Legendary crypto trader Arthur Hayes said Thursday that he believes Bitcoin will reach $1 million, but he closed his eyes and was not on the train.

With the new essay entitled Fat Fat Boom BoomArthur explained why he is taking a short position despite his long-term beliefs. He used obesity and the broken American economy as two aspects of the same coin, denounced both a bloated system, or financial stability, which serves business interests more than public health.

According to Arthur's essay, America was once lean. Not only physically, but economically. But now he says that both the country's waistline and its balance sheet are out of control. He compared the rise of “fat-positive” stories with the addiction and money print of the Federal Reserve.

According to Arthur, the food industry sells waste processed by Americans, and the big drugs came along with drugs to treat symptoms rather than causes. In his words, the economy followed the same pattern. Continuous expanding of trust without modification.

Arthur Hayes says capital management is coming

Arthur said that tariffs cannot correct the imbalance in US trade as voters cannot withstand higher prices and empty shelves. He pointed to a 90-day tariff rollback with China as evidence that the difficult routes would not work politically. Instead, the current solution the White House prefers is to tax foreign ownership of US financial assets.

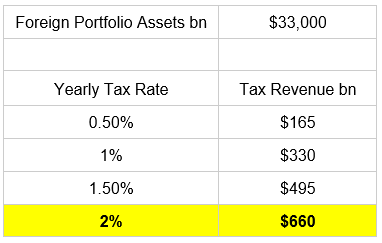

That's where capital control comes in. Arthur simply laid it out: if a foreigner wants to buy American stocks, bonds or real estate, they have to pay it. He gave an annual tax of 2%, as an example.

With $33 trillion in foreign portfolio assets held in the US, this tax could replace most American income taxes. “Trump was able to eliminate income taxes for the majority of voters,” writes Arthur, and such mathematics wins elections.

Source: Arthur Hayes

Arthur said capital management is easier to enforce than tariffs and avoids political fallout. If foreign money stays, you will be taxed. Once it leaves, the dollar weakens and American production returns. Either way, voters win. “This is a boiling frog theory,” Arthur said. I wrote itand we expect the market will not respond violently as changes progressively.

Arthur warns financial markets will feel pain

Arthur said foreign investors will not stick forever. When they realize their returns are being taxed, they begin dumping stocks, bonds and real estate.

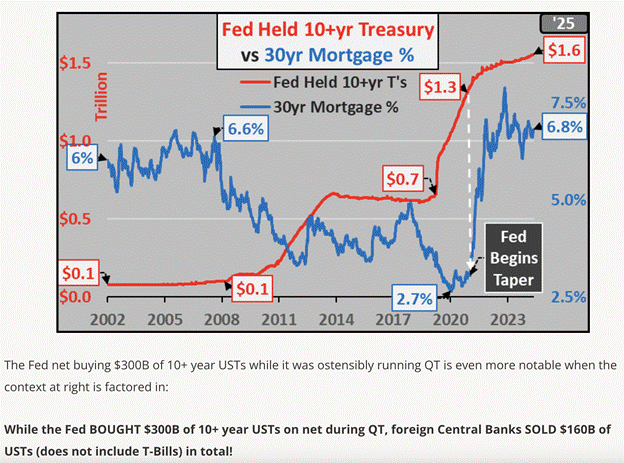

It puts pressure on the Treasury yields for 10 years, which he called the first major battlefield. Washington panics when the yield creeps towards 5%. It said it was time for the government to hit the “BRRR” button again.

He took steps taken by the Federal Reserve and the Treasury Department. He cited steps to make banks more flexible with quantitative tightening, resuming bond purchases, pushing short-term debt, and changing regulations.

Source: Arthur Hayes

Chairman Jerome Powell may sound tough at the press conference, but Arthur said he's already playing the ball behind the scenes. “Powell's butt sits firmly in the cuck chair,” writes Arthur.

Arthur also predicted that home prices would rise again as mortgage rates drop. Credit Spigot opens wide as Fannie Mae and Freddie Mac play. But this is not a fix. It's just a way to replace foreign capital with printed money. And it will light a fire under Bitcoin, Arthur says.

Arthur says Bitcoin is the only real escape

Arthur argued that Asian countries like Taiwan and South Korea have already strengthened their currencies. It shows that capital is back home and the global carry trade is being rewinded.

Private Asian capital borrowed in local currency and invested in the US is now inverting trade. They sell assets to us and are back in their own currency.

According to Arthur, the move will cause more sales at the Long-Term Treasury, leading to more volatility and more printing. That's why he thinks Bitcoin is the best place to go. No permission is required.

Even in countries like China where exchanges are prohibited, people still trade it for peer-to-peer. “Satoshi was given to faithful Bitcoin,” Arthur wrote.

He said the US will not kill Bitcoin because Trump's team believes the old system is broken. If only 10% of the $33 trillion foreign assets are moved to Bitcoin, Arthur says the price will explode.

“Just because we believe Bitcoin will be $1 million doesn't mean we don't have the opportunity to take a tactical short position.”

Arthur ended up saying that Trump has no fixed ideology. He responds to pressure. That means Bitcoin could rise, but it's not a straight line. “The trend is your friend.