ApeChain, the Yuga Labs-backed Layer 3 network built for the ApeCoin ecosystem, celebrated its one-year anniversary last month. After a brief rise in on-chain value and activity, ApeChain has mostly fallen since its launch, and its native token ApeCoin (APE) has also struggled to regain its NFT-era highs.

When launched at Hong Kong's ApeFest on October 20 last year, the project promised various features such as fast transactions, non-fungible token (NFT) staking, and multiple utility cases for APE, which launched two years before the network's debut.

First, the launch of ApeChain, proposed to the ApeCoin DAO by a team including Horizen Labs, Arbitrum developer Offchain Labs, and the head of the Arbitrum Foundation, sparked a surge in activity as the network was supported by the “Banana Bill,” an initiative with over 100 million APE tokens aimed at encouraging developers and apps.

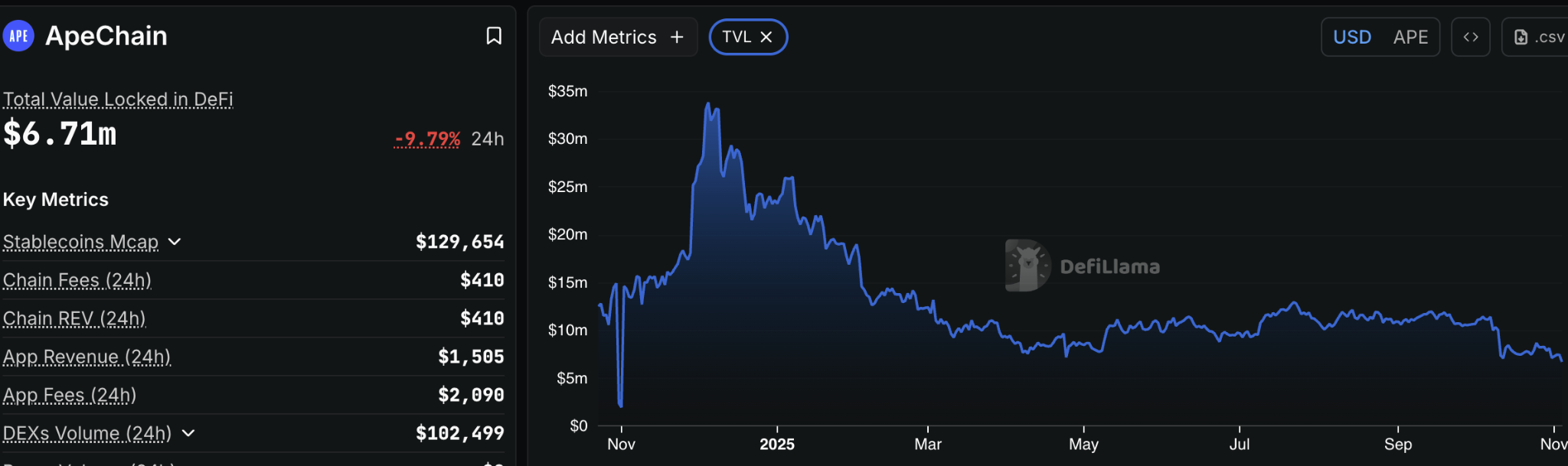

ApeChain TVL (USD). Source: Defilama

And these efforts certainly paid off, albeit in the short term, as the network's Total Value of Lock (TVL) soared, reaching a peak of $33.8 million in December 2024, according to data from DefiLlama.

However, TVL has fallen almost steadily since then, dropping to $6.7 million at the time of writing, its lowest level on record, excluding a brief drop last November.

