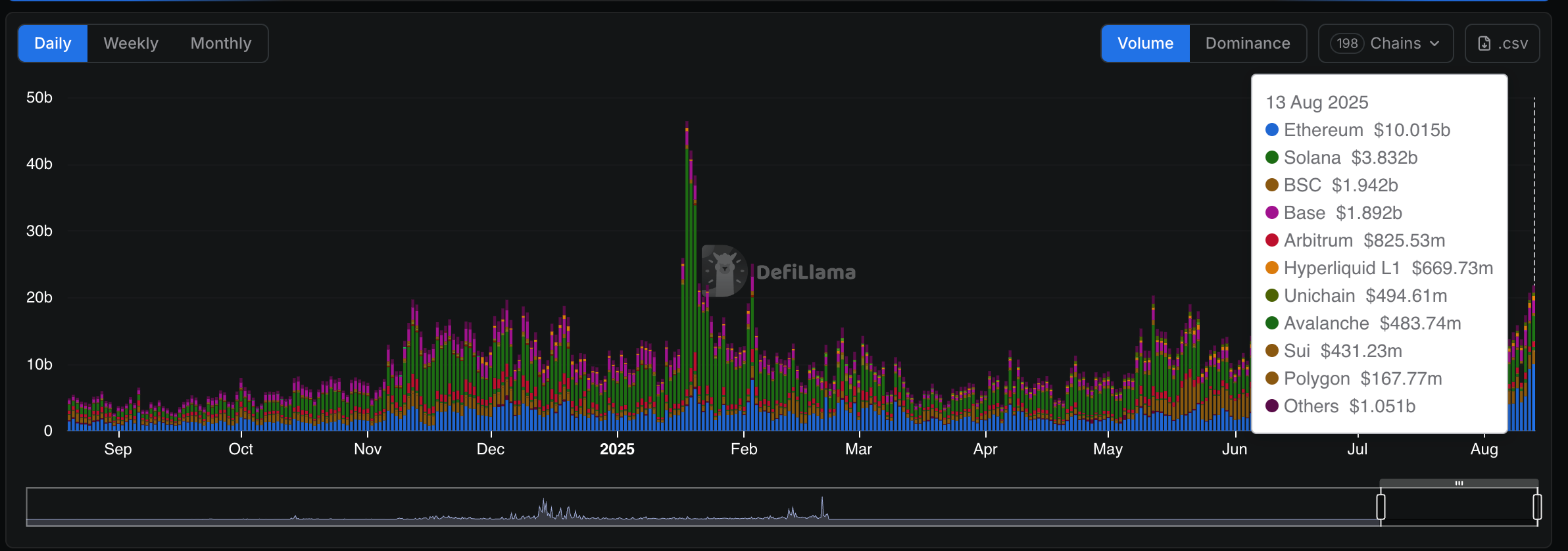

Ethereum's Distributed Exchange (DEX) volume leapt through Solana for the first time since April after a rapid shift in emotions from Solana-based Memocoin and a rapid shift towards ether {{eth}} amid a wave of institutional activity.

Over the past 48 hours, Ethereum-based Dexs has made trading volumes at $24.5 billion compared to Solana's $10 billion tally, according to Defillama.

Ethereum two weeks ago also ruled, with a total of $28 billion and $27 billion defeating Solana's total of $20 billion and $24 billion.

This contrasts with trader behavior earlier this year, when Solana and the BNB chain were dominated by the waves of speculative memo coin trading.

However, the trend towards spot ether ETFs within the facility supports the second largest cryptocurrency, which has been raised to $4,680 this month, after a 53% increase in the last 30 days.

Coinglass data shows that net inflows into ETFs on Monday exceeded $1 billion for the first time.

Meanwhile, Solana appears to have lost her magic in the second quarter of this year. For example, in January, Dex exceeded $98 billion in a week and $84 billion in the next week. The hype subsided after President Donald Trump released Trump Memecoin, but ultimately lost more than 88% of its value in the next seven months.

Uniswap is the most commonly used Dex in Ethereum, with $8.6 billion in trade over the last 24 hours.

The change in behavior could be on the steady pace for Ethereum-based staking tokens that experienced a boost following last week's clarification. LDO-like tokens, the governance tokens for liquid staking protocol liquido, have increased by 65% over the past week.