For years, Ripple was best known for its legal battles and its token, XRP, which was a symbol of friction between cryptocurrencies and the traditional financial world.

After years of court and regulatory turmoil, Ripple is now quietly building something far more ambitious. It is a full-stack institutional finance platform similar to a 21st century investment bank, although it has not yet been licensed to establish a bank.

The launch of Ripple's new digital asset brokerage service, Ripple Prime, and the integration of Ripple Payments and Ripple Custody will place Ripple at the center of a growing network that settles, secures, and moves digital money around the world.

These components work together to form an ecosystem, with all transaction, payment, and custody layers running on Ripple’s own rails and powered by Ripple’s regulated dollar-backed stablecoins, XRP and RLUSD.

From token issuer to financial infrastructure giant

After securing legal clarity in a lawsuit with the US Securities and Exchange Commission (SEC), Ripple has begun spending heavily to reposition itself from a blockchain company to a regulated financial infrastructure provider.

The 2025 acquisition spree, which includes prime broker Hidden Road, custody firm Palisade, treasury management platform GT Treasury and stablecoin payments provider Rail, now forms the basis of a vertically integrated company across trading, custody, payments and liquidity management.

Ripple Prime acts as a trading front end. Ripple Custody protects institutional assets through a combination of multiparty computation (MPC) and zero trust architecture.

Ripple Payments processes real-time payments across multiple blockchains and fiat corridors. And Ripple’s RLUSD stablecoin ties everything together as a universal medium of exchange across these services.

In effect, Ripple has built a crypto-native equivalent of JPMorgan. This will be an organization that provides liquidity, clearing, and payments without relying on traditional banking infrastructure.

The difference is that Ripple’s rails are programmable and transparent, and all dollars and XRP tokens are processed on-chain.

Closed loop of liquidity and trust

What differentiates Ripple's strategy from its competitors is how deeply integrated its internal ecosystem is.

Ripple's liquidity design is intentionally circular. Institutional investors trade through Ripple Prime, store assets in Ripple Custody, and settle payments through Ripple Payments. All of these use XRP and RLUSD as connective tissue.

The result is a closed liquidity loop that reduces friction, increases velocity, and keeps value circulating within Ripple's unique ecosystem.

Notably, this reflects the “walled garden” model that Apple has perfected with consumer technology, giving it control over every layer from the hardware to the App Store.

Ripple applies the same principles to institutional finance. Own the rails, currency, and storage to ensure compliance, speed, and cost efficiency across your product stack.

Ripple's approach is already paying off.