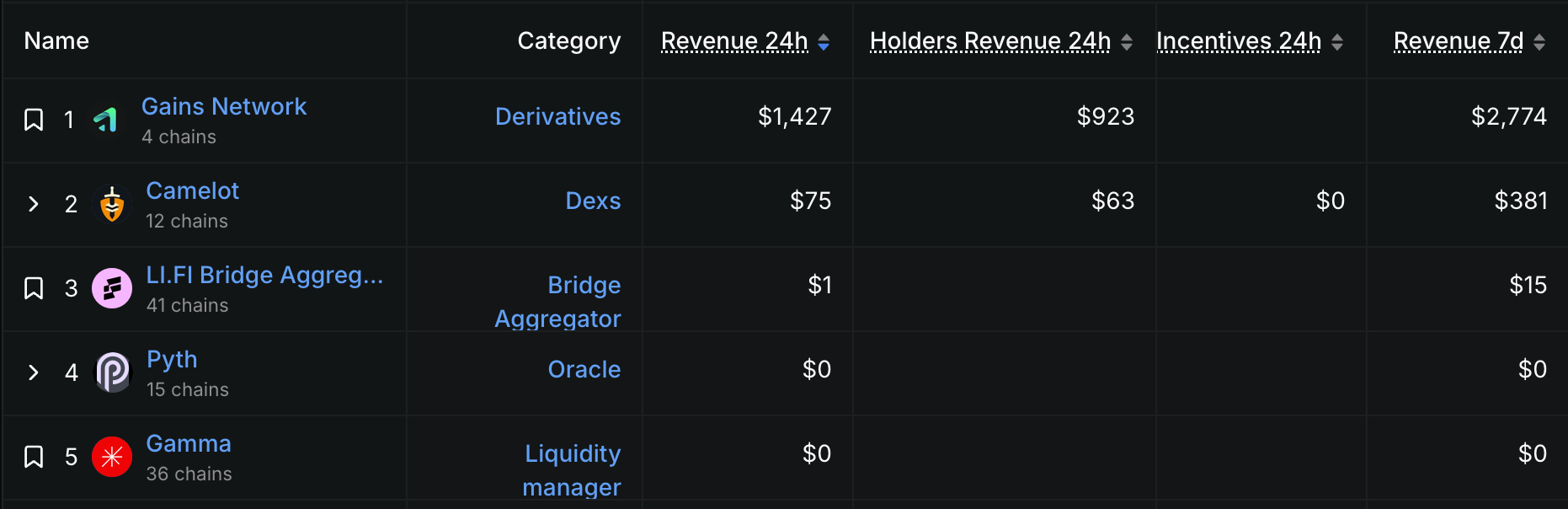

Also, according to DefiLlama, only three of the approximately 30 protocols on ApeChain are profitable, and two of them have generated less than $100 in revenue in the past 24 hours.

Top 5 ApeChain protocols by 24-hour revenue. Source: Defilama

According to The Defiant’s price page, since the launch of ApeChain’s native token APE, its price has also fallen by over 95% and is trading at $0.36 at the time of writing.

APE historical price chart. Source: CoinGecko

Token before network

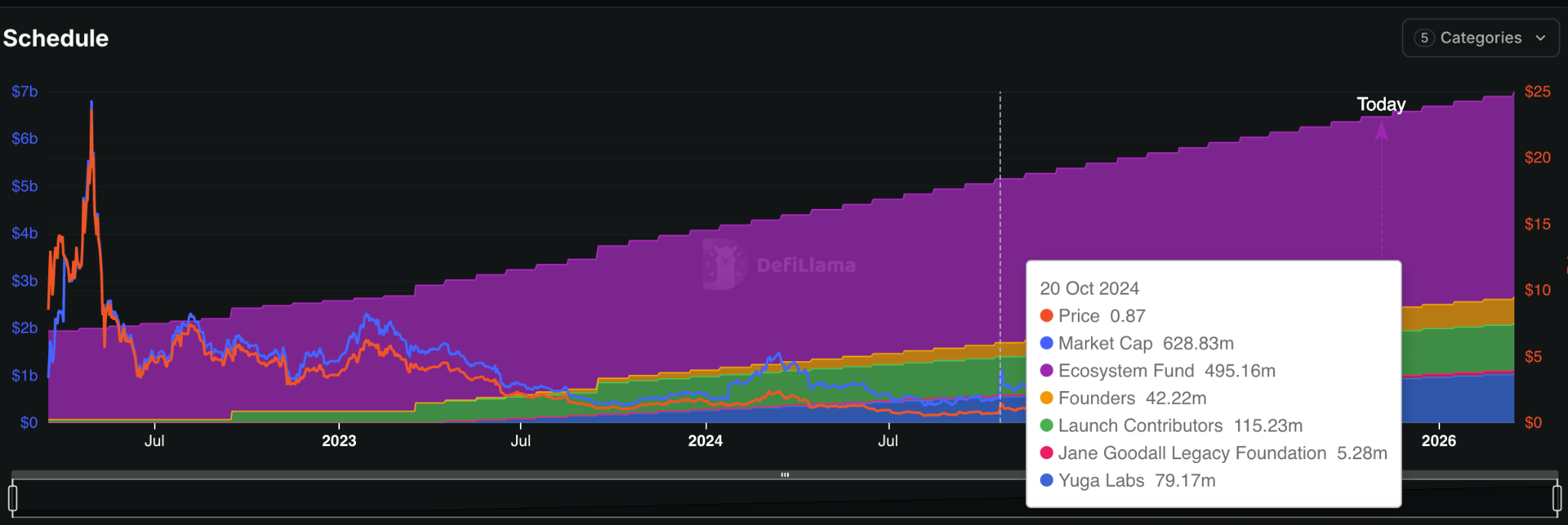

At launch in March 2022, APE tokenomics included allocations to DAO treasury and launch contributors, as well as unlock allocations to founders and Yuga Labs, ensuring meaningful supply well in advance of ApeChain's launch.

