For nearly a decade, the conflict between Zcash (ZEC) and Monero (XMR) has defined the cryptocurrency privacy movement.

The two digital assets promised something that Bitcoin could not: true transactional anonymity, but they took very different paths to achieving it. Monero mandated privacy and encrypted all transactions by default. Zcash has made this optional, allowing users to choose between complete transparency and complete privacy.

For years, that choice seemed to hurt Zcash. Monero's no-compromise design won the loyalty of cypherpunks, darknet users, and privacy maximalists who saw ZEC's “opt-in” model as a compromise.

However, as regulatory scrutiny increased and exchanges began delisting privacy tokens, Zcash's hybrid model evolved from a weakness to a weapon.

This fall, Zcash overtook Monero in market capitalization for the first time in seven years, reclaiming the “Privacy Crown.” According to data from CoinGecko, Monero has a market capitalization of $6.3 billion, while ZEC currently has a market capitalization of $7.5 billion, ranking it among the top 20 cryptocurrencies in the world.

This change means not just a reorganization of the leaderboard, but a deeper narrative reversal. The very architecture, balance of privacy and compliance that once made Zcash controversial, is now attracting institutional investors, ETF links, and mainstream legitimacy.

From cypherpunk to compliance

Zcash was founded in 2016 by Electric Coin Company (ECC) under the leadership of cypherpunk founder Zooko Wilcox. Its mission was to address Bitcoin's biggest flaw: transaction traceability.

Zcash uses advanced zero-knowledge proofs (zk-SNARKs) to allow users to fully encrypt sender, recipient, and amount data while proving validity to the network.

However, the protocol introduced new flexibility that allows users to choose between transparent (T-address) or shielded (Z-address) transactions. Its optionality has put off privacy purists, but it is not completely anonymous by default, allowing crypto exchanges to list ZEC, making it easier to regulate the project.

Monero, created in 2014, on the other hand, went in the opposite direction. We enforced privacy across the board through ring signatures and stealth addresses, making every transaction opaque and untraceable. Over the years, this has given Monero an edge in the privacy space, making it a currency that is immune to chain analysis.

However, Monero's strength is also its Achilles heel. Because all transactions are private, the network remains under regulatory siege. Due to concerns about anti-money laundering (AML) regulations, it was delisted from several major exchanges including Binance, OKX, and Huobi.

Meanwhile, Zcash continues to trade freely on compliant platforms, and accessibility is now more important than purity.

The 51% moment that changed everything

The tipping point for the two privacy-focused blockchain networks occurred in mid-2025. That's when the AI-based protocol Qubic claimed control of the majority of Monero's hashing power, resulting in a 51% attack that shook trust in the network.

The attackers allegedly rearranged six blocks and orphaned dozens of others, effectively rewriting part of the blockchain's recent history.

A few weeks later, an independent monitoring group reported a new 18-block reorganization, the largest in Monero history. Although no double spending occurred, this event revealed structural weaknesses.

For investors and exchanges, this confirmed long-standing concerns. Monero's anonymity efforts made it difficult to secure and audit.

In contrast, Zcash was quietly building a more modern governance and upgrade framework through ECC, the Zcash Foundation, and its consumer wallet project, Zashi.

Its stability and perceived regulatory friendliness combined to create the perfect backdrop for Zcash’s return.

How Zcash recovered

Zcash's rise didn't happen in a vacuum. Over the past year amid widespread backlash against global surveillance measures, from the EU's MiCA digital ID rule to Grayscale's Zcash Trust (ZCSH), privacy tokens have returned 90% in September alone, with ZEC's open interest reaching an all-time high of nearly $700 million.

Market participants interpreted these inflows as an early sign of “regulated privacy trading,” or exposure to crypto privacy without Monero’s legal baggage.

With this in mind, Maelstrom CIO Arthur Hayes predicted that the token could reach $10,000 while describing Zcash as a “bet on clean privacy.”

Additionally, Zcash's recent momentum is rooted in true technological advancements.