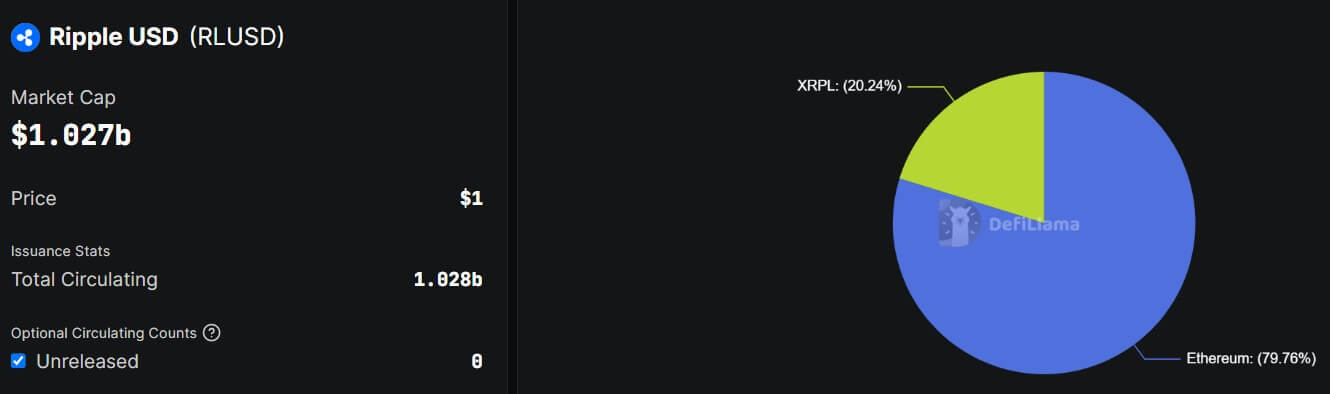

XRP trading volume has surged to multi-year highs this year due to mass adoption, and RLUSD supply exceeded $1 billion in November, an increase of more than 30% month-on-month.

Interestingly, most of that demand came from institutional investors who are using RLUSD to hedge their exposures and settle cross-border debt.

What is noteworthy is that Ripple's pursuit of regulatory credibility has further deepened its credibility.

The company has formally applied for national bank charter with the U.S. Office of the Comptroller of the Currency (OCC). If approved, it would operate under both state (NYDFS) and federal oversight.

At the same time, Ripple also moved to secure a master account with the Federal Reserve through its subsidiary Standard Custody. This access allows RLUSD reserves to be held directly by the Fed, eliminating intermediary risk and providing additional guarantees.

For institutional investors wary of opaque reserve practices, this combination could become a new benchmark for stablecoin transparency and trustworthiness.

The end of banking as we know it

Ripple's broader vision seems clear. It is about replicating the core functionality of global banks using crypto infrastructure.

While traditional banks rely on SWIFT messages and multi-day payments, Ripple offers near-instant payments through blockchain-based payment rails.

Where banks use custodians and clearinghouses, Ripple builds custody and payments directly into its protocol stack. And where banks issue credit and manage liquidity, Ripple has deployed its native stablecoin RLUSD to serve the same role, but is backed by short-term government bonds and cash rather than loans.

Ripple executives see this evolution not as a rebellion against traditional finance, but as a modernization of it. Brad Garlinghouse, CEO of Ripple, said:

“(Ripple) is leveraging the unique position and strengths of XRP to accelerate its business, enhance its current solutions and technologies, and pursue opportunities to transform the universe at scale.”

With these layers in place, Ripple is effectively bridging the gap between regulated finance and decentralized payments. Its infrastructure already supports tokenized real-world assets (RWA), allowing on-chain representations of treasury and corporate cash to move as seamlessly as data packets.

Beyond XRP: A broader financial empire

Ripple's future no longer depends on XRP's market performance. While the token remains a liquidity bridge, the company's core business is now infrastructure and institutional adoption.

The acquisition of GTreasury gives RLUSD direct access to corporate cash management, giving thousands of Fortune 500 treasurers the ability to manage trillions of dollars in short-term assets.

Incorporating RLUSD into these workflows has the potential to evolve from a trading token to a mainstream financial instrument used for payments, yield optimization, and liquidity management.

Each layer of Ripple's stack strengthens the other layers. Custody secures funds, Prime provides liquidity, Settlement facilitates capital movement, and RLUSD powers it all.

The pending OCC charter and potential Fed account move Ripple closer to becoming the first blockchain-native institution with bank-level powers. In effect, they are creating a “bank without a bank” that operates entirely within the confines of U.S. financial law.

Ripple President Monica Long succinctly stated the company's mission. She said the company is focused on modernizing the way value moves across borders by replacing legacy systems built on “walled gardens” and fragmented payment rails with open and interoperable infrastructure.

He noted that while decentralized finance has so far primarily catered to crypto-native users, Ripple sees an opportunity to extend its benefits to the broader financial system and remove long-standing barriers.

This effectively means that the companies that once fought for the legitimacy of XRP are now shaping the architecture of regulated cryptocurrency finance. But whether Ripple competes with Wall Street or merges with Wall Street, Ripple's next chapter suggests the same conclusion. In other words, the future of banking may not belong to banks at all.