By the time the ApeChain network debuted last year, more than 495 million APE tokens had already been unlocked for the ApeCoin DAO ecosystem fund, while founders held 42.22 million APE, launch contributors 115.2 million APE, Yuga Labs 79.17 million APE, and Jane Goodall Legacy Foundation a more modest 5.28 million APE, according to DefiLlama.

For context, at the time, ApeCoin's price was around $0.87 and its market cap was $628.8 million.

ApeCoin token unlocking, allocation, price and market cap. Source: Defilama

But a year later, APE's price has fallen by more than 50%, and its market cap has fallen to approximately $325 million at the time of writing. On the other hand, the amount of tokens unlocked increased and allocations increased overall.

Ecosystem Fund allocation increased by 25% to 620 million APE, Founders' share increased by almost 90% to 80 million APE, Launch Contributor allocation increased by 21% to 140 million APE, Jane Goodall Legacy Foundation nearly doubled to 10 million APE, and Yuga Labs' share increased by 88% to 150 million APE.

consolidation of capital

Nicolas Lallement, co-founder of NFT analysis site NFT Price Floor, said that token unlocking and ApeCoin's early tokenomics are “only part of the story behind the TVL decline.”

“If you look at cryptocurrencies more broadly, there is always a power law in play, meaning a few dominant players capture the majority of the value,” Lallement told The Defiant.

“For example, Aave currently commands over 80% of Ethereum’s lending market (chain-wide, it has more TVL than the next 30 lending protocols combined). A similar concentration is occurring across L2, with Base and Arbitrum leading the other chains by a wide margin. So in that context, ApeChain’s declining TVL is not an anomaly, but part of a broader pattern of capital concentrating around the largest ecosystems.”

He added that ApeChain's decline was the result of a combination of subdued hype, token unlocking, and a downturn in the NFT market, which “didn't see a proper bull market this cycle.” Lallement pointed out that while adoption is progressing in the DeFi space, the token's performance has lagged, largely due to the poor performance of Ethereum itself until recently.

“And ApeChain is not alone,” he continued in a comment to The Defiant, adding that “Abstract also peaked around August and since then, despite the efforts of Luca Netz (CEO of NFT project Pudgy Penguins), TVL has been declining.”

governance reset

According to Lallement, another important factor in ApeChain's decline is its governance structure. He said operating as a DAO in the early stages is probably not optimal because “most DAOs struggle to run efficiently.”

ApeChain's initial proposal stated that its purpose was to “accommodate the next generation of consumer applications and games,” a goal that required “strong business development, rapid adaptation to market changes, and aggressive incentive design,” Lallement noted.

“That's why I think the proposed transition from ApeChain DAO to ApeCo is the right move,” he said, referring to a June proposal to transfer governance and operations from the DAO to an entity created by Yuga Labs, saying the goal is to “strengthen the APE ecosystem by supporting high-quality builders and strengthening the three core pillars of ApeChain, Bored Ape Yacht Club, and Otherside.”

“Once the ecosystem strengthens, there will be a time to decentralize later,” Larmento added.

In fact, later that month, ApeCoin holders voted to dissolve the ApeCoin DAO, handing over management of the ecosystem to ApeCo, founded by Yuga Labs. Despite the centralizing nature of the move, an overwhelming 99.66% of voters supported it.

By that time, some prominent figures such as Alexis Ohanian, who was a member of the DAO's special council, had already resigned as governing powers were transferred to other members of the community.

Meanwhile, the prices of ApeChain TVL and ApeCoin have been almost flat since the voting ended in late June, but have fallen further in the last month.

The broader Ape ecosystem and APE prices also failed to recover following news in March that the U.S. Securities and Exchange Commission had concluded a lengthy investigation to determine whether ApeCoin and Bored Ape Yacht Club (BAYC) constitute securities. The SEC's decision to close the investigation without enforcement removes significant regulatory uncertainty that has dogged the project since October 2022, just seven months after APE was launched.