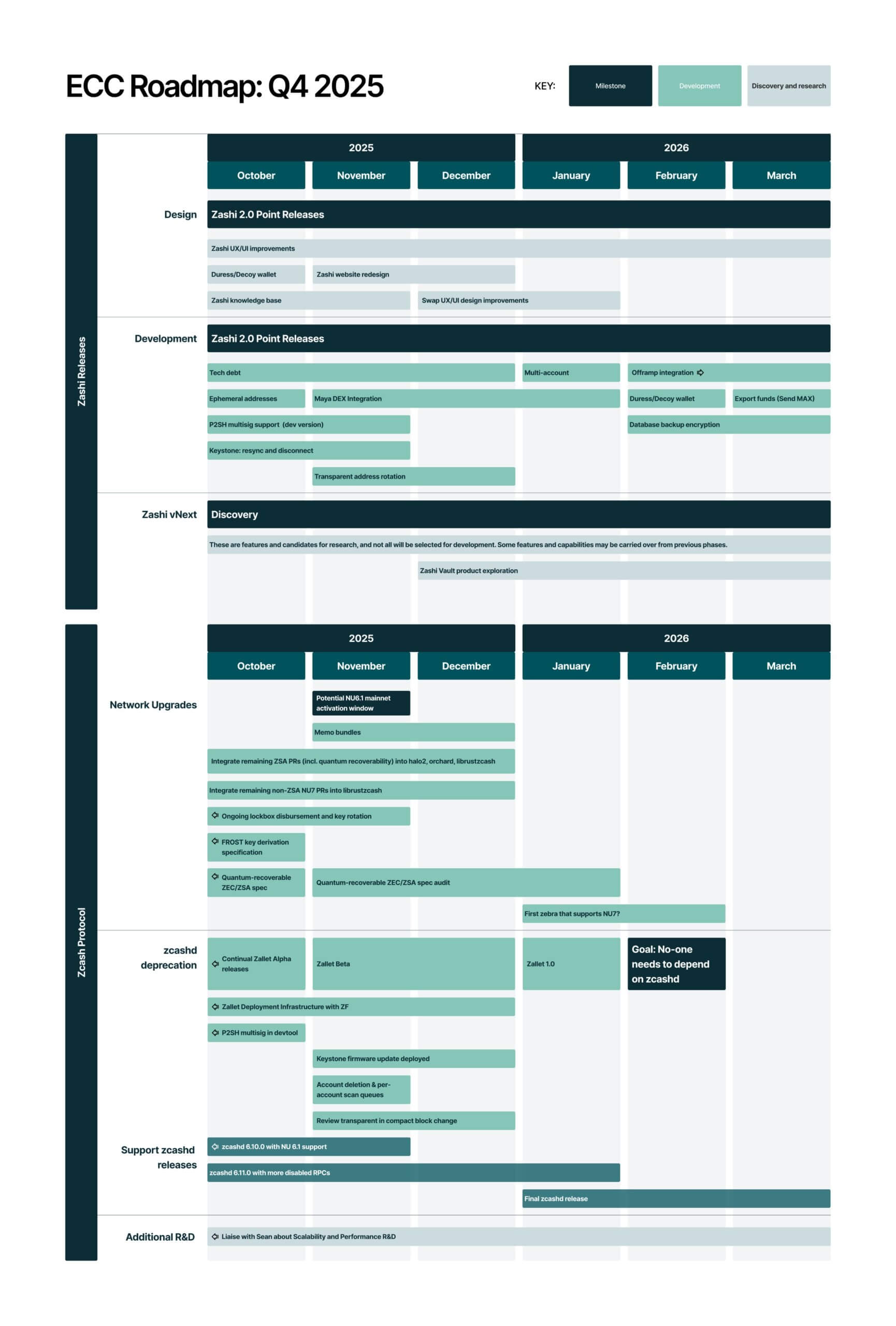

In its October 2025 roadmap, ECC outlined several upgrades aimed at simplifying and securing private transactions.

This plan introduces temporary addresses for all swaps via the NEAR Intents protocol, automatic address rotation after funds are received, hardware resynchronization capabilities for Keystone wallets, and multisig Pay-to-Script-Hash (P2SH) support to better protect developer funds.

These improvements streamline the way users interact with ZEC through the Zashi wallet, which debuted earlier this year. Once criticized for its complex privacy workflow, Zcash's interface now functions similarly to mainstream cryptocurrency wallets, removing a major usability barrier.

Perhaps most notably, more than 30% of ZEC's total supply currently resides in shielded pools, indicating that privacy usage is keeping pace with market speculation.

As more transactions move to these encrypted channels, Zcash's overall anonymity set expands, strengthening both privacy guarantees and the network's long-term resilience.