continues to buy Bitcoin.

Bitcoin Price Prediction: What’s Next for December?

Veteran trader Peter Brandt noted that while the short-term outlook may be changing, recent price movements resemble a complete dead cat pattern. Nevertheless, Brandt remains bullish on the long term.

Full disclosure everyone.

Of my largest Bitcoin position to date, I still own 40% and the price is 1/20th of Saylor's average purchase price.

I'm a long-term bull on Bitcoin. This dumping is the best thing that could happen to Bitcoin. Bitcoin’s next bull run should be around $200,000. that…— Peter Brandt (@PeterLBrandt) November 21, 2025

After being tested last week, the $80,000 region remains the most immediate line of defense. A break below this could trigger a decline into the $72,000 to $75,000 range, which is a key technical and psychological support area.

If the macro-driven decline goes deeper, Bitcoin could fall into the $60,000-$65,000 zone, which represents the lowest expected downside under current conditions. Further declines are likely to be contained by ETF inflows and treasury companies.

None of these guarantee a reversal, but they do indicate that buyers are regaining some control over the short-term market. The next few weeks will determine whether Bitcoin stabilizes or whether its downward trend resumes as the new year approaches.