BAYC and the NFT sector

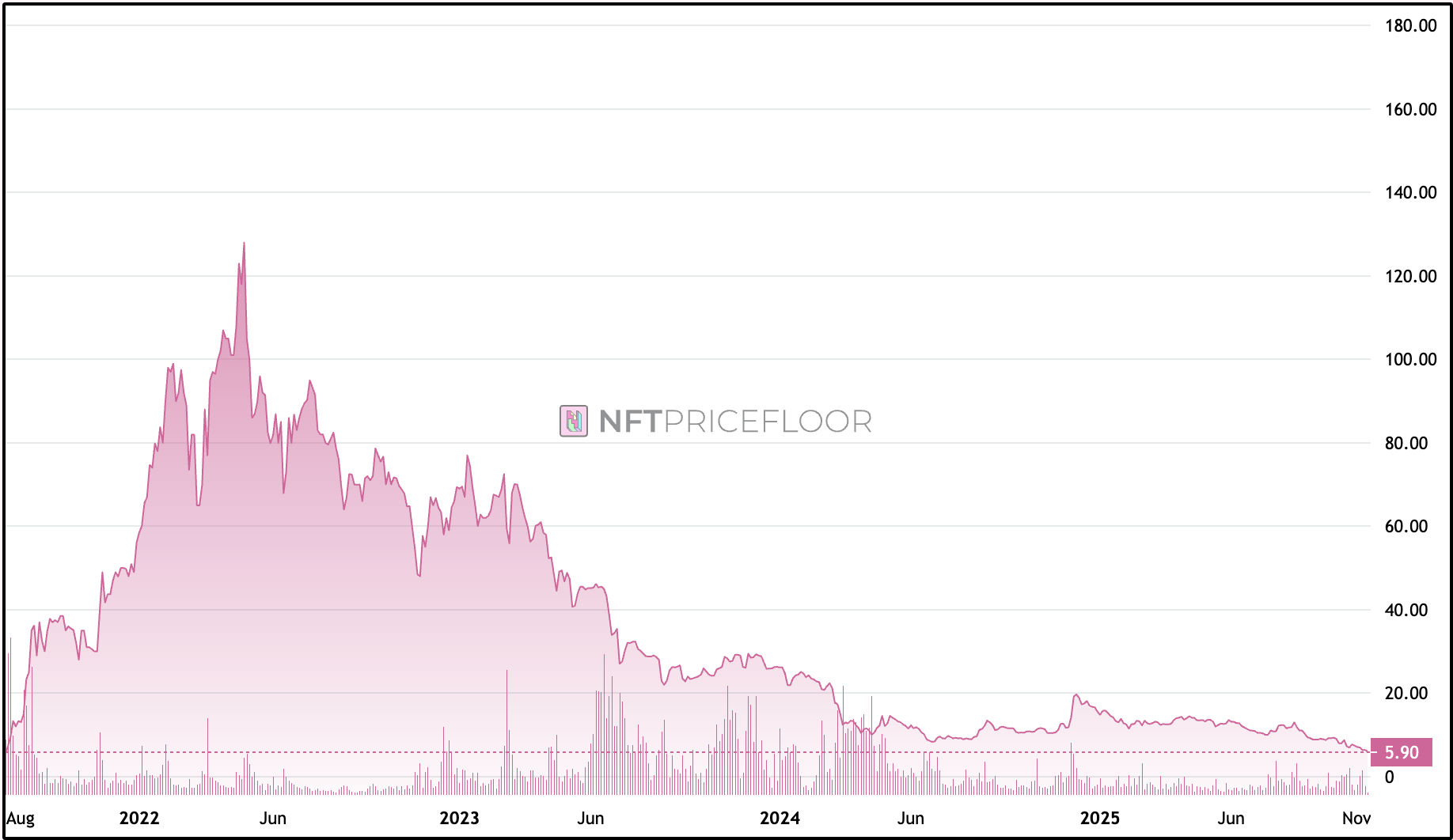

BAYC, Yuga Labs' flagship NFT collection at the heart of the Ape ecosystem, is the second largest NFT collection after CryptoPunks, with a market capitalization of 58,990 ETH, or over $206 million. According to NFT Price Floor data, the minimum collection price (the lowest market price of the NFTs in the collection) has hovered around 10-13 ETH since ApeChain's debut, and has fallen in recent months to 5.9 ETH at the time of writing.

BAYC price floor. Source: NFT Price Floor

In May of this year, Yuga Labs sold the intellectual property of CryptoPunks, one of the oldest collections in the field. It was originally launched by Larva Labs, who sold the IP to Yuga Labs in 2022. Later that month, crypto gaming startup Orange Cap Games acquired the IP for another Yuga Labs collection, Moonbirds.

As Lallement explained, Yuga Labs' focus has now shifted to its long-term strategy, adding that it has “rationalized by selling non-core IP assets such as Meebits, CryptoPunks, and HV-MTL, and is now doubling down on its original IP and Metaverse ambitions.”

He suggested that the right market settings could create a “perfect storm for an NFT resurgence,” including ETH reaching new highs, established DeFi assets pumping up, and wealth effects spilling over into NFTs.

Defiant reached out to Yuga Labs for comment about the Ape ecosystem and the company's broader plans, but did not receive a response by press time.

“We are in touch with a lot of the community,” NFT Price Floor’s Lallement continued, “and one of the things that ApeChain has been relatively successful at is serving as a launching pad for new NFT collections with lower entry prices to attract and engage new users.”

However, a resurgence for NFTs is unlikely to happen soon, given that the market has struggled after the October 10 crash, with ETH falling below $4,000 and NFT sales volume declining by more than 44% over the past